Enhancements

Fix-to-Float and Changes to Payment Frequency, Day Count and

Business Day Adjustments

Some securities are now issued in

which the initial coupon is fixed but changes to a floating coupon after a

specific number of accrual periods. Usually, when the coupon is fixed, it pays

like a vanilla corporate bond having a semi-annual payment frequency, a 30/360

day count, and coupon payment dates without business day adjustments. However,

once the coupon starts to float, the payment frequency becomes quarterly, the

day count becomes ACT/360 and payment dates are business day adjusted. Our calculators support all of these changes

and because we accurately project the cash flows for these instruments, the

risk measures are precisely reported. We calculate the correct accrued interest

within each accrual period which may be helpful for your back offices or

administrators who are reconciling with Kynex.

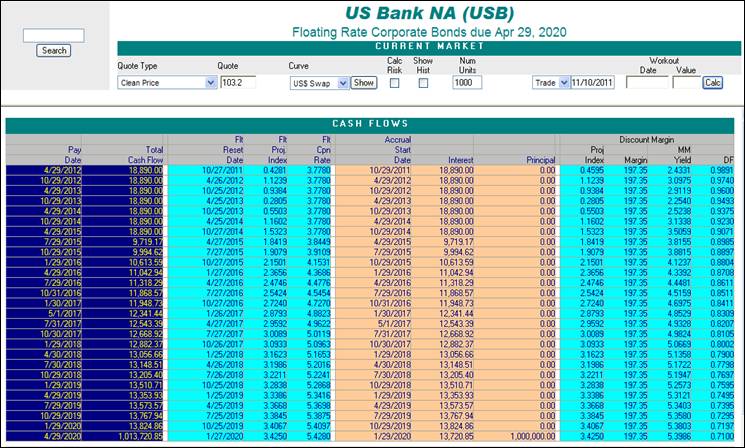

A classic example of a

fixed-to-float bond is US Bank (

As is the case here, these fix-to-float structures commonly have a call between the fixed and floating payments. The details are illustrated on the cash flows.

Please note that the future coupon

payments become quarterly after

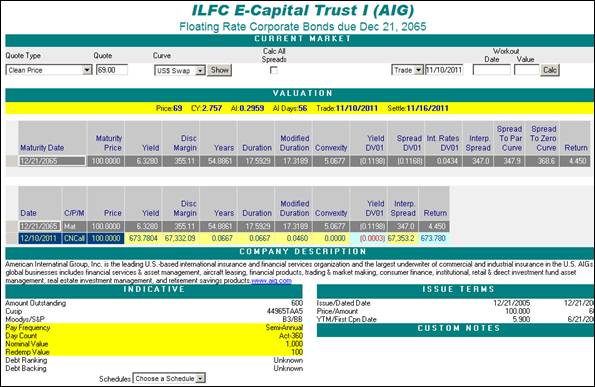

In order to see the analysis if

settling in the float period we can consider a fixed-to-float bond ILFC E-Capital

Trust I, maturing on

Please note that yields are expressed slightly differently for these two bonds. For the US Bank bond, the yield of 2.7989% is a nominal semiannual rate, as expected because it is settling in the fixed period. However, the yield of 6.328% is a nominal quarterly rate, the same as any corporate bond that pays quarterly.

Accretion Methods

To handle the recent nuances of various accreting structures in the market, we now support three additional accretion methods: Principal Only, Principal Only (CD rollover) and Straight Line. Principal-and-Interest is the most widespread accretion method and has always been supported by our calculators. Note that this accretion method is directly comparable to a bond yield (compound interest from settlement to the next coupon date). We have seen these three new accretion methods used in new issues, exchange offers as well as in zero coupon accreting bonds when the Co-Pa has been triggered. The new accretion methods will more accurately value the small percentage of structures that have these features. If a non-standard accretion method is used by the issuer, we show the true accretion rate for a direct comparison to the standard Principal-and-Interest rates. Some examples are below.

Principal Only Accretion

An example of a Principal Only is the School Specialty Exchange bonds due 2026 (807863AM7). The bond pays a 3.75% coupon and accretes at 3.9755% using the Principal Only method. Although the Principal Only accretion is constant, the true accretion rate (Principal-and-Interest) starts at 7.7808% and declines to 6.0331% at maturity. The longer you hold the bond, the slower the true accretion.

