KYNEX Bulletin

June 2008

We are pleased

to announce the release of support for volatility surfaces for the pricing of

convertible securities and equity options. Specifying a volatility surface that

captures your view of the implied volatility in the market will result in the

following benefits:

-

Precise control

over the valuation of equity options and the convertible securities.

-

Obtain a Delta

profile for hedging that reflects your view of the relationship between spot

prices, strikes, expirations and implied volatilities.

We describe how

to create, edit and save a volatility surface later

in this document, with an explanation of all of the input fields, and we

also offer several general comments on the specification

of volatility surfaces in conjunction with our existing infrastructure (e.g.

the New Issue Analytic, the Sensitivity screen, etc.). We also emphasize here

that you could continue to value equity derivatives without a volatility

surface, i.e. flat volatility. We analyzed several instruments (equity options

and convertibles) with flat volatilities and volatility surfaces, and we present a summary of our observations below:

·

The effect of

the skew in the volatility surface on the valuation is more pronounced as the

time to expiration increases. This is especially true for long dated equity

options and long call protected convertible securities that have been coming to

market in the past year. We strongly recommend the specification of volatility

surfaces for valuing convertible securities with over three years of call

protection.

·

Volatility

surface is a better way to capture skew in valuing mandatory convertibles. If

the mandatory convertible has structural features such as calls, and one-to-one

upside participation that make a simple decomposition difficult, volatility

surfaces is the only way to capture the skew in valuation.

·

Volatility

surface is a better way to value convertibles with variable conversion ratio

(aka embedded warrants) features. You can specify a surface that captures the

appropriate volatilities for the complex set of options that get embedded into

a convertible security with the variable conversion ratio feature.

Briefly, the input

volatility surface consists of a set of implied volatilities, with their

associated strikes and maturities. (The model will interpolate or extrapolate

the surface as required, for valuing equity derivatives.) Since convertible

bonds are valued on a risky basis, the inputs are treated as risky implied volatilities. We include a

discussion of the concept of risky and risk-free implied volatilities in the

following section.

The general

“volatility surface” referred to by market practitioners is in fact a surface

of implied volatilities. The new functionality allows you to input a set of

implied volatilities, for selected expirations and strikes (as well as a time

factor to grow or decrease the implied volatility beyond the last input

expiration). The valuation model internally calculates a so-called “local

volatility” surface, for pricing the equity derivative such as an equity option

or a convertible security. We have implemented the well-known Dupire formula [B. Dupire, “Pricing and hedging with smiles”

Proc.

Another point to

note is that for exchange-traded listed equity options, the implied

volatilities are calculated by valuing the options on a risk-free basis. One

can call this a “risk-free” implied volatility (risk-free in the sense of

having no default and counter-party risk). However, a risky basis is more

appropriate for the valuation of convertibles, because the option embedded in a

convertible is written by the issuer (not an exchange), and one must

take into account the possibility of default by the issuer. The concept of risky and risk-free implied volatilities is discussed in

more detail in the companion article. Temporarily setting aside the put

and call features of a convertible, a common visualization of a convertible is a

straight bond (paying periodic coupons and principal at maturity) and a call

option on the underlying stock. The straight bond is treated as risky and the

call option is treated as risk-free. This view point suffers from the

deficiency that it is assumed that the bond floor will hold as parity approaches

zero. However, at a zero stock price, the issuer is in default (bankrupt) and

therefore does not have the ability to honor the principal redemption amount of

the bond. A more fundamental way to visualize a convertible is to treat it as a

stock plus a put option (plus coupons). As the stock price goes to zero, the

put goes more in the money, but the issuer’s ability to honor the put becomes

more and more questionable. Hence the implied volatility of a convertible is

effectively that of a risky put

option, i.e. a risky implied volatility.

Another way to state this is the implied volatility of a convertible is the

volatility an options broker would be willing to pay for a put whose ability to

collect when it gets in-the-money is tied to the credit worthiness of the

issuer.

However, note

that the visualization of a convertible as a straight bond plus call option, or

as a stock plus put option, is only approximate. The option embedded in a

convertible does not have a fixed strike or expiration. The effective strike of

the embedded option is a function of the time to maturity. An approximate

measure of the expiration of the embedded option is the median life of the

convertible. Hence when we speak of a “risky put option” or a “risk-free call

option” we are not implying that a

rigorous separation of the option from the convertible bond exists. Overall,

the above ideas lead to the following two points of view when pricing a

convertible using an implied volatility surface (and a third for

exchange-listed equity options):

·

You can specify

a surface of risky implied volatilities. This will value the embedded risky put

in the convertible. In particular, the risky implied volatility should decrease

to zero as the stock price decreases to zero, which indicates the decreasing

probability that the risky put will be honored as the stock price declines. An

investor is less willing to pay for implied volatility for a security which is

unlikely to be honored. Conversely, an investor would be willing to pay a

higher implied volatility for a security with a greater likelihood of a

positive payoff; hence the risky implied volatility increases as the stock

price increases. However, at high parity,

the embedded put is way out of the money (and has negligible Gamma), and once

again an investor would pay a lower implied volatility. Hence, overall, a

surface of risky implied volatilities has a peak as the parity level increases from

low to high values.

·

You can specify

a surface of risk-free implied volatilities (for example, obtained or extrapolated

from the listed options market). In this case you should switch on the

bankruptcy mode (with an appropriately chosen decay factor that captures the

relationship between stock prices and credit spreads) to model the fact that the

bond floor is not guaranteed to hold as parity approaches zero. However, it is

inconsistent to employ a surface of risk-free implied volatilities for a

convertible, without modeling the fact that the bond floor will not hold at

zero parity. In the post-1987 era, the implied volatility surfaces of listed

options (which are risk-free implied volatilities) typically have a negative skew, i.e. the implied

volatility decreases monotonically as the strike level increases.

·

For valuing exchange-listed

equity options, a surface of risk-free implied volatilities is appropriate.

There is no concept of a bankruptcy mode for valuing equity options because

there is no counter-party risk.

To illustrate

these ideas, we display examples of the valuation of equity options using a surface

of risk-free implied volatilities, and convertible bonds using both a surface

of (i) risky implied volatilities and (ii) risk-free implied volatilities with

bankruptcy mode. For the equity option, we select the AG 60 strike Jan 2010

call and put options. For convertibles, for simplicity we consider two bullet

bonds with maturities of at least 5 years. We value the CAI bullet bond

maturing in May 2014 using a risky implied volatility surface, and we value the

NDAQ bullet bond maturating in August 2013 using a risk-free implied volatility

surface, with bankruptcy mode. We summarize our overall findings as follows.

·

We analyzed the

valuation of the fair value and Delta as a function of the stock price, for a

fixed trade date. Next we analyzed the valuation as a function of the trade

date (i.e. time to maturity), for a fixed stock price. We refer to the change

in the implied volatility with the strike level as volatility skew or curvature

(for a risky implied surface with a downward curvature).

o

For equity

options valued using a risk-free implied volatility surface with a negative

skew, the valuation basically follows what one would expect.

§

When sweeping

the stock price the fair value is higher using a volatility surface at low

stock prices (compared to valuing with a flat volatility) and lower at high stock

prices. The Delta is lower at moderate stock prices, and is higher at very low

and very high stock prices.

§

When varying the

trade date (time to expiration), the difference in valuation (for the fair

value) is approximately linear to time-to-expiration, and also approximately

linear in the volatility skew.

o

For convertibles

valued using a risky volatility surface with a negative curvature, the

valuation is more complicated.

§

When sweeping

the stock price the fair value is lower using a volatility surface (compared to

valuing with a flat volatility). This can be understood because of the negative

curvature; the volatility in the surface is lower than the flat assumed

volatility.

§

However, the Delta

displays a complicated behavior, and can be either higher or lower than the Delta

obtained using a flat volatility, depending on the stock price level. The

precise behavior of the Delta is a function of several inputs such as credit spread;

borrow cost, dividends on the stock, etc.

§

When varying the

trade date (time to expiration), the difference in valuation (for the fair

value) is highly nonlinear along time-to-expiration and also nonlinear along

volatility-skew.

o

For convertibles

valued using a risk-free volatility surface with a negative curvature, and the

bankruptcy mode, the valuation is also more complicated.

§

When sweeping

the stock price the fair value is usually but not always lower than with a

volatility surface (compared to valuing with a flat volatility). The precise

behavior depends on many factors.

§

However, the Delta

displays a behavior similar to that of equity options. The Delta is lower at

moderate parity levels, and is higher at very low and very high parity.

§

When varying the

trade date (time to expiration), the difference in valuation (for the fair

value) is approximately linear along time-to-expiration, and also approximately

linear along volatility-skew.

·

In addition to a

volatility skew or curvature, we also allow you to input a time factor, so that

the implied volatilities will grow (or decay) at a specified rate. For example

a time factor of -1 means the volatilities decrease to 99% of their original

values after 1 year. We also analyzed the valuations of equity options and

convertible bonds as a function of time factor decay of the implied

volatilities.

o

We found that in

all cases, when valuing with a volatility surface with a time factor, the

difference in valuation (for the fair value) is approximately linear along time-to-expiration,

and also approximately linear along time-factor.

