|

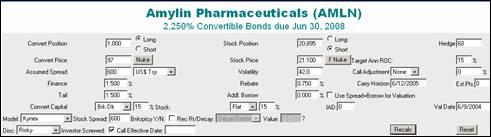

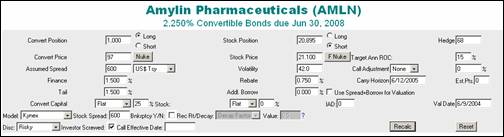

The convertible hedge calculator allows you to analyze a

convertible security that is hedged with the underlying common stock. You can

dynamically change the amount of hedge, convertible and stock prices,

assumptions such as financing and rebate rates, carry horizon, and margin

requirements, etc. and analyze the expected static (assuming convertible

and stock prices do not change) as well as realistic (estimating the

accretion/decay in the value of the convertible over the holding period)

cash flows, and hence the expected return on capital deployed.

The convertible hedge calculator also estimates the

weekly profit-and-loss in excess of the realistic return, required to

generate a target return on capital. In addition you can also analyze

rule-of-thumb calculations used by market participants such as

breakeven-at-par (also referred to as crosses-par) and breakeven-at-parity

(also referred to as up-breakeven). Last but not the least, valuation

measures such as fair value, delta, gamma, yields, premium; convertible

indicative information such as conversion ratio, call, put, outstanding

amount, ratings, issue terms; stock indicative information such as 90-day

and 250-day volatility, distance from 52-week high and low, economic

sector, market capitalization are also presented along side the cash flows

and hedge-breakeven levels.

The convertible

hedge calculator is presented in two sections:

·

The upper section allows you to specify the

inputs and assumptions.

·

The lower section shows the results from the

calculations.

The upper section has been laid out such that your

inputs for the convertible and the stock are grouped in a logical fashion for

ease of entry. The table below

explains the input to the convertible hedge calculator.

|

Input

|

Definition

|

|

Convert Position

|

The number of Convertibles you

own long or short.

|

|

Convert Price

|

The price of the Convertible

|

|

Assumed Spread

|

The credit spread of the bond

over the chosen Yield Curve

|

|

Finance

|

The percentage rate that your

prime broker charges to finance the convertible position

|

|

Tail

|

The Tail is applicable if the broker

charges a different rate on the point premium. For example the broker

charges a 1.5% finance charge on the parity of the convertible position

and a .75% on the balance or point premium. If the broker charges one rate then the

Finance and Tail should be the same.

|

|

Convert Capital

|

The agreement between you and

your broker to calculate margin requirements. Please click

here to see the Rules.

|

|

Stock Spread

|

You can specify the spread to

grow the stock in the finite difference grid. Input the same value as the assumed

spread to value the convertible

risky/risky (recommended), 0 for risk-free risky, or something

else for a custom setting

|

|

Bankruptcy

|

Enable the bankruptcy model to simulate

risk-of-default for a convertible.

|

|

Investor Screwed

|

This flag tells the convertible

valuation model if the investor will receive a coupon payment if the bond

has been called for redemption effective on the interest payment

date. If the box is checked it

indicates to the model that the investor is getting screwed out of the

coupon and will not receive the interest payment. If the box is unchecked the investor

will receive the interest payment if the convertible is called for

redemption and the investor is forced to convert

on the interest payment date

|

|

Call Effective Date

|

If a bond is called, this is the

date on which the call is effective. This box will not be filled for partial

redemptions. You can use this input to value convertibles that you expect

to be cash-called for redemption.

|

|

Stock Position

|

The number of shares you are long

or short.

|

|

Stock Price

|

The price of the common stock.

|

|

Nuke

|

Pops up a new window to calculate

the dollar neutral price. If you

hit the “OK” button it will put the dollar neutral price in the hedge

calculator.

|

|

F Nuke

|

This nuke is a quick way to

calculate a dollar neutral price. If you have a convert price and stock

price in the hedge calculator, and hit “calculate” you can just change

the stock price and get the new dollar neutral price. The F Nuke takes the previous stock and

convert price as reference prices and then takes the new stock price and

hedge to calculate the dollar neutral price.

