|

Kynex is pleased to

introduce our new Trade Entry Execution mechanism. It is an improvement from our original

mechanism and has several advantages: Kynex is pleased to

introduce our new Trade Entry Execution mechanism. It is an improvement from our original

mechanism and has several advantages:

•

Trades can now be allocated across multiple prime brokers in a single execution.

•

Improved logic does a more accurate job of

maintaining Distribution and Hedge across accounts and prime brokers.

•

Easily manage your

hedge by seeing exactly what your post-trade deltas will be.

•

Post-trade inventory can be targeted to the nearest 1, 10, or 100 of your choice.

Quick Links

Allocation

Concepts

Mechanics

Modifying

Allocations

Benefits

of the New Execution Mechanism

Modifying

an Existing Execution

Frequently

Asked Questions

Allocation Concepts

We would like to

introduce three allocation concepts for entering executions. They are Pre-set Allocation, Maintain

Distribution and Maintain Hedge.

Maintain Distribution is a new allocation concept that has many advantages. Maintain Distribution is the starting

point of the allocation. You can

change the allocation by clicking the different allocation buttons in the

Main section of the page.

• Maintain

Distribution is the starting point for the Execution ticket. It

attempts to maintain post-trade inventory to the targets specified on your

Trade Entry à

Accounts page. Maintain Distribution

will look at your current inventory and then attempt to allocate the

current trades such that your ending inventory will match your specified

targets. Taking the allocation on

the primary side (derivative) into account, it then allocates the swap

quantity such that the post-trade deltas are balanced across accounts and

prime brokers.

For example, suppose the targets on your Accounts page

are 80% for Account 1 and 20% for Account 2. Your current holdings on a

particular security are 800 bonds vs. 20,000 short in Account 1, and 200

bonds vs. 5,000 short in Account 2.

Now assume that there has been some capital inflow into

Account 2, making its NAV equal to that

of Account 1. Your targets have changed to 50% for Account 1 and 50% for

Account 2, and you have updated the Trade Entry à

Accounts page to reflect this new ratio.

On your next trade, the Execution mechanism will

allocate the total quantity across accounts such that the 50/50 account

ratio will be preserved.

Additionally, the Maintain Hedge feature (described later in this

section) will intelligently distribute this trade’s stock shares to

equalize your deltas (as closely as possible) across each account.

• Pre-Set Allocation breaks down your current trade and

allocates it to different accounts based upon your pre-set targets. If you have set up your target as 30%

(Account 1), 40% (Account 2), 30% (Account 3) and you book a trade, Buy

Long 1000 Convertible bonds and Sell Short 500 shares, then the Pre-Set

Allocation will allocate 300 convertibles and short (150) stock in Account

1, 400 bond and short (200) shares in Account 2, and 300 bonds and short

(150) shares in Account 3. Pre-Set

Allocation ignores pre-trade inventory when allocating new trades.

• Maintain Hedge attempts to allocate your swap quantity

to balance your post-order delta across accounts and prime brokers. You can arbitrarily overwrite the primary

side of the trade and use the Maintain Hedge to balance the deltas across

Accounts and Primes.

Advantages of Using Maintain Distribution

When you have

multiple accounts with capital in-flows and out-flows

from existing accounts at different rates as well as capital in-flows into

new accounts, your inventory will get out-of-balance with respect to the NAV of accounts very quickly. Often it may

not be economical to trade in specific accounts in response to capital

flows. It is better to keep the inventory at the risk of a slight change in

leverage and trade opportunistically and allocate the trades such that your

inventory approaches the desired targets. Our Maintain Distribution is the

most efficient way to accomplish this. The Pre-Set Allocation, which is the

most prevalent on the Street, will never reach the desired targets without

manual overrides.

Top

Mechanics

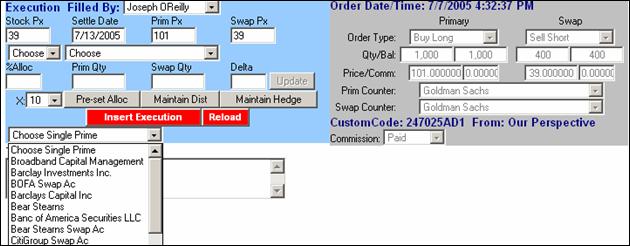

The new Trade

Entry Execution interface is presented in this section. The Main section

(top half, see Figure 1) allows you to specify execution prices and

allocations.

