January 2007

High

Yield & Corporate Bonds

Kynex has expanded its security coverage to include a sizable portion of the domestic corporate bond market. Currently, Kynex has included all domestic high yield bonds in its indicative (terms and conditions) database and a significant number of liquid investment grade bonds as well. Additions and enhancements are highlighted here, but you can follow the links for additional detail and explanation.

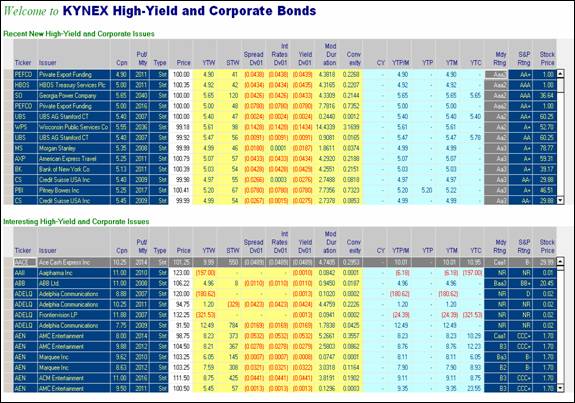

- A “HY/Corp” tab has been added to the main Kynex blue banner. From this link, you can click to a page showing Recent New High-Yield and Corporate Issues as well as Interesting High-Yield and Corporate Issues.

- Kynex now stores valuation and risk measures for every corporate on a daily basis. This history can now be viewed.

- Advanced Search now allows you to find corporate and high-yield bonds based upon your specified criteria (terms and conditions or valuation and risk measures stored in history).

- Price/Yield/Spread analytics for a single security is located on the Kynex Corporate Detail Page. This Yield-to-Worst calculator includes numerous other measures (e.g. Spread DV01) as well.

- If you wish to examine the cash flows used during valuation, you can follow the Cash Flow link located in the left hand blue column.

- For those bonds with calls and puts, advanced

Yield-to-Worst analytics are now available. The Worst Date

Migration Analysis tool helps you identify and analyze bonds whose

spreads and durations may be “jumping” for small changes in yield. This tool identifies where the jumps

occur as well as their magnitude.

Kynex has added a new tab to its main blue banner. Clicking this tab will bring you to a page showing

you Recent New High Yield and Corporate Issues as well as Interesting

High-Yield and Corporate Issues. The

Recent New High Yield and Corporate Issues are new bonds that have come to

market within the last four weeks. For

Interesting High Yield and Corporate issues, we look for bonds that have had a

spread change of 10 percent either way, or bonds whose stock price is within

0.5 percent of a 52 week High or Low, or bonds whose week-over-week stock

movement is at least 10 percent. The

tables will give you a quick glance of the bonds’ terms and valuation

measures. For a comprehensive analysis

of the bond just left click on the specific bond and go to the Corporate

Details Page.

If you wish, you can sort on any column by just (left) clicking on the column name.

Kynex

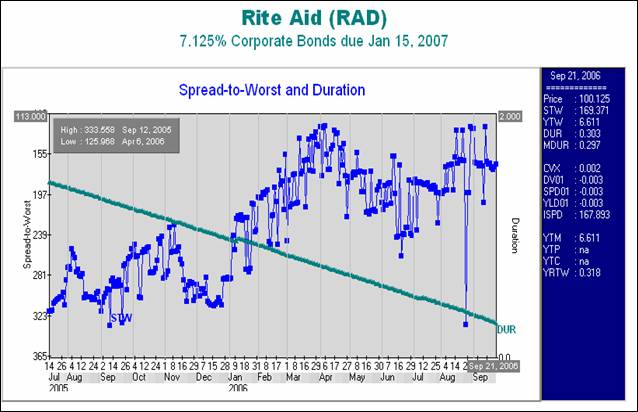

now stores historical valuation measures for every corporate bond in our

system. On the left hand side of the

Corporate Details Page you will find a link to the History. The history page will chart Spread to Worst

and Duration, Spread to Worst and Years to Worst, and Spread to Worst and Yield

to Worst. You can put your mouse inside

the interactive chart on a particular day and the chart will display the

securities valuation measures in the right column.