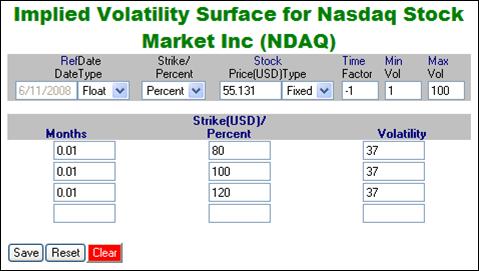

We now present

more detailed descriptions of our valuations. We begin with the equity options.

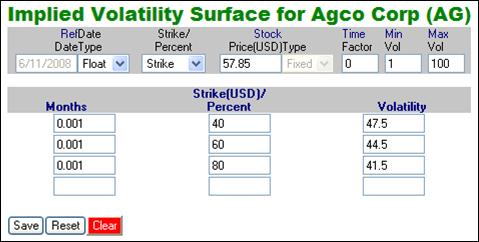

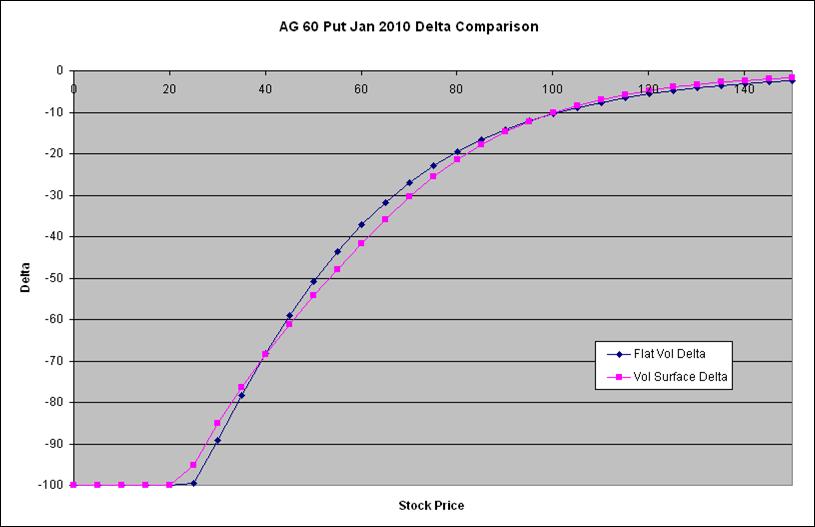

The implied volatility surface is presented in Fig. 1. The

at-the-money implied volatility of 44.5 was taken from the 60 strike Jan 2010 listed

options. We also input two other strikes of 40 and 80, and a negative skew of 3

volatility points (i.e. implied volatilities of 47.5 and 41.5, respectively.)

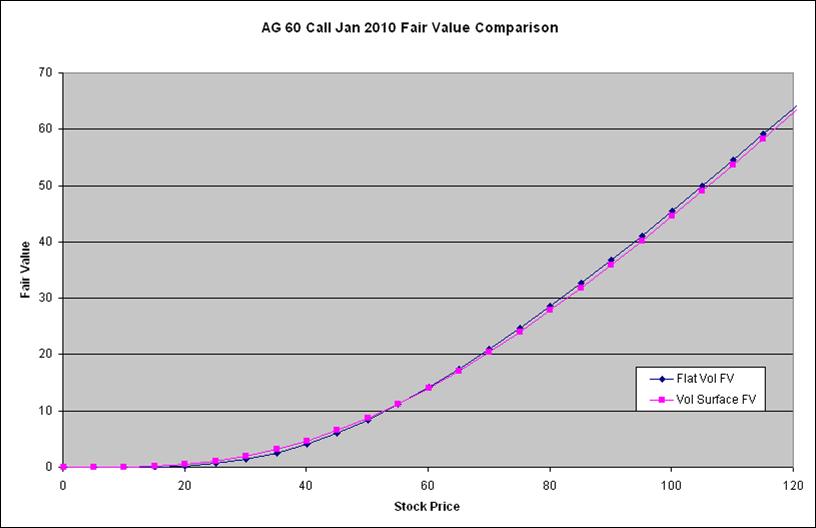

We present the relationship between fair value and stock price for a Jan 2010

call option, in Fig. 2. The blue curve is the valuation

using a flat assumed volatility of 44.5 (the at-the-money implied volatility),

and the pink curve is the valuation obtained using the implied volatility surface.

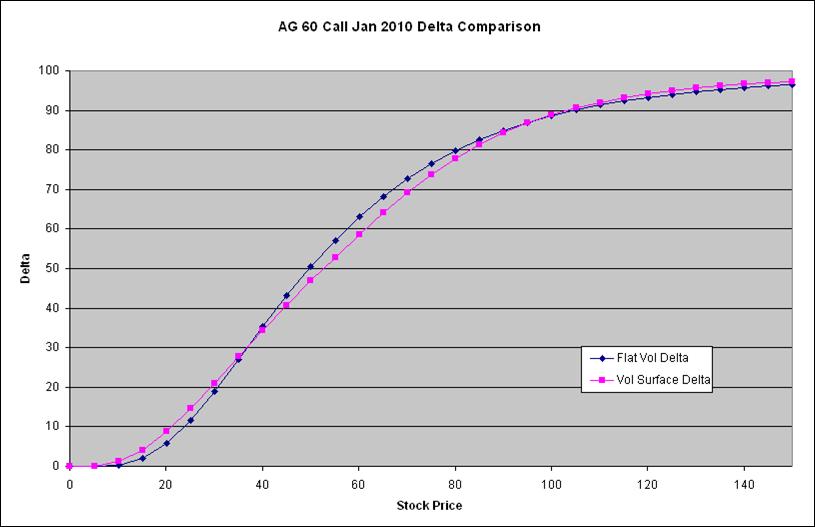

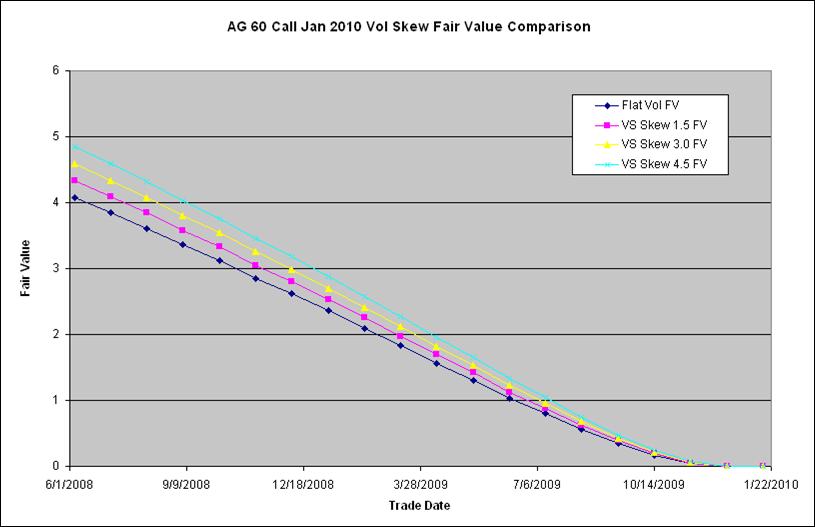

In. Fig. 3, we present the relationship between Delta and

stock price for the same option. As before, the blue and pink curves are the

valuations using a flat assumed volatility and an implied volatility surface,

respectively. We note the following general observations.

·

The graph of the

fair value (Fig. 2) displays a

“crossover” behavior. The valuation using an implied volatility surface is

higher (than the valuation using a flat assumed volatility) at low stock prices,

and is lower at high stock prices. This behavior can be understood because of

the negative skew of the implied volatility, because the implied volatility is

higher at low stock prices and lower at high stock prices. There is no simple formula for the

location of the crossover point, in general.

·

The graph of the

Delta (Fig. 3) has two crossover points. The valuation

using an implied volatility surface is higher (than the valuation using a flat

assumed volatility) at low and high stock prices, and is lower at moderate stock

prices. This behavior can also be understood because of the negative skew of

the implied volatility.

o

At moderate stock

prices, the fair value crosses from a higher to a lower valuation (compared to

a flat assumed volatility), and so overall has a lower slope. Hence the Delta

is lower at moderate stock prices.

o

At high stock

prices, the fair value approaches intrinsic value more rapidly (compared to

valuation using a flat assumed volatility), so the Delta approaches 100 more

rapidly. Hence the Delta is higher using an implied volatility surface.

o

Conversely, at

low stock prices the fair value is higher (compared to valuation using a flat

assumed volatility), but we also know that the fair value equals zero at a

stock price of zero. Hence again the Delta is higher using an implied

volatility surface.

o

As with the

graph for the fair value, there is no simple formula for the locations of the

crossover points.