Figure 1:

Main Section

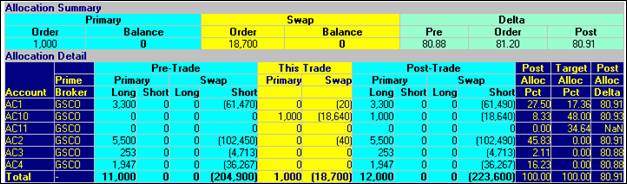

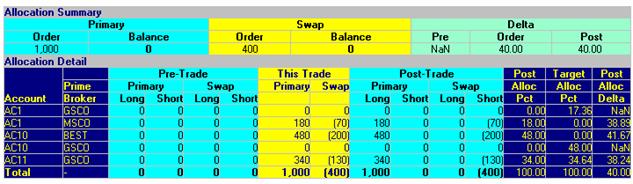

The Allocation section (bottom half, see Figure 2) of the Execution

interface presents Pre-Trade, This Trade, and Post-Trade quantities, as

well as deltas. On the far right

side of the interface are displayed three important fields: (1) Post-Alloc Pct, (2) Target Alloc

Pct, and (3) Post-Alloc Delta. These fields will now be discussed.

1 2 3

Figure 2:

Allocation Section Figure 2:

Allocation Section

1. Post-Allocation Percent

This column

displays your post-trade inventory allocation after the execution is

completed.

2. Target Account Percentage

To set your

Target Account Percentage, go to the main Trade Entry page and click on

“Accounts.” Then, in each of the

account boxes, enter the percentage of the desired allocation. When you place future trades, the Kynex

Execution mechanism will choose the optimal allocation based on these

target percentages. These

percentages will be implemented only for your default prime broker. If you would like different account

percentages for different prime brokers, please give us a call so that we

can make the necessary configuration changes.

3. Post-Allocation Delta

After the

primary side has been allocated the new Trade Entry mechanism will allocate

the swap quantity to match the Post-Alloc

Delta. This will allow you to

maintain your hedge equally across the accounts and different prime

brokers.

EXAMPLE: To illustrate how Post-Allocation Delta works,

let us assume your current inventory is 1,000 on the primary versus 20,000

on the swap, representing a delta of 60.

If you are buying 2000 bonds vs. 30,000 shares short, your

post-trade delta would be 50. If your pre-trade inventory of 1,000 vs. 20,000

was not balanced across accounts, our Maintain Hedge mechanism will

allocate the swap quantity such that the delta in all accounts approach the

post-trade delta, which is 50 in this example.

Top

Modifying Allocations

Using the Main

section of the interface (Figure 3), Account and Prime Broker allocations

can be added or deleted, with the change being reflected in the Allocation

section (Figure 4). The screen-shots below illustrate the basics of

inserting new Account and Prime Broker allocations, and for modifying

existing allocations.

Figure 3:

Modifying Allocations

|

|

|

|

|

|

Set all account allocations to a single Prime

using this control.

|

|

|

|

Each line displays part of the total allocation

for this trade.

|

|

Figure 4: Allocation Results Figure 4: Allocation Results

Current Holdings for each Account & Prime

|

|

Allocation

for this trade

|

|

Holdings AFTER this

trade

|

|

Top

Benefits of the New Execution Mechanism

If you have only

one Account, the basic functionality of this interface is similar to the

previous version. However, the real advantages of the new system are fully

realized if you deal with multiple Accounts and Prime Brokers.

Clients with a Single Account and Single

Prime Broker

Only the

Execution mechanism’s general layout is changed. All trades will be allocated to your

single Account and Prime Broker.

Clients with a Single Account and

Multiple Prime Brokers

The new

Execution mechanism will now allow you to book a trade and allocate it

across multiple Prime Brokers in one execution. Previously, you would have to enter a

separate execution for each Prime Broker.

If you want a Prime Broker target percentage to be set up, please

give us a call. The default

allocation is Maintain Distribution.

Allocating

trades to a single Prime Broker is simple. Suppose you place a trade which

is initially allocated to both Goldman Sachs and Morgan Stanley. If you wanted to switch the Prime Broker

from Goldman Sachs and Morgan Stanley to Merrill Lynch, simply open the

“Choose Single Prime” drop-down menu in the Main section (Figure 5), then click on

Merrill Lynch. All allocations for this trade will automatically be set to

Merrill Lynch, and this change will be reflected in the Prime Broker column

of the Allocation section.