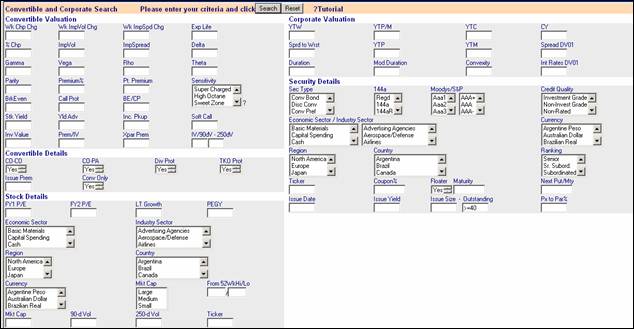

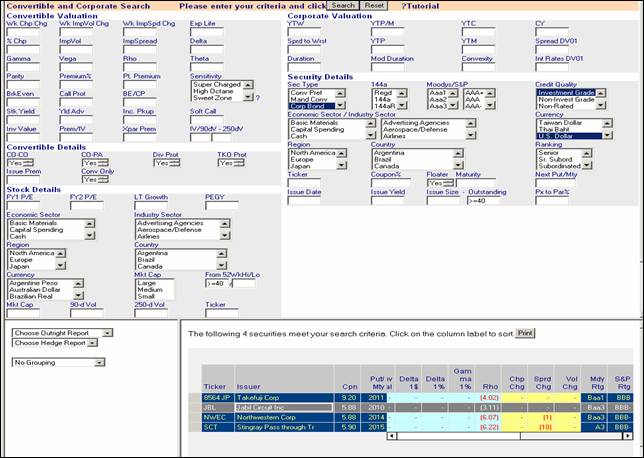

Kynex Advanced Search allows you to identify bonds with certain characteristics that you specify. You can simultaneously specify valuation parameters (e.g. yield or spread), terms and

conditions (e.g. coupon, call protection) and corresponding stock characteristics. For example, suppose you are interested in dollar denominated investment grade corporate bonds whose stock price has deteriorated by 40% or more from its 52 week high. The following filter gives the desired set of bonds.

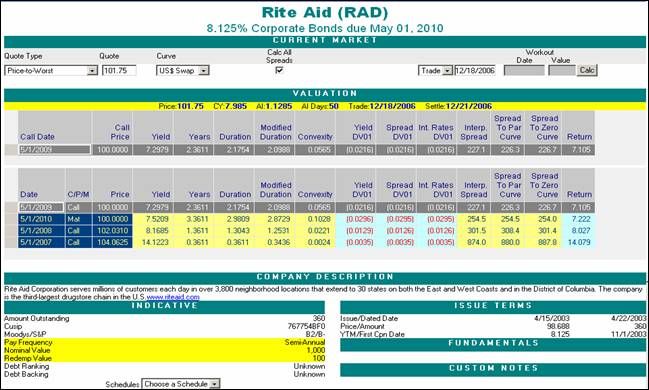

The

Corporate Details Page calculates various price/yield/spread measures for a

specified bond or preferred stock. As an

example, consider the Rite Aid (RAD) 8.125% corporate bond maturing on

The

Corporate Details Page defaults to a “Price-to-Worst”

quote type. Other quote types include:

Yield-to-Worst

Clean Price

Dirty Price

Yield-to-Workout/Maturity

Spread-to-Workout/Maturity (Interpolated

Yield Curve)

Spread-to-Workout/Maturity (Par Yield

Curve)

Spread-to-Workout/Maturity (Zero Curve)

Yield-to-next-call (call notice period

if currently callable, maturity if not callable)

Yield-to-next-put (maturity if not put)

Most

of the risk measures are self-explanatory.

It should be noted that the “Years” column gives the weighted-average

time to all future principal payments (WAL).

It reflects the day count of the security. For sinkers, the Years value

will be less than the number of years until maturity or workout. The SpreadDV01

value will always be equal to the IntRatesDV01 for non-floaters. For floaters,

the IntRatesDV01 also reflects the change in future projected coupon rates

based upon implied forward rates.

Therefore, the IntRatesDV01 can actually become positive for longer

floaters. When the yield curve is

steeper, the IntRatesDV01 will also become or be more positive since the

projected forward rates will be greater.