Principal Only (CD Rollover) Accretion

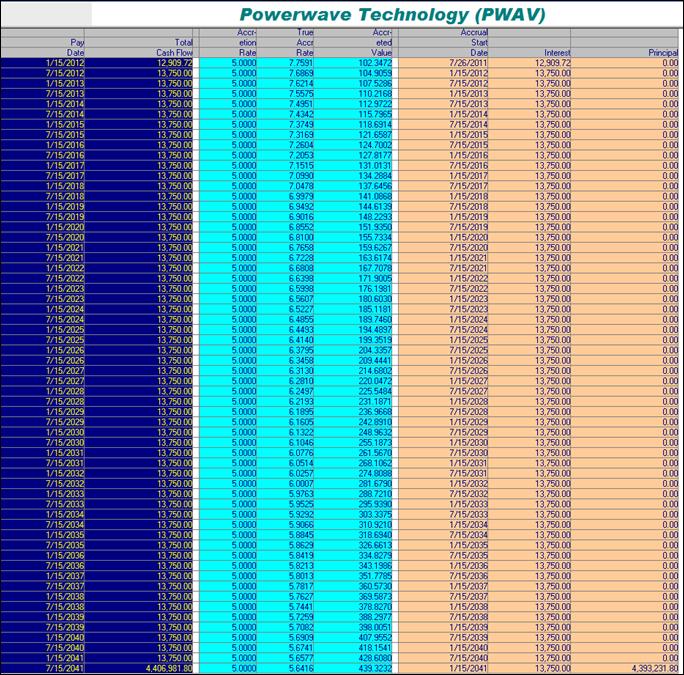

Powerwave

Technology (

Principal

Only (CD Rollover) Simple Interest: $1000*(1 + (5/200)*(169/180)) = $1023.47222

Principal

Only Compound Interest: $1000*(1 + 5/200)^(169/180) =

$1023.45445

True Accretion Compound Interest: $1000*((1 +7.75907397/200)^(169/180))-12.9097222 =

$1023.47222

For normal accrual periods, the two Principal Only methods will always give the same values on coupon dates, and slightly different values between coupon dates if the coupon is nonzero.

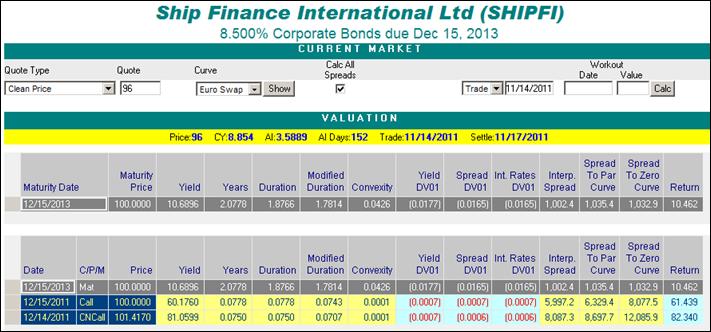

Price/Yield Analytics Using Foreign Benchmark Curves

Spread comparisons between corporate

(non-convertible) bonds denominated in different currencies can be difficult. Kynex

now provides the flexibility of valuing a bond using a benchmark curve

denominated in a currency different from that of the security. For example,

consider Ship Finance International 8.5%

=================================

OVER US$ Swap ===============================

================================

OVER EURO Swap ==============================

================================

OVER EURO Swap ==============================

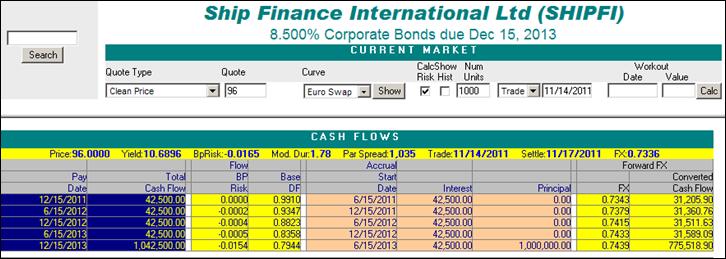

Kynex provides this flexibility by first converting the future cash flows of the Ship Finance bond into EUR by using implied forward FX rates. The flows can then be discounted at a spread over the Euro swap curve. The resulting full price is then converted back to USD using spot (at settlement of the bond). The FX rates used are displayed on the cash flows.

The interest parity calculation can be seen in the table below.