·

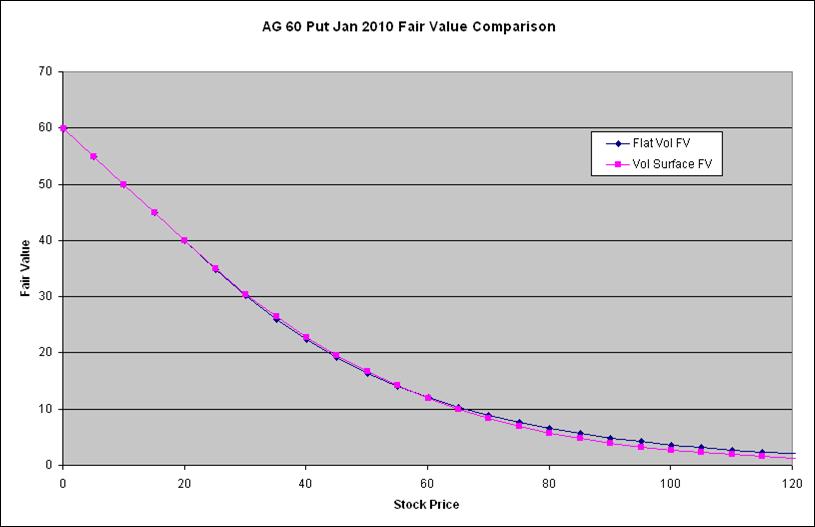

For put options,

we consider the AG 60 strike Jan 2010 put. We display a graph of the fair value

vs. stock price in Fig. 4 and a graph of Delta vs. stock

price in Fig. 5. As before, the blue and pink curves show

the valuation using a flat assumed volatility and an implied volatility

surface, respectively.

o

As for a call

option, the fair value graph shows a crossover where the valuation using an

implied volatility surface is higher at low stock prices and low at higher

stock prices.

o

For the graph of

Delta, the crossover behavior is as follows: at moderate stock prices the Delta

is more negative (higher absolute value), whereas at low and high stock prices,

the Delta is less negative (smaller absolute value).

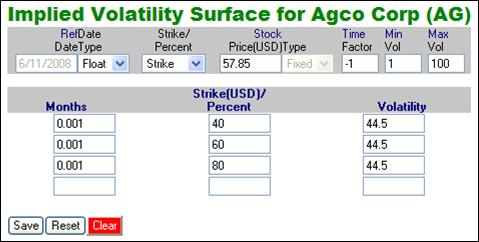

Another way to

analyze the data is to graph the valuation as a function of the time to

expiration, i.e. to sweep the trade date. In Fig. 6, we

plot a graph of the fair value vs. the trade date, for a fixed stock price

S=40. We display multiple curves, for an implied volatility skew of 0, 1.5, 3.0

and 4.5, respectively (the skew of zero is a flat assumed volatility). The

differences in the valuations are approximately linear in the time to

expiration and also approximately linear in the skew. This is only an approximate

relation, because it is known theoretically that as the time to expiration

increases to infinity (perpetual options), the fair value approaches an

asymptotic limit. Hence the differences shown in Fig. 6 cannot

grow forever but must approach asymptotic limits. However, for moderate skews

and times to expiration (a few years), the above linear relationship is

approximately valid.

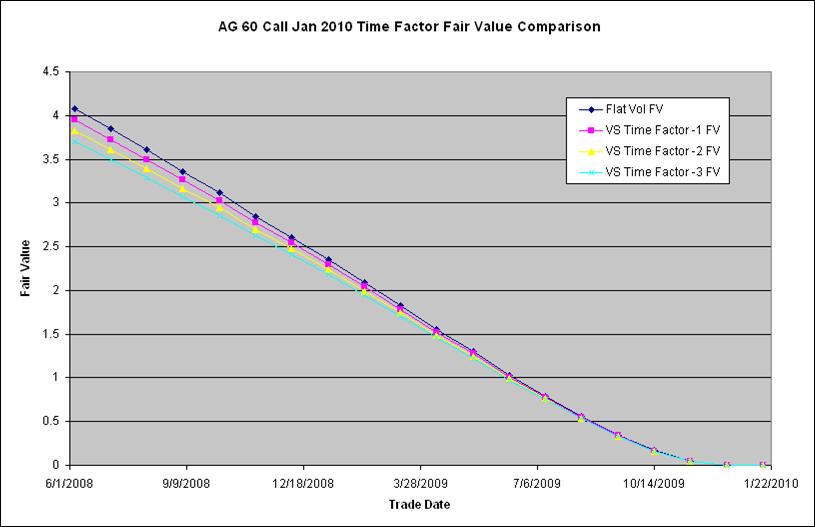

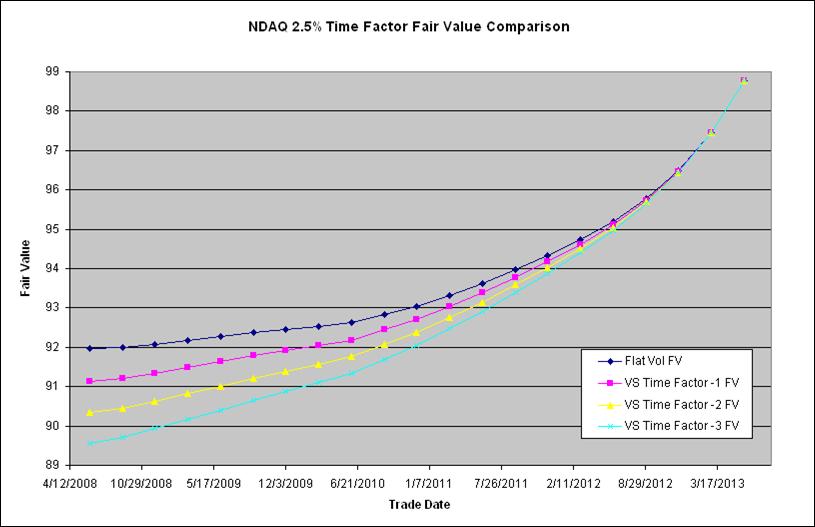

There is also

another type of implied volatility surface to consider, i.e. a time structure

(as opposed to an implied volatility skew). We display a second implied

volatility surface in Fig. 7. The time factor is -1 which

means the implied volatilities decay by 1% per year. To simplify the analysis,

we set the skew to zero, so the implied volatility is 44.5 at all the strike

levels. Hence after 1 year, the extrapolated implied volatilities will be![]() . In Fig. 8, we display a graph of the fair

value vs. the trade date, for a fixed stock price S=40. We display multiple

curves, for time factors of 0, –1, –2 and –3, respectively (the time factor of

zero is a flat assumed volatility). The valuation is very similar to Fig. 6, except now a more negative time factor yields a

smaller fair value. The differences in the valuations are approximately linear

in the time factor and actually slightly faster than linear in the time to

expiration.

. In Fig. 8, we display a graph of the fair

value vs. the trade date, for a fixed stock price S=40. We display multiple

curves, for time factors of 0, –1, –2 and –3, respectively (the time factor of

zero is a flat assumed volatility). The valuation is very similar to Fig. 6, except now a more negative time factor yields a

smaller fair value. The differences in the valuations are approximately linear

in the time factor and actually slightly faster than linear in the time to

expiration.

The valuations

for other call and put options are basically similar. To simplify our analysis,

we have demonstrated valuations using either an implied volatility skew or a

time factor for implied volatility decay. However, in general you would specify

both a skew and a time factor together. The effect of a negative time factor changes

the valuation downwards at all stock price levels. The effect of volatility

skew is minimal near the crossover point, and has an opposite effect on the

valuation on either side of the crossover point. However, there is no simple

formula to determine where the crossover point will be located.

We now analyze

the valuation of convertible bonds. We consider the

·

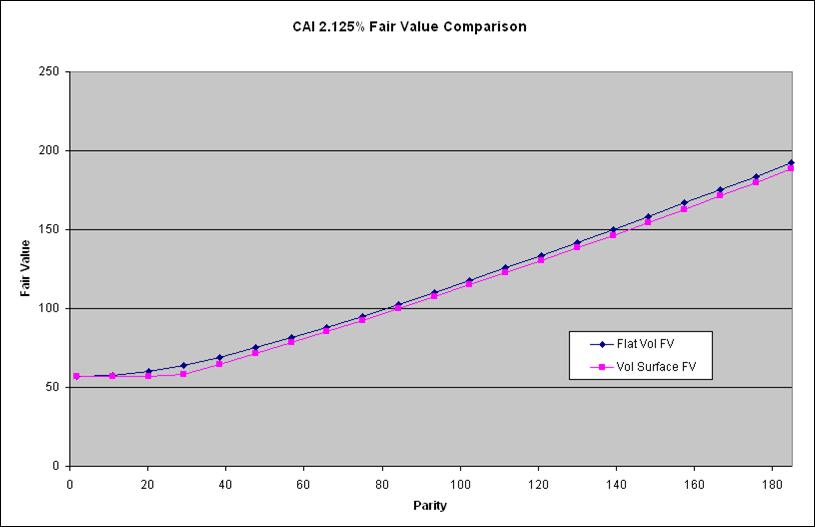

We display a

graph of the fair value vs. parity in Fig. 10. As with

the valuation of the equity options above, the blue curve is the valuation

using a flat assumed volatility (i.e., the 100% strike implied volatility of 45),

and the pink curve is the valuation obtained using the implied volatility

surface. The fair value using an implied volatility surface is always lower

than the fair value using a flat assumed volatility. This is expected because

the volatility from the surface is always lower than the flat assumed

volatility of 45. Note that the asymptotic limits at zero and infinite parity

are independent of the volatility. Hence the bond floor is the same,

independent of the volatility. At very high parity, both valuations also

converge to the same limit.