If you wish to enter a

workout date, you may do so without specifying a workout price. The workout price will be determined

from the call schedule (or the accretion schedule for an accreting bond). This feature is especially useful for

floating-accretion bonds (e.g. MER 0%

The

following graph shows the US Dollar Swap Curve as of the close of

The Par Curve Spread gives the number of basis points that the yield curve (blue curve in the above graph) would need to shift in order for the full price of the bond to equal the sum of the discounted bond flows. The Zero Curve Spread gives the number of basis points that the spot curve (purple curve in the above graph) would need to be raised in order for the full price of the bond to equal the sum of the discounted bond flows. The Interpolated Spread is based upon a single point on the par yield curve (blue curve). That point is determined from the time to workout or maturity (for sinkers, the WAL is used). Additional detail on interpolated spreads can be found in the Worst Date Migration section.

The

Return value is the percentage return from settlement until maturity or workout

assuming that future coupons are reinvested at risk-free rates from the coupon

date until maturity or workout (implied forwards are used).

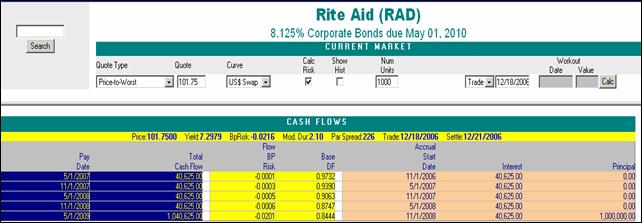

Cash Flows

On

the left hand side of the Corporate Details Page you will find a link to Cash

Flows Page. Once again consider the Rite Aid (RAD) 8.125% corporate bond maturing

on

The flows are calculated to

maturity or the workout date or the worst date depending upon your other

inputs. If the “Calc Risk” flag is checked, the IntRatesDV01

is decomposed by cash flow so that you can see what each flow contributes to

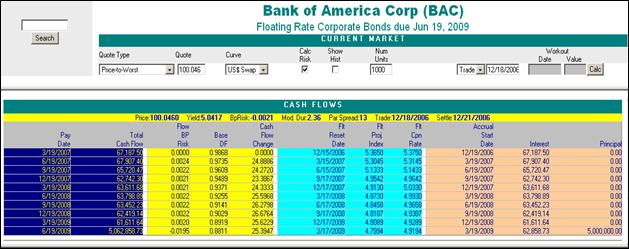

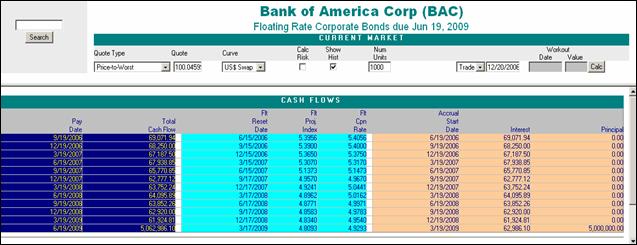

the total risk. Additional information is provided for floaters. Consider the

Bank of America floater maturing on

Note that the reset dates, the projected index values and the coupon rates are shown for each of the future accrual periods. For LIBOR floaters, the reset dates are usually two business days before the start of an accrual period. In this case, the minimum denomination of the bond is $5,000, so 1000 bonds have a face of $5 million. If you desire to see prior coupon fixings, you need only select “Show Hist”.

In this table, past and projected coupons are shown together.

For accreting bonds, the

accretion rate and the accreted value are shown. Consider the FWTR 9%

convertible bond maturing on

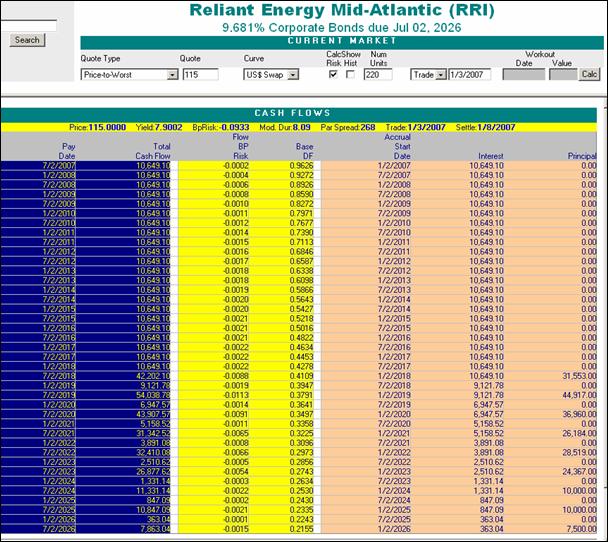

For sinkers, the principal flows are clearly shown as well as the breakdown of risk. Consider below the Reliant Energy sinker RRI 9.681% 7/2/2026.