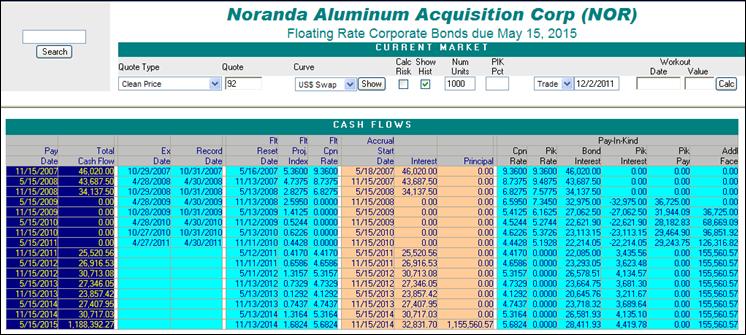

PIK Bonds & PIK Toggles

Pay-In-Kind (

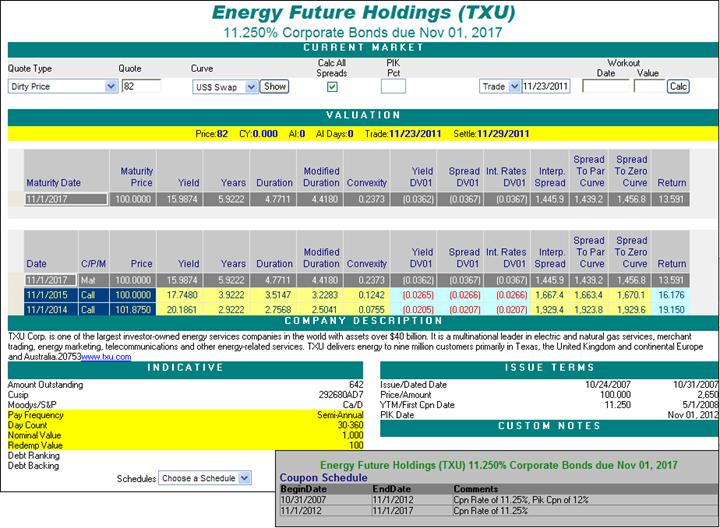

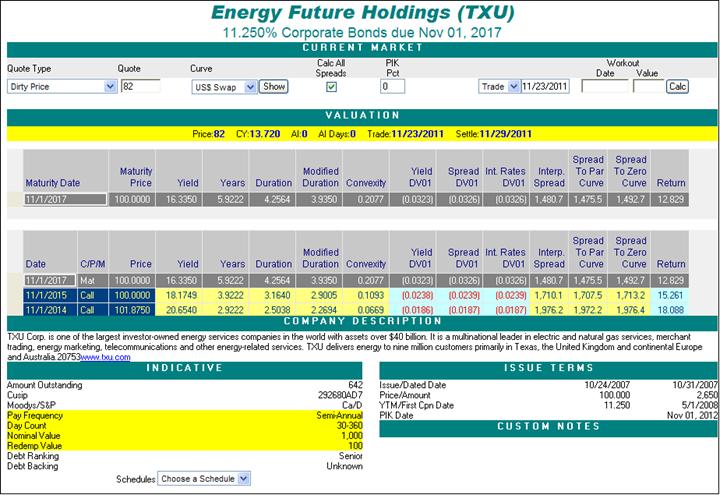

An example of a

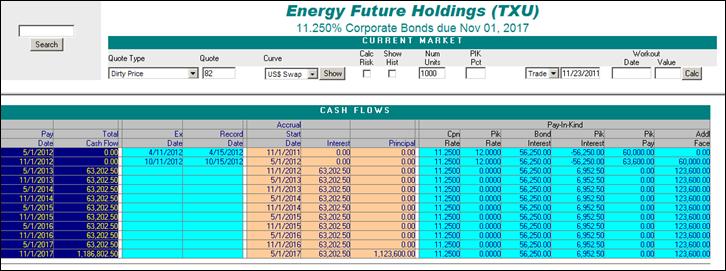

The cash flows provide additional detail and analysis. The price of 82 is a dirty price per $100 of current face.

Yields and other P/Y measures are

based upon the “Total Cash Flow” column. Unless otherwise specified, the

analysis assumes a 100%

The All Cash Yield is equal to 16.335%, while the PIK yield is 15.9874%, so you give up almost 35 bps for the PIK at a price of 82. Please note that any PIK percentage between 0 and 100 can be entered.