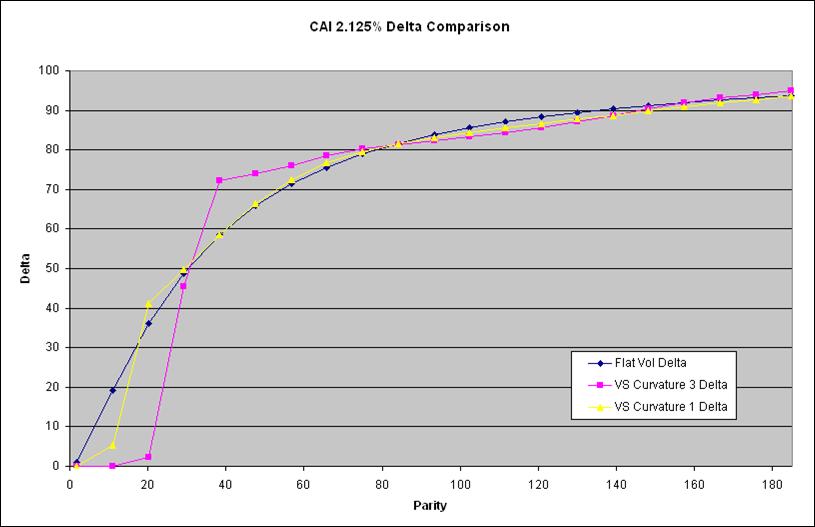

·

In. Fig. 11, we display a graph of Delta vs. parity. However, we

display three curves. The blue curve

is the valuation using the flat assumed volatility of 45, and the pink curve is

the valuation using an implied volatility surface with a curvature of 3 points.

The yellow curve is the valuation using implied volatility surface with a

curvature of 1 point. Unlike the corresponding graph for equity options, the

crossover behavior for the Delta of a convertible is much more complicated. The

Delta is initially lower at low parity, and is higher at moderate parity, and

there is a second crossover point at a parity of about 90. However, for a

curvature of 3 points, there is a third

crossover point at a very high parity of about 160. Basically, the option

embedded in a convertible cannot be expressed as a simple equity option.

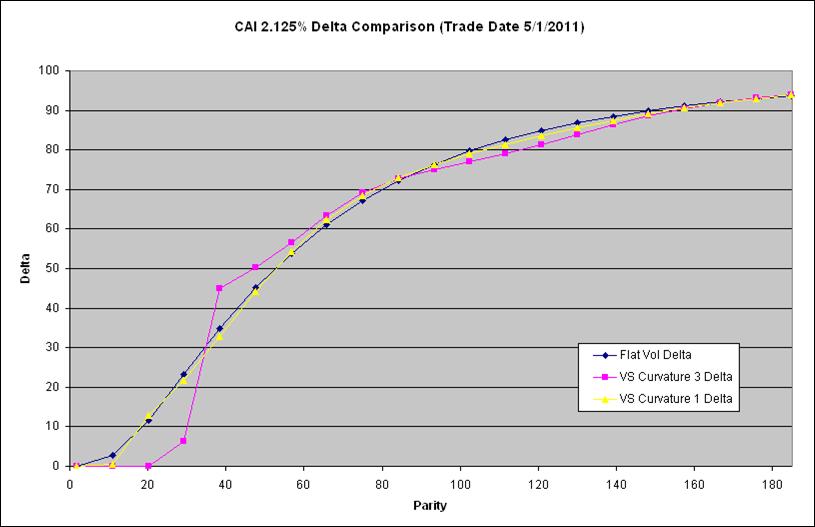

·

In. Fig. 12, we also display a graph of Delta vs. parity, but we

set the trade date forward to

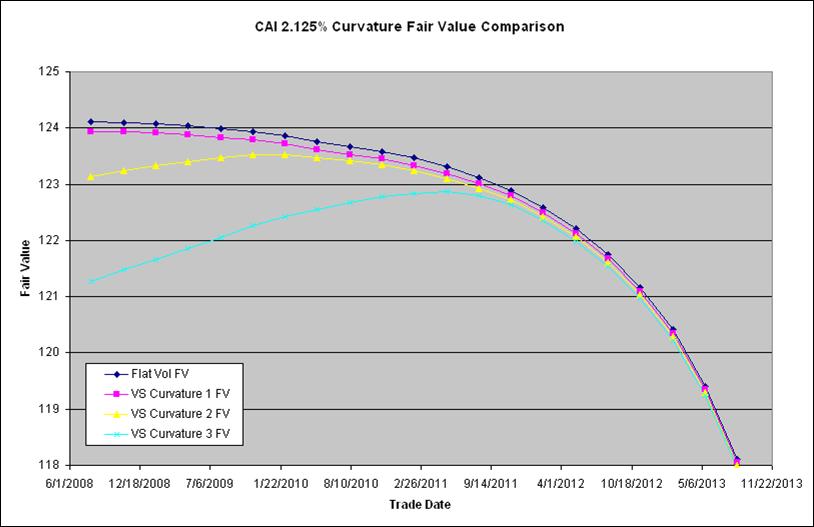

Next, we plot

valuations of the convertible as a function of the trade date, i.e. the time to

maturity. In Fig. 13, we display graph of the fair value

vs. trade date, for curvature values of 0, 1, 2 and 3 points (zero curvature is

same as a flat volatility specification). The curves are respectively blue, pink, yellow,

and light blue. The stock price was set to 60 in the valuations. Unlike the

case for equity options, the difference in valuations for a convertible is

highly nonlinear in the time to expiration, and also in the curvature of the implied

volatility.

·

In general, as

the time to maturity increases, the fair value using an implied volatility

surface stays close to that using a flat assumed volatility, and then diverges

rapidly in a very nonlinear manner. The difference in valuation is small for

times less than one year to maturity (approximately) but grows very fast as the

time to maturity increases beyond that value.

·

For a curvature

of 1 point, the fair value (pink curve) remains fairly close to the valuation

using a flat assumed volatility (blue curve) for all the trade dates in the graph.

However, there are significant differences in valuation for curvatures of 2 and

3 points. The difference in valuation increases nonlinearly with an increase of

curvature.

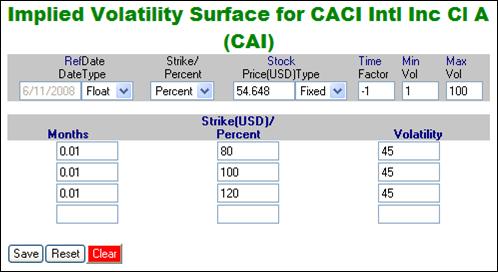

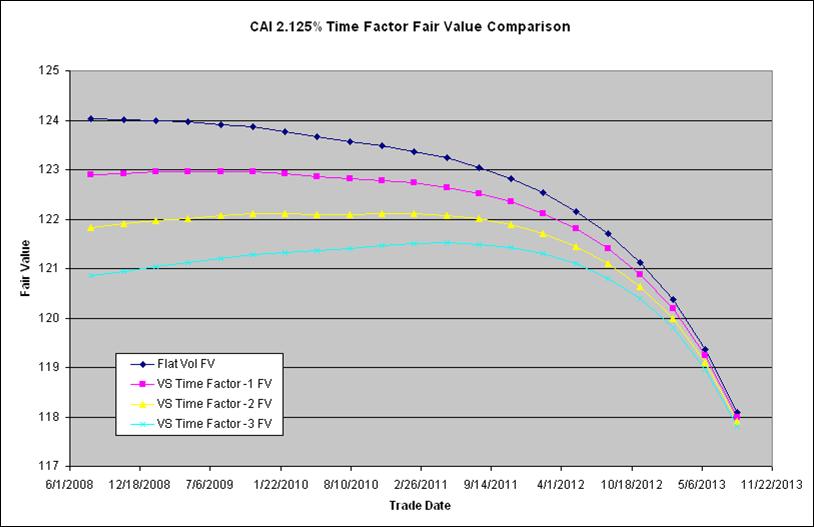

Next, we value

the convertible bond using an implied volatility surface with a time factor for

the volatility decay. We display the implied volatility surface in Fig. 14. The time factor is –1, which again means the

implied volatilities decay by 1% per year. We set the curvature to zero, so the

implied volatility is 45 at all the strike levels. We set the stock price to

60. In Fig. 15, we display a graph of the fair value vs.

the trade date, for time factors of 0, –1, –2 and –3, respectively (the time

factor of zero is a flat assumed volatility). The curves are blue, pink, yellow and light

blue, respectively.