|

|

Volatility

|

Your volatility estimate for the

common stock

|

|

Rebate

|

The rate used to calculate the

rebate on your short-sale proceeds.

|

|

Additional Borrow

|

You can specify an additional borrow

cost for tough to borrow stocks. This will be netted out of the rebate.

|

|

Hedge

|

Fill in your hedge and the

calculator will automatically update your stock position. Changing the

stock position will update the hedge, as well.

|

|

Target Ann ROC

|

Your target annualized return on

capital

|

|

Call Adjustment

|

Setting the call adjustment to

Parity+ and putting a number of 20 will make the model value the

convertible such that the issuer cannot call the convertible until the

parity is at least 20% above the call price. NCL stands for Non Call Life.

|

|

Carry Horizon

|

Your investment horizon

|

|

Est. Pts.

|

Your estimate of point premium at

which the convertible is likely to trade on the horizon date

|

|

Use Spread + Borrow

|

If this is checked the valuation

model will use the spread of the finance and rebate plus the borrow cost,

as an additional cost that increases with delta. If left unchecked, the

model will not take these inputs into account.

|

|

IAD

|

Indicated Annual Dividend. The

page will default to the current indicated annual dividend. You may

change this to simulate dividend increases/decreases. If you want to make the IAD from .5 to

0 you must put in .0001. By convention if the IAD is zero the valuation

model will pick up the value stored in our database.

|

|

Val Date

|

The trade date you want to

analyze your hedge

|

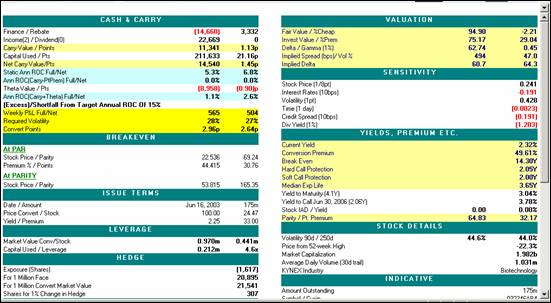

The lower part of the screen presents the results of our

calculations - cash-flows and hedge-breakeven (left side) and theoretical

valuation and indicative information (right side). We present below a table

explaining each output from the convertible hedge calculator, followed by a

more detailed explanation of some of the results.

|

Cash & Carry Outputs

|

Definition

|

|

Finance

|

This is the cost of financing the

convertible position at the current price using the financing rate over

the carry horizon. Finance = Finance

Rate X Convert Position X Convert Price X Horizon. Example:

14660 = .015 X 1000 X (970) X

1.00756

|

|

Rebate

|

This is the rebate on the short

stock position using the rebate rate over the carry horizon. Rebate =

Rebate Rate X Stock Position X Stock Price X Horizon. Example: 3,332= .0075 X 20,985 X 21.1 X 1.00756

|

|

Income

|

The Income is the sum of the

coupon payments received from the long convert position over the carry

horizon net of accrued interest.

|

|

Dividends

|

The Dividends is the sum of the

dividends paid out on the short stock position over the carry horizon

|

|

Carry Value

|

This is the sum of the Finance,

Rebate, Income, and Dividends.

Carry

Value = (Finance) + Rebate + Income + (Dividends)

11,341=(14,660)

+ 3,332 + 22,669 + 0

|

|

Capital Used

|

This is the

estimated capital in dollars using the capital rules and rates.

|

|

Net Carry Value

|

This is the Carry in dollars if

one assumes Capital is free.

Net Carry Value = Carry Value + [Capital

Used X Finance X Horizon]

14,540= 11,341 + (211,633 X .015

X 1.00756)

|

|

Static Ann ROC

|

Static Ann ROC full is the

annualized return on capital assuming that the capital cost is the same

as Finance cost. Static Ann ROC net is assuming capital is free.

|

|

Ann ROC(Carry-PtPrem)

|

Annualized Return on Capital if

the convertible trades at input point premium on the horizon date. Full is assuming cost of capital same

as finance rate and Net is assuming cost of capital is zero.

|

|

Theta Value

|

Theta Value is the estimated

decay/acceleration in the value of the convertible over the carry horizon

in dollars. See

Commentary below for more details.