Figure 5: Allocating Entire Trade to a Single Prime

Broker

Clients with Multiple Accounts and

Multiple Prime Brokers

The new

Execution mechanism eliminates the need for multiple executions in the

event that one trade needs to be allocated across several Prime Brokers.

Allocations for both multiple Prime Brokers and multiple Accounts can now be done with a single trade.

Top

Modifying an Existing

Execution

The new Modify Execution feature is

accessed by clicking on the appropriate line in the Today’s Executions,

Recent Executions, or Trade History View pages, and selecting Modify

Execution from the menu.

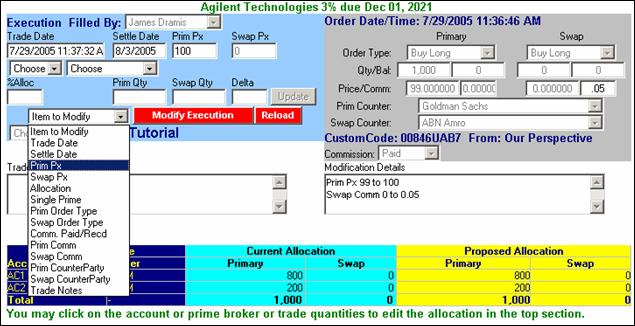

The Modify Execution interface is similar

in appearance to the Execution interface that was described earlier in this

tutorial. The main difference is

that an Item to Modify field and

a Modification Details box

appear in the Main section (Figure 6).

Figure 6:

Modify Execution (Main Section)

To modify an

execution, simply use the Item to

Modify control to select the trade attribute that requires a change.

The appropriate field (Prim Price in the Figure 6 example above) will then

be activated, allowing you to enter the change. Once the change has been

made, click your mouse outside of the field to commit the change. The

modification will then be displayed in the Modification Details box.

In the example above, the Prim Price was changed from 99 to 100, and

the Swap Commission was changed from 0 to 0.05.

It may frequently

be necessary to modify an execution’s quantity for a particular Account and

Prime. To do this, find the line in the Allocation section (Figure 7) that

requires modification, and click on either the Account, Prime Broker, or

the Proposed Allocation Quantity (yellow field). Then, go to the Main

section to edit the quantity, and click the Update button to commit the

change.

To move

allocations to other Accounts and Prime Brokers, please refer to the

complete explanation here.

ain

Section)Execution feature,. in betweeco for the past few days. It is'

Figure 7:

Modify Execution (Allocation Section)

Top

Frequently Asked Questions

• This looks too complicated! Where do I begin?

Although there

is a slightly greater learning curve to the new system, you will find that

it is much more powerful than the previous version. Take a few minutes to experiment with

adding and deleting Account and Prime Broker allocations, and get a feel

for how the page works. After making

a change, be sure to click the Update button to commit the change, and then

verify that the new allocation is correct by looking at the Allocation

section.

It is important

to keep in mind that the actual trade allocation will be entered EXACTLY as

it appears in the Allocation section, so always verify that your Accounts, Prime Brokers, and Quantities are correct

before inserting the execution.

With a little

bit of practice, we’re confident that you will appreciate this system’s

greatly-improved functionality.

• I have several accounts, and this page

defaulted all of them to the wrong Prime Broker. Is there an easy way to fix this?

Yes. Simply click on the Choose Single Prime

on the top section of the screen, and select your new Prime Broker. All

Account allocations will then be switched to the new Prime Broker.

• The

default allocations are not going to the Accounts and Primes that I

want. How can I fix this?

Start by

zeroing-out any Account/Prime combinations that you don’t need. To do this, look at the Allocation

section and click on the Account, Prime, or “This Trade” Quantity to select

the appropriate Account/Prime combination in the Main section of the

interface. Then set quantities to

zero, and click Update. Repeat for

all Account/Prime combinations that you need to delete.

Next, find any

Account/Prime combinations that you need which are

already existing in the Allocation section. If you need to modify

the quantity of a particular allocation, click on the quantity in the “This

Trade” column to select the appropriate combination in the Main

section. Edit the Quantity fields in

the Main section as needed, then click the Update

button to commit the changes. Repeat

this process for all Account/Prime combinations that require modification

of the quantity.

Finally, you

must add any Accounts and Primes that require allocation, but do not yet

exist as a line item in the Allocation section. First, select an Account in

the drop-down menu in the Main section, then select a Prime Broker. Type in

the Primary and Swap Quantities, and click Update. The new row will appear

in the Allocation section of the interface. Repeat this step for each

Account/Prime combination that you need to add.

Top

|