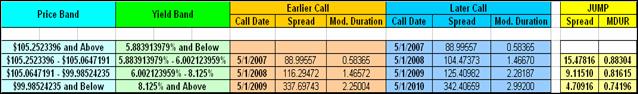

Worst Date Migration Analysis (WDMA) is intended to identify those

price-yield points on the Yield-to-Worst curve where the worst date is changing

from one redemption date or call date to another as interest rates fluctuate. The tendency for the worst date to migrate to

earlier call dates as yields decline demonstrates the negative convexity of

callable bonds (even though the convexity of every price/yield curve

corresponding to the redemption dates is positive). As an example, we will use the Rite Aid (RAD)

8.125% corporate bond maturing on

The Yield-to-Worst curve is defined as the minimum price over all of the redemption dates for a given yield (or equivalently, the minimum yield over all the redemption dates for a given price). Given a yield, the worst curve gives the lowest price. Given a price, the worst curve gives the lowest yield. If you take a closer look at the same price/yield points, you will see that every call date becomes the worst date for some yield (the arrows on the next graph indicate the worst dates). If the bond is trading at a price in the proximity of these cusp points, prices and yields will remain smooth but spreads and durations will jump (unless evaluated with an OAS model). Around these points, there is significantly more doubt about the duration of the bond. If you are segmenting a portfolio of bonds into duration buckets for risk purposes, some bonds may jump into longer buckets even as the bonds age. These jumps are not due to market movements or changes in credit worthiness. Rather, they are entirely attributable to the migration from one redemption date to another as price levels change. Spread jumps will be more severe if the benchmark curve is steeper.

![]()

![]()

![]()

![]()

Kynex identifies these points of

intersection (crossover yields and crossover prices), and then calculates the

magnitude of the spread jump and the duration jump. All

spreads are interpolated spreads. These

spreads are not just calculated by direct interpolation on the yield curve.

Rather, risk free par yields are first calculated from implied spots and

forwards (see the December

2003 Kynex Bulletin on Interest Rate

Swaps). These interpolated spreads

are numerically close to par yield spreads, but can be computed much more

quickly. It is common in the corporate

market not to use interpolated spreads.

Rather, spreads are quoted to a specific Treasury whose maturity is

close to that of the corporate bond. Although this method will not produce

these spread jumps, it does not address the issue of when to change the

benchmark security. If the benchmark security is not changed, the corporate

bond price will not track well with the Treasury. WDMA gives you the exact

price/yield when change of benchmark is prudent.

For this Rite Aid bond on

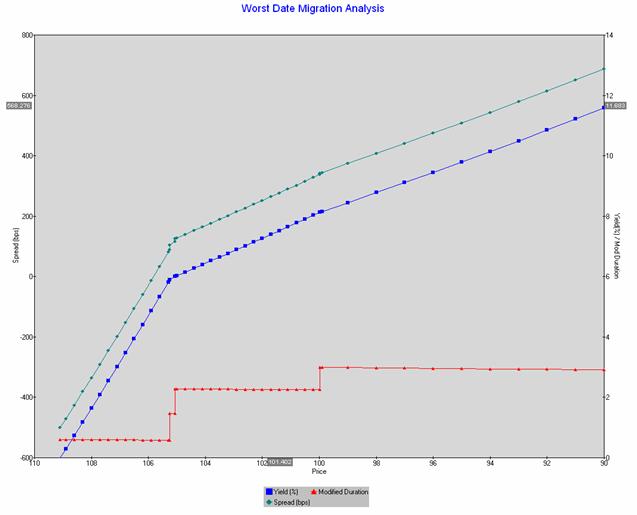

In WDMA, Kynex graphs spread

versus price, yield versus price and modified duration versus price. We make sure that the points to be graphed

include the crossover prices. Intermediate points are then sprinkled

between. At the bottom of the graph, cross over yields and prices are

shown in a table.

As the graph clearly shows, modified duration will lengthen as prices decrease, and the points at which it jumps are indicated by a vertical line. Since you know the price of the security, you can easily determine if the bond’s price is close to one of the crossover prices.