|

|

Ann ROC(Carry+Theta)

|

Ann ROC(Carry + Theta) is the annualized

return on capital including the estimated decay/acceleration in the value

of the convertible over the carry horizon.

|

|

Weekly P&L

|

Weekly P&L Full is the

estimated weekly P&L after the Carry + Theta on the position to meet the

target ROC assuming cost of Capital is the same as financing rate. The Weekly P&L Net is the estimated

weekly P&L after the Carry + Theta on the position to meet the target

ROC assuming the cost of Capital is zero.

|

|

Required Volatility

|

Volatility need to be realized

from gamma trading after the Carry + Theta on the position to meet the

target ROC. See below for

commentary.

|

|

Convert Points

|

The convertible needs to richen

by this many points over the carry horizon to meet the target ROC after

Carry + Theta on the position.

|

|

Exp. Gamma P&L

|

Potential gamma P&L if

assumed volatility is realized. P&L = Position * Gamma1% *

(Conversion Ratio / Fx) * Stock Price * 0.5 *

(VolAssump/100)^2 * (days to horizon/365)

|

|

Outputs-Breakeven

|

Definition

|

|

At Par-Stock Price

|

If the stock price reaches the

level listed and the convertible goes to par/accreted value, the P&L will

go to zero using the current hedge.

|

|

At Par-Parity

|

Parity calculated based on the

stock price above

|

|

At Par-Premium

|

The Conversion Premium for zero

P&L for the above stock price

|

|

At Par-Points

|

The Point Premium for zero P&L

for the Parity above

|

|

At Parity-Stock Price

|

If the stock reaches this level

and the convertible trades with zero premium, the P&L will be zero

using the current hedge.

|

|

At Parity-Parity

|

Parity calculated based on the

stock price above

|

For more information on Breakeven see the commentary below

|

Outputs-Leverage

|

Definitions

|

|

Market Value Convert

|

The total market value on your

convert position. Market value Convert

= (Convert Price)(Convert Position)(10)

|

|

Market Value Stock

|

Total market value on your stock

position Market Value Stock= (Stock Position)(Stock Price)

|

|

Capital Used

|

The Capital used is the estimated

capital in dollars using the capital rules and rates.

|

|

Leverage

|

Leverage = Convert Market

Value/Capital Used. For example,

if you want a leverage of 4, then put the Convert Capital both to “Flat”

and the % stock to 25 and the other box to 0 %. This will give you a leverage of 4.

|

More Details:

Full Carry Vs Net Carry

Depending

on your financing situation, you should choose either full carry or net

carry. If you are part of an institution such as a bank where the financing

is charged on the entire long position, you should use the full carry. If

you are a hedge fund with margin treatment from the prime broker, and your

perspective is the expected profit-and-loss, you may want to use the net

carry. This is because, the prime broker will calculate the margin

requirement based on your agreement with them and will charge the financing

only on the portion of the long that you borrow. While using the net carry

gives you a more accurate estimate of profit-and-loss, it also makes the

cost of capital zero, which may not be appropriate if your perspective is

other than profit-and-loss.

Theta

The static cash-flow analysis

assumes that on the horizon date the stock price is unchanged, and so is

the convertible price. To be realistic we have to take into consideration

the convertible’s bond value accretion as well as option value decay over

time. We estimate this value (theta) by calculating the expected market

price for the convertible on the horizon date based on the current implied

spread, stock price, and volatility assumption. The difference between the

current convertible price and the estimated market price on the horizon

date is theta. This calculation

takes into account both the accretion of the bond value and decay of the

option value.

Required Volatility

We estimate the required volatility

from the weekly profit-and-loss requirement to reach the target return on

capital. The calculation assumes that you are trading stock for a 1% move

in the stock price based on the gamma of the convertible and that the stock

price is volatile around the current price. The weekly profit-and-loss

requirement itself is based upon your finance and rebate rates, capital

deployed, and carry horizon. In the market however, the stock price is more

likely to deviate higher or lower from the current levels, and your capital

requirements will change as a result. The theoretical valuation model on

the other hand does not know anything about your horizon date, and

leverage, but takes into account the entire structure of the convertible

such as call, put, and exercise schedules, etc; current yield curve;

volatility and credit spread assumptions and uses market’s expectation of

forward rates, and stock prices based upon probabilities. Given the vastly

different set of assumptions used to calculate the required volatility

based on cash-flows and the theoretical market implied volatility, they are

apples and oranges and should not be

compared. One should look at both the volatilities in the proper

context and make investment decisions.