There is both good news and bad news when it comes to PIKs. The bad news is that PIKs

invariably are called before the PIK date despite being issued by cash

distressed companies (e.g. Univision 9.75%

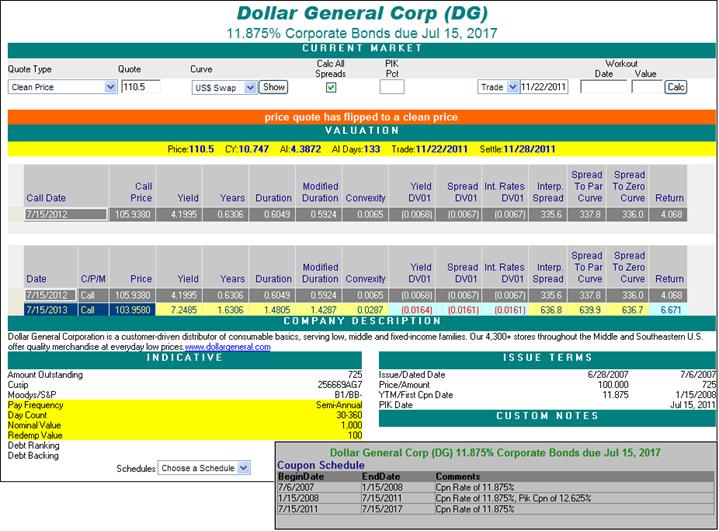

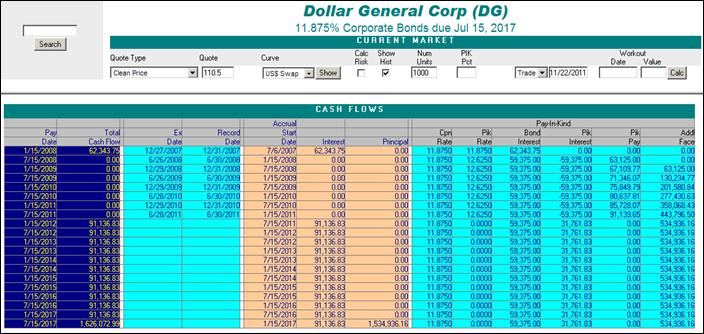

An example of a PIK bond

currently in its payout phase is Dollar General 11.875%

The historical cash flows will

show the past

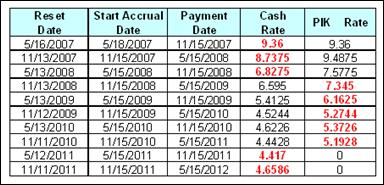

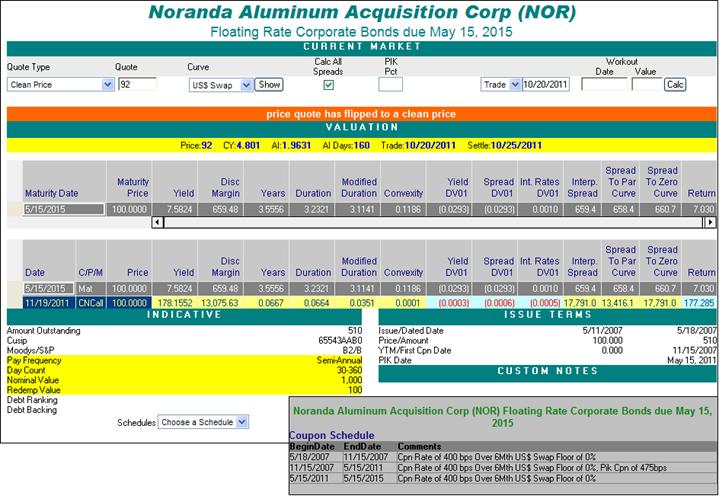

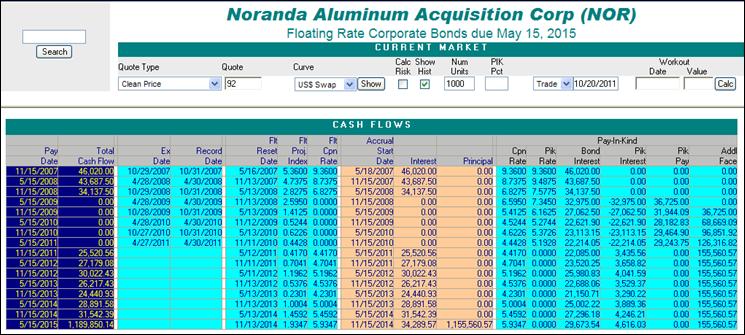

A floating rate

Note that the PIK coupon is 475bps over 6 month libor. You can evaluate this bond in terms of yield (7.5824%) or in terms of discount margin (659.48 bps). Past interest and PIK coupon payments are shown in the historical cash flows.

The issuer stipulated that the payment

on the first coupon date would be all cash. For the next two payments, the

issuer also chose to pay all cash. In the above table, it should be noted that

the coupon for the accrual period beginning on

The actual coupon history is

summarized below from the table above.