Rho Allocation

Our Rho Allocation Analytic allows

you to maintain assignments between instruments that need interest rate hedge

and instruments used to establish the hedge. Let us consider a portfolio

consisting of several convertible securities, corporate bonds, treasury bonds,

treasury futures, etc. You might have a short position in a five-year treasury

bond as an interest rate hedge against four different long convertible

positions with a median expected life of about five years. The proportion of the

treasury bond position against a specific convertible

security is a function of the position size and the interest rate sensitivity

of the convertible and the treasury bond. Our analytic allows you to maintain

the assignments, which could be static absolute, static relative, or dynamic.

You need to call us to configure the type of desired assignment. Brief

descriptions of the behavior of the three possible assignments follow.

![]()

Static Absolute

Assignment: This type