Breakeven At Par

(Crosses Par)

The breakeven-at-par calculates the

stock price that gives a zero profit-and-loss effect using the current

hedge if the convertible trades at par/accreted value. Using this stock

price we also compute the conversion premium. Some market participants use

this metric to analyze how heavy the hedge should be, if they want to setup

a bearish hedge or want to hedge for potential deterioration of credit

spread as the stock prices decline. The idea is to challenge if the

convertible is likely to trade at the crosses-par premium, and refine the

hedge. While one can question the sanctity of the convertible trading at

par as the stock is declining, this metric is useful for analyzing

comparable convertible securities on a hedged basis.

Breakeven At Parity

The breakeven-at-parity calculates

the stock price that gives a zero profit-and-loss effect using the current

hedge if the convertible trades at parity, i.e. zero conversion premium.

This metric is useful in analyzing hedged convertible positions when the

convertible is currently callable or callable in a few months. Since many

CFOs tend to wait for the parity to cross 10%-15% over the call price

before calling their convertibles for redemption as a cushion, the market

also tends to trade on that basis as we get close to the call date.

Therefore, on a hedge basis, a breakeven parity of 110 is less risky than a

breakeven parity of 140 because if the stock rises, the risk of premium

collapse also increases, and will adversely affect both the long and the

short sides. Of course, this does not help assess the risk of cash calls in

low interest rate environments. This metric is also useful in analyzing the

risk from a cash takeover. If the company of the underlying stock is taken

over for cash at a low-to-moderate premium and the convertible is trading

at a high premium because of long call protection (option value), the risk

is evaporation of conversion premium as the option is abruptly terminated.

The breakeven at parity gives a threshold for the take over stock price on

the current hedge. If you have a view on the likely take over level for the

stock price, you can refine the hedge to minimize the takeover risk.

Examples for Capital Calculations:

We took two securities one with a low conversion premium

and one with a high conversion premium and compared the two with the

different capital rules.

NCEN 3.5%

2008 Premium: 9.58 Hedge: 77 Stock

Price: 40.86 Convert Price: 128.658

Convert Rate:

15% Stock Rate: 15% Point Premium:

11.24

EW 3.875%

2033 Premium 61.98 Hedge: 53 Stock

Price: 34.69 Convert Price: 102.799

Convert Rate:

15% Stock Rate: 15% Point Premium:

39.33

|

Capital Rules

|

NCEN- Low

Premium

|

NCEN Leverage

|

EW-High Premium

|

EW

Leverage

|

|

BrkDlr

Rule

Lesser of Convertible Rate on

Convertible Market Value + Stock Rate on Stock Market Value OR Point

Premium on Hedged Portion + Convertible Rate On unhedged portion

|

130,967

|

9.82

|

204,657

|

5.02

|

|

Flat

Convertible Rate on Convertible Market

Value + Stock Rate on Stock Market Value

|

328,603

|

3.92

|

204,657

|

5.02

|

|

PtPrm+

Entire

Point Premium + Convertible Rate on unhedged portion

|

156,827

|

8.20

|

465,807

|

2.21

|

|

PtPrm25C

Point

Premium on hedged portion with a cap of 25% of hedged Convertible Market

Value + Convertible Rate on unhedged portion

|

130,947

|

9.83

|

208,686

|

4.93

|

|

10-30

10% of hedged portion + 30% of

unhedged portion

|

187,835

|

6.85

|

199,422

|

5.16

|

|

PtPrm15C

Point Premium on hedged portion

with a cap of 15% of hedged Convertible Market Value + Convertible Rate

on un-hedge portion AND a floor of 2.5% on the total Convertible Market

Value.

|

130,967

|

9.82

|

154,199

|

6.67

|

If you have any questions regarding the Hedge Calculator

please give us a call 201.796.4900.

|