·

As expected, a

more negative time factor yields a lower fair value.

·

In contrast to

the previous graph (Fig. 13), as the time factor is

varied the difference in valuation is approximately linear in the time to

expiration, and is also approximately linear in the time factor.

·

The magnitude of

the differences in valuation, between Fig. 13 (change of

curvature) and Fig. 15 (change of time factor), are

approximately comparable. In general, you would input an implied volatility

surface using a term structure of curvatures and a time factor.

The valuations

for other convertibles are similar. There are quantitative differences if the

bond has call and put provisions. There are also differences of detail due to dividend

protection, because the changes the conversion ratio depend on the stock price

history, i.e. the volatility.

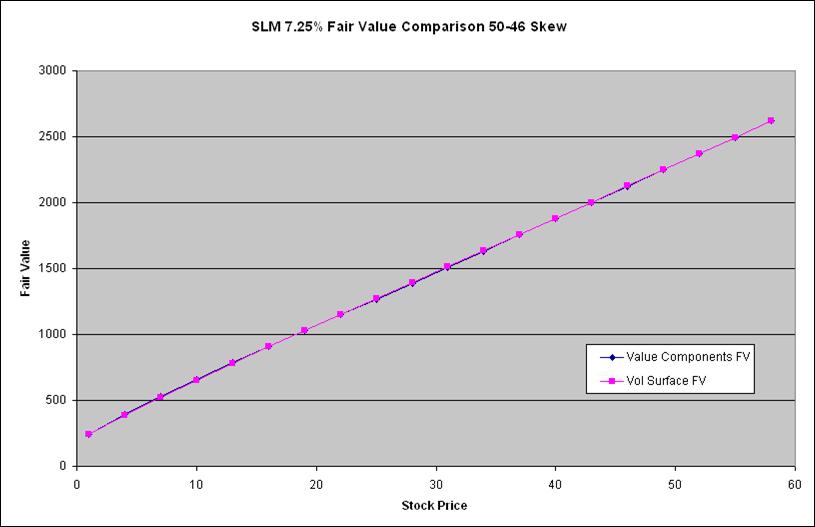

Next, we analyze

the valuation of convertible bonds using a risk-free implied volatility surface

and the bankruptcy mode. We consider the

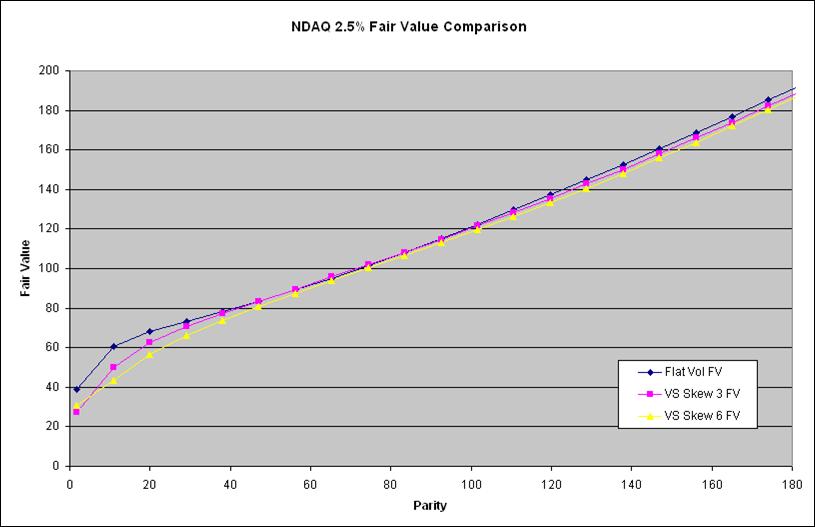

·

We display a

graph of the fair value vs. parity in Fig. 17. We display

three curves, where the blue, pink and yellow curves are for skew values of 0,

3 and 6, respectively. (The skew of zero is same as flat assumed volatility of

37.) As expected because of the bankruptcy mode, the fair value decreases to

zero at a parity of zero.

o

The valuation

using a skew of 6 (yellow curve) is always lower than the valuation using a

flat volatility (blue curve). There is no crossover behavior as with equity

options.

o

However, for a

skew of 3 points (pink curve), in an interval of parity from about 55 to 85,

the valuation using a volatility surface is slightly higher than the valuation

using a flat volatility.

o

One can

understand the above results as follows. At high parity, the negative slope of

the volatility surface causes the convertible to be valued with lower

volatility, hence a smaller fair value. At low parity, one expects the

converse, but there is a competing effect from the bankruptcy mode. The higher

volatility at low parity makes it easier for the stock to reach lower levels,

where the credit spread (i.e. the discounting of cashflows) is larger, which in

turn reduces the fair value. Hence there is a balance between two competing effects,

and it is not obvious what will happen to the overall valuation.

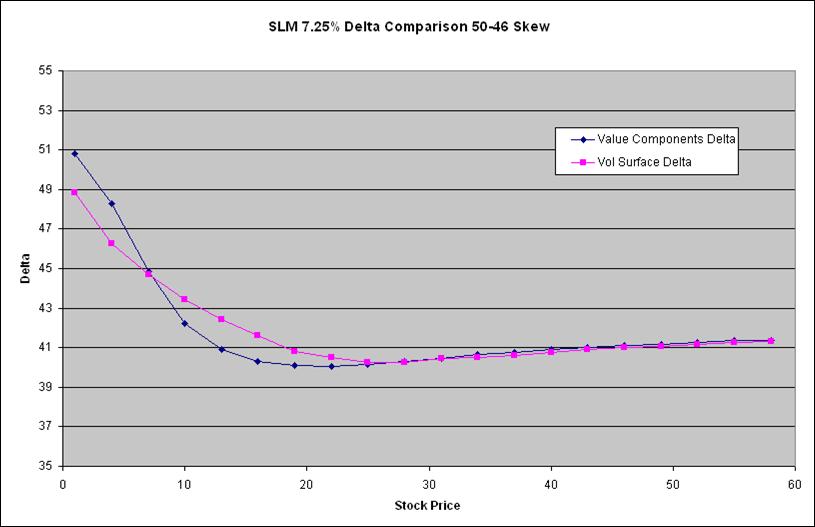

·

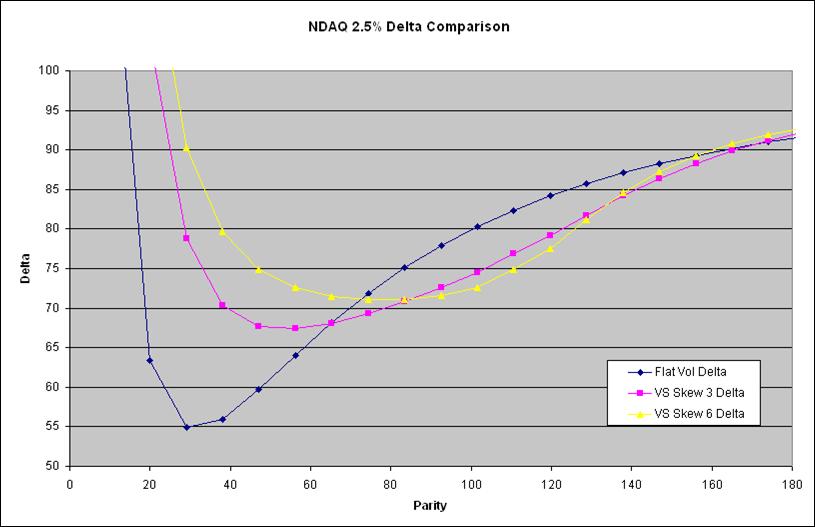

Next, we display

a graph of the Delta vs. parity in Fig. 18. We again

display three curves, where the blue, pink and yellow curves are for skew

values of 0, 3 and 6, respectively, and the skew of zero assumed a flat volatility

of 37. Also as expected because of the bankruptcy mode, the Delta increases to

infinity at a parity of zero.

o

As was the case

with equity options, the Delta displays two crossover points. At moderate

parity, the Delta is lower when the convertible is valued using a volatility

surface. Also, the Delta (using a volatility surface) is higher at low and high

parity. The locations of the crossover points depend on many factors and are

not described by a simple formula.

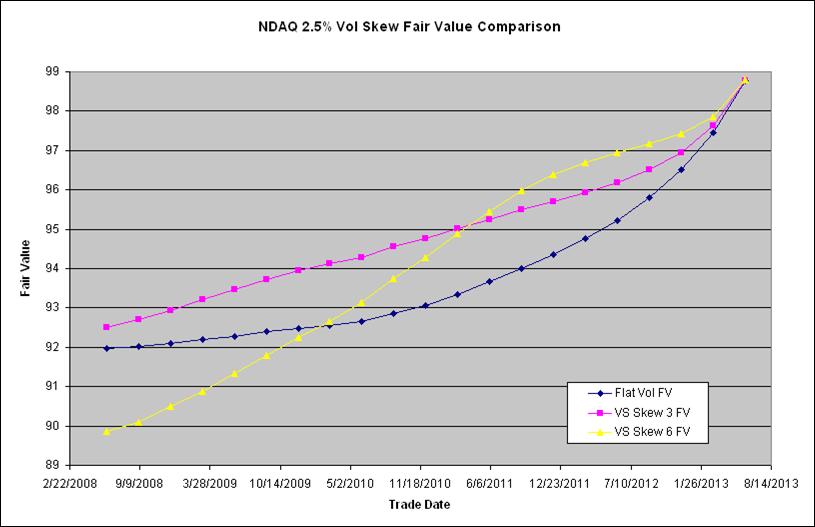

Next, we plot

valuations of the convertible as a function of the trade date, i.e. the time to

maturity. In Fig. 19, we display graph of the fair value

vs. trade date, for skew values of 0, 1, 2 and 3 points. (The valuation for

zero is same as flat assumed volatility.) The curves are respectively blue,

pink and yellow, respectively. The stock price was set to 33.15 in the

valuations. Unlike the case for equity options, the difference in valuations

for a convertible in completely nonlinear. No simple conclusion can be drawn.

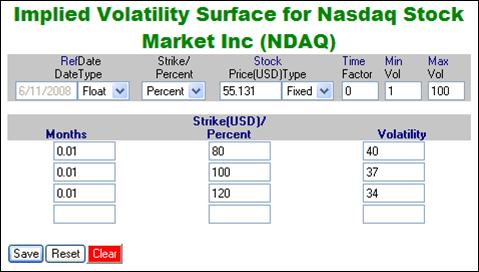

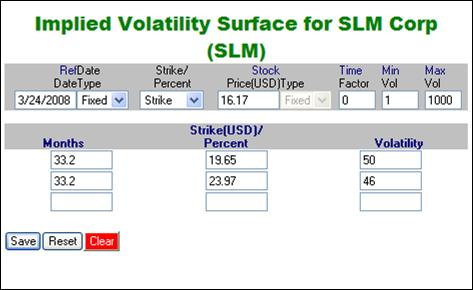

Next, we value

the convertible using an implied volatility surface with time factor decay. The

implied volatility surface is shown in Fig. 20. We set

the implied volatilities to 37 at all strike levels, so the skew is zero. We

set the stock price to 33.15. In Fig. 21, we display a

graph of the fair value vs. the trade date, for time factors of 0, –1, –2 and

–3, respectively (the time factor of zero is a flat assumed volatility). The

curves are blue, pink, yellow and light blue, respectively.

·

As expected, a

more negative time factor yields a lower fair value.

·

Similar to

equity options, the differences in valuation are approximately linear in the

time to expiration, and also approximately linear in the time factor.

Fig. 1 Implied Volatility Surface for AG Showing Volatility Skew

Fig. 2 AG 60 Jan 2010 Call Fair Value vs. Stock Price

Fig. 3 AG 60 Jan 2010 Call Delta vs. Stock Price

Fig. 4 AG 60 Jan 2010 Put Fair Value vs. Stock Price

Fig. 5 AG 60 Jan 2010 Put Delta vs. Stock Price

Fig. 6 AG 60 Jan 2010 Call Fair value Time Scan (with fixed stock

price=40) for Multiple Volatility Skews

Fig. 7 AG Implied Volatility Surface with Time Factor

Fig. 8 AG 60 Jan 2010 Call Fair Value Time Scan (with fixed stock

price=40) for Multiple Time Factors

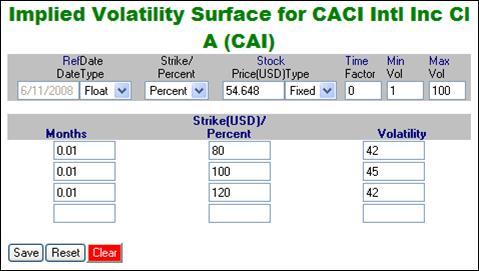

Fig. 9

Fig. 10

Fig. 11

Fig. 12

Fig. 13

Fig. 14

Fig. 15

Fig. 16

Fig. 17

Fig. 18

Fig. 19

Fig. 20

Fig. 21

We now analyze

some other convertible securities. The two most important examples are a

mandatory convertible and a convertible with a variable conversion ratio

(“embedded warrants”). We begin with a mandatory. Up to now, the only way for

you to value a mandatory with different volatility levels was to specify the

low and high strike volatilities in the Value Components section. This is only

an approximation, since a mandatory is really one instrument, not a sum of

separate pieces. For this reason, KYNEX, Inc. does not offer the Value

Components screen for a callable mandatory. A mandatory with 1-1 upside also

cannot be priced using the Value Components screen. However, all of these types

of securities can now be priced using a volatility surface. There is no concept

of a bankruptcy mode for a mandatory, since you receive stock at low stock

prices, and so the volatility surface would in general be a risk-free implied volatility

surface, with (typically) a negative skew. However, there are some important

details because for a mandatory we have a specific concept of low and high

strikes, and the implied volatility levels to input at those strikes.

For our example,

we select the

In Fig. 23 we plot the fair value against the stock price,

using Value Components (blue curve) and the volatility surface (pink curve).

The two valuations are almost equal. Hence the methodology in the Value

Components screen does give a good approximation for the fair value. The Delta

is however different at parity levels below the high strike. In Fig. 24 we plot the Delta against the stock price. Note that

for a mandatory, we plot the unnormalized

Delta, whereas in all of the previous examples we displayed the Hedge Delta.

The specification of a volatility surface therefore gives a more realistic

estimate of the number of shares to hedge. The Delta obtained with the

specification of a volatility surface is higher (compared to the Delta from the

Value Components methodology) at moderate stock prices, including the zone

between the low and high strikes, and is lower at low or high stock prices.

Fig. 22 Implied Volatility Surface for

Fig. 23

Fig. 24

Next, we analyze

convertibles with a variable conversion ratio (“embedded warrants”). Using a

volatility surface allows you to value the contribution of the embedded options

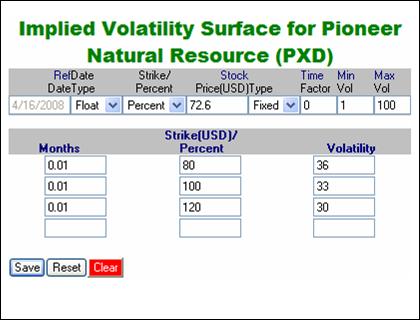

with greater precision. We select as our example Pioneer Natural Resources (

Fig. 25

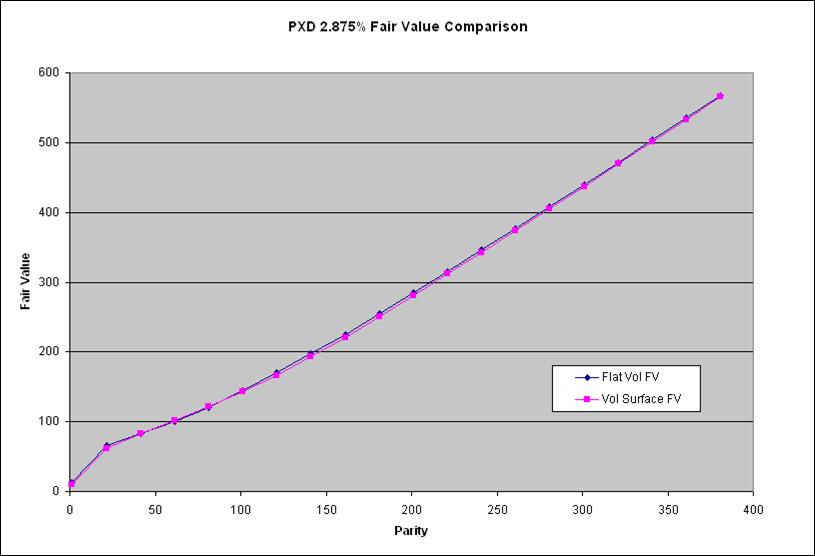

We plot a graph

of the fair value against parity in Fig. 26. The blue

curve is the fair value with a flat assumed volatility of 41.2%, and the pink

curve is the fair value using the volatility surface displayed in Fig. 25. The valuation using a volatility surface is

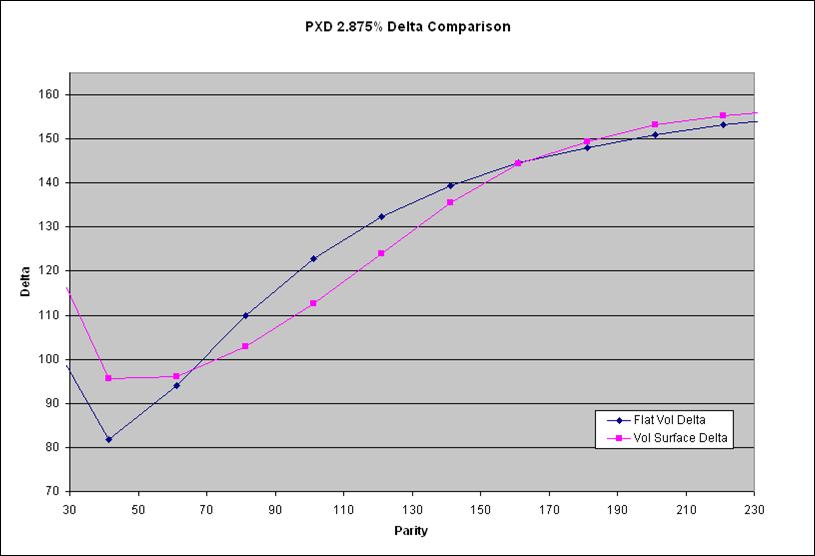

slightly lower than the valuation using a flat volatility, as expected. In Fig. 27 we plot the Delta against parity, again using blue

and pink respectively for the valuations using a flat volatility and a

volatility surface. The basic structure of the graphs of the fair value and Delta

are in fact not very different from that of the

Fig. 26

Fig. 27

General Remarks on Specifying a Volatility Surface

Volatility

surfaces can be saved and retrieved from the database. The valuation of a security will remain the same as before, if you do

not specify a volatility surface. Note that a volatility surface is

attached to an underlier, not a

derivative. This has the following consequences:

·

All

convertibles/options on a given underlier will see the same volatility surface.

·

You can choose, on a security-by-security basis, whether

or not to consider the volatility surface. Hence GM A can be valued with a

volatility surface, but GM B can be valued with a flat volatility. However, if both GM A and GM B are valued with a

volatility surface, it will be the same

surface for both.

·

A volatility

surface can also be specified in the New Issue Analytic, to price a

hypothetical new security. However, note that we only allow you to save one volatility surface, although you can

save up to ten scenarios. Hence, when pricing using a volatility surface in the

New Issue Analytic, you must edit and update the volatility surface whenever

you switch from one scenario to another.

In general,

there are two ways for you to create and maintain a volatility surface:

·

You can create a

surface with a fixed date, fixed strikes and a fixed reference stock price.

This is typically what will happen if you create a surface using the implied

volatilities from the listed equity options market, for example. If you create

the surface using listed options data, it will be a surface of risk-free

implied volatilities, and should be used in conjunction with the bankruptcy

mode.

o

The advantage of

this method is that the data will be current with the listed options market.

o

The disadvantage

of this method is that you have to update the surface every day.

o

Another

disadvantage is that, if the surface is not updated every day, the

interpolation of the volatilities, to construct the local volatility surface,

will be based on the surface date (i.e. out of date).

·

You can create a

surface with a floating date and specify the strikes as percentages, with a

floating reference stock price. This could be either a risk-free or a risky

volatility surface.

o

The surface will

maintain its shape and the at-the-money implied volatility will track with the

current spot price. This may be a simpler way to maintain a volatility surface.

The surface does not need to be updated every day.

o

The

interpolation of the volatilities to construct the local volatility surface

will be based on the current trade date. As such, the “months” will reflect the

actual terms to expiration.

o

The disadvantage

of this method is that if the underlier spot price changes significantly, especially

if there is a sudden change to market conditions, then the volatility surface

may not accurately reflect the conditions in the market.

Note also the

following points:

·

If a volatility

surface is blank, then the valuation model will employ the flat (assumed)

volatility.

·

The implied volatility is calculated in the

same way as before. The implied volatility is always defined to be the flat volatility such that the theoretical fair

value equals the Market Price of the security.

·

The implied spread will, however, be

affected by the specification of a volatility surface. The implied spread

calculation will consider the volatility surface when calculating the fair

value.

·

If the valuation

date is in the future, then the valuation model will interpolate forward

volatilities (analogous to the concept of forward interest rates for a yield

curve). The valuation will be based on the forward volatility.

·

The Vega sensitivity is calculated by

applying a parallel shift to the (internally generated) local volatility surface.

In general this is not a parallel shift of the input implied volatilities.

·

For Delta (also Gamma), the sensitivity to a

change in the stock price will in general also include a contribution from the

change in the local volatility.

Since you still

have the ability to input an assumed volatility instead of a volatility

surface, this leads to the following consequences in these situations:

·

Sensitivity

screen

o

If you sweep the

volatility (either dimension 1 or 2), then you cannot specify a volatility surface.

The valuation model will consider the volatility surface instead, and disregard

the volatility sweep.

·

Impact analysis

o

You cannot specify

a volatility surface to price securities for Impact Analysis. A shock to the

volatility will change the value of the flat assumed volatility. The tuner of

RefImpVol will apply to the flat assumed volatility.

·

Options

o

Kynex treats an

assumed volatility of zero to mean that an option should be valued using the

implied volatility. However, if you specify that an option should be valued with

a volatility surface, then that surface will be used even if the assumed

volatility is specified as zero.

o

Hence, an option

will be valued using the implied volatility only if the assumed volatility is

zero and you do not select a volatility surface.

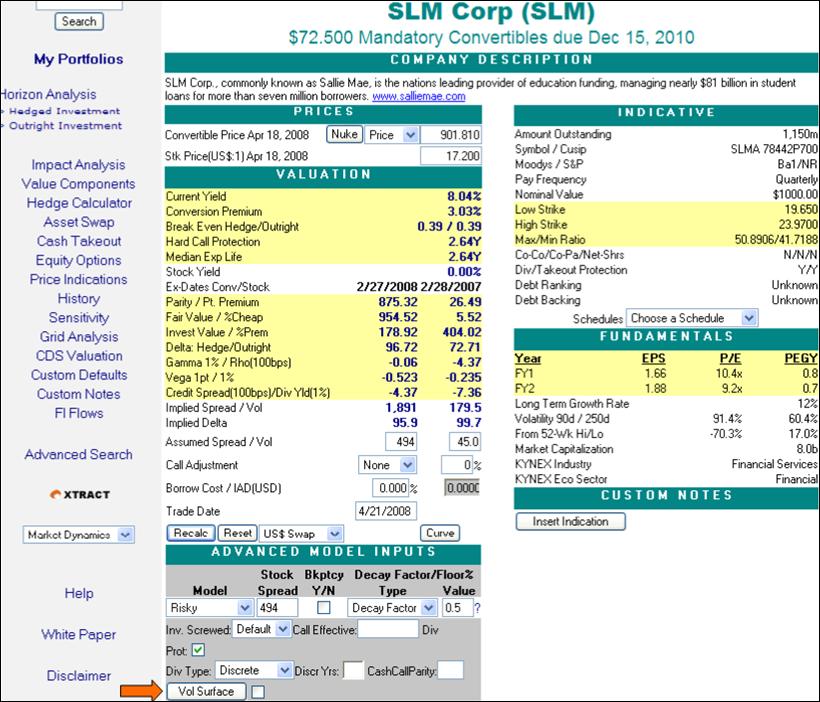

Creating/Editing the Volatility Surface

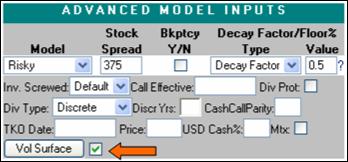

On the bottom

left corner of the details page (under the Advanced Model Inputs section) you

will now see a button and check box which enables you to value a security using

a volatility surface (see Fig. 28). To create the volatility surface, first click

on the “Vol Surface” button. After

clicking on the button a new window will appear (see Fig. 29).

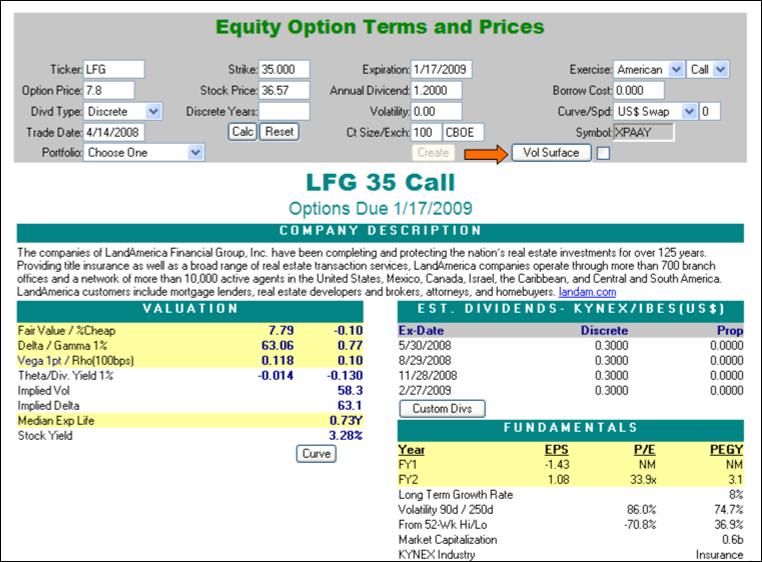

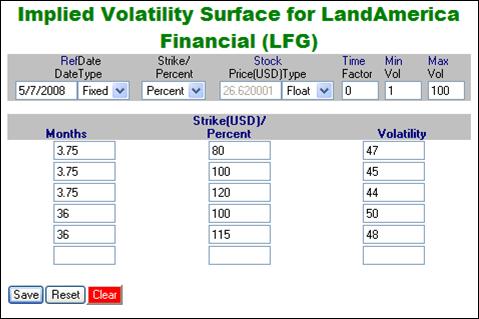

A similar button will also appear on the valuation page for equity options (see

Fig. 30). Fig. 31 shows a volatility surface using percent strikes (as

opposed to fixed strikes in Fig. 29).

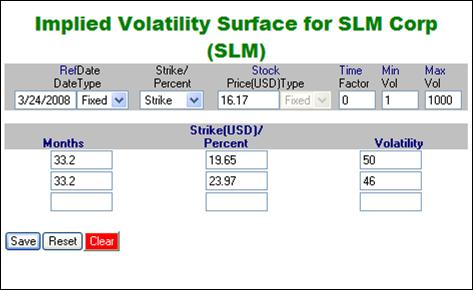

Fig. 28 Convertibles Valuation

Page Showing Button for Volatility Surface

Fig. 29

Fig. 30 Options

Valuation Page Showing Button for Volatility Surface

Fig. 31

The

following is a list of definitions which details the inputs for the volatility surface:

RefDate- The

date from which the model interpolates the volatilities. This can be

either a fixed date or a floating date. The type of date is specified in the

drop-down box.

- A

fixed date will assume the implied volatilities are interpolated from the

specified date. You may enter a fixed date that is earlier than

today. Entering a date earlier than

today will produce a warning message that reads “The surface date is earlier

than today, do you want to save with an old date?” If you would like to save the surface

with an old date, simply click OK.

The model does not allow you to enter a future date.

- A

floating date means the interpolations will be calculated from the input

trade date.

Strike/Percent- This

field will specify if the strikes entered in the volatility surface are fixed

numbers or percentages of the reference spot price. Note that when fixed

strikes are input, the values should be expressed in the local currency.

Stock Price & Type- This

field specifies the underlying spot price at which the implied volatilities

were determined. If percent strikes are specified, then they will be a

percentage of this stock price. Values

of less than or equal to zero are not allowed.

A floating reference spot price, and strikes which are

percentages of spot, is useful if you have the view that the volatility surface

will retain its shape for small day-to-day movements in the stock price.

Time Factor- The percentage rate (annualized) at which the volatility surface

will compound or decay beyond the last expiration date specified in the in the

surface. In the example above, the input

of -1 means that the volatilities will decay by 1% every year after 36 months.

Min Vol- The interpolated volatility is not allowed to go below the

minimum volatility value.

Max Vol- The interpolated volatility is not allowed to go above the

maximum volatility value.

Months- The interval (measured in months from the RefDate) to which

the strikes and implied volatilities apply. Decimal values are allowed but

values less than or equal to zero are not allowed. (Example: 1.5 would indicate

1 month and 2 weeks from RefDate). If

you would like to delete an existing row, delete the value you have input in

the months field for the row you want to delete. When you click the save button, the surface

will be saved and the row will be deleted.

Strike/Percent- The strike value of the implied volatility. This can be a

fixed number, or a percentage of the reference spot price, but values cannot be

equal or less than zero.

Volatility- The implied volatility for the given month and strike

inputs. Values cannot be equal or less

than zero.

After entering a surface you should

click the “Save” button. You can also save

a surface by clicking “Enter” at any time.

When the surface is saved, the rows will automatically be

sorted according to the Months, then Strikes (in ascending order).

Reset Button- This

will restore the surface to the last state which was saved in the database.

Clear Button- This will prompt an automatic warning. If you click “OK”

it will blank all the rows and restore all values to their default settings

(e.g. the date). Note that this only

clears the screen, not a surface saved in the database.

Once you are satisfied with the

volatility surface, save it and exit the screen. Then return to the details

page and check the box next to the “Vol Surface” button.

After checking this box, you should then

click the “Recalc” button. The valuation

will now include the volatility surface which you have entered. You may enter one volatility surface per

equity.

Risky and Risk-Free Implied Volatility

The concept of

implied volatility is well-known to market practitioners, especially in the

context of the listed options market. Convertible bonds contain embedded option(s),

hence they also have implied volatility. However, subtleties are involved when

attempting to compare the implied volatility of a convertible to that of listed

options. A convertible is valued on a risky basis; whereas exchange traded

options are valued on a risk-free basis. This leads to the concept of a “risky

implied volatility” for a convertible bond.

Temporarily

ignoring the put and call features of a convertible bond (also the complications

of dividend protection, etc.), a common practice is to visualize a convertible

bond as a risky straight bond plus a risk-free American call option. However,

this viewpoint has the weakness that it assumes the bond floor will hold at low

parity. A better visualization is as follows: at low parity, a convertible bond

behaves as a stock plus a European put option and cash equal to the present

value of the coupon cash flows (the coupons are of course not affected by the

volatility). Note that the above put option is written by the issuer of the stock. As the stock price declines to zero,

the put goes deeper into the money, but

the issuer’s ability to honor the put becomes more and more questionable.

Unlike a listed option, a convertible bond is not guaranteed by an exchange, hence an investor is not guaranteed that the embedded put

will be honored. For this reason, one should value a convertible on a risky

basis (the credit spread indicates the issuer’s creditworthiness). The implied

volatility of a convertible bond is effectively the implied volatility of a risky European put: it is a “risky

implied volatility.” Another way to state this is the implied volatility of a

convertible is the volatility an options broker would be willing to pay for a

put whose ability to collect when it gets in-the-money is tied to the credit

worthiness of the issuer. Note also that the visualization of a convertible as

a straight bond plus call option, or as a stock plus put option, is only

approximate. The option embedded in a convertible does not have a fixed strike

or expiration. The effective strike of the embedded option is a function of the

time to maturity. An approximate measure of the expiration of the embedded

option is the median life of the convertible. Hence when we speak of a “risky

put option” or a “risk-free call option” we are not implying that a rigorous separation of the option from the

convertible bond exists.

On the other

hand, because exchange-traded listed options are guaranteed by the exchange, a

listed put option will be honored even if the underlying stock price goes to

zero. Hence for a listed put option, its implied volatility is “risk-free.” As

such, it is not valid to directly compare the risky implied volatility of a

convertible with the risk-free implied volatilities of exchange-listed options.

Another important point to note is the relationship between observed

volatilities in the stock market and risky/risk-free volatilities especially

during periods of credit crisis. When the observed volatility of a stock

increases in conjunction with stock price decline and credit deterioration, the

risk-free volatility (listed equity options) also increases. However, the risky

volatility decreases as the ability of the issuer to honor the option

diminishes. As a result, convertible securities rarely benefit from the spike

in the risk-free volatilities in such situations. The convertible market has

witnessed this phenomenon time and time again during periods of flight to

quality such as the stock market crash in 1987, the LTCM crisis during 1999,

and the credit crisis during 2007.

We are pleased

to introduce a new metric - “Estimated Risk-Free Implied Volatility” which

gives an equivalent risk-free implied volatility for a convertible bond. Note

that this number is an estimate: it

is calculated by valuing the entire convertible as one security (including all

put and call features, etc.), but the option(s) embedded in a convertible bond

cannot necessarily be expressed as a single (put or call) option with a

definite strike and expiration. The estimated risk-free implied volatility is

an approximate number to back out the credit risk described by the credit

spread specified in the valuation of the convertible. It is calculated using

the risky implied volatility and adjustments based on various internally

computed sensitivities (partial derivatives) to the credit spread, etc. The

estimated risk-free implied volatility is higher than the risky implied

volatility. This is consistent with the fact that investors are willing to pay

a higher implied volatility for a riskless asset than a risky asset. Note that

we do not report this metric for a mandatory or capped convertible, which can

have negative Gamma (or Vega) because they contain embedded short option positions. Furthermore, the

above methodology is based on first-order derivatives. If the credit spread is

large (for example 1000 bps), then the estimated risk-free implied volatility

may come out much higher than the risky implied volatility, but this is not

necessarily a reliable extrapolation.

We only report

the Estimated Risk-Free Implied Volatility when a convertible is valued using

the risky basis (our recommendation), because this methodology values the

entire convertible in a consistent manner. We do not report this metric if the

“Bond+Option” or “Blended” methodologies are specified, where the convertible

is artificially decomposed into pieces valued with different credit spreads.

Note also that if the bankruptcy mode is switched on, then the collapse of the

bond floor at a zero stock price is explicitly included in the convertible bond

valuation. This fact is reflected in the implied volatility. Hence in this case

we also do not report an estimated risk-free implied volatility.

For volatility

surfaces, the input surface is taken to be a set of risky implied volatilities. If you input risk-free implied

volatilities (for example the implied volatilities of exchange-listed options),

then you should also employ the bankruptcy mode, with an appropriately chosen

decay factor that captures the relationship between stock prices and credit

spreads. The bankruptcy mode will capture the risk associated with default by

the issuer, as the stock price goes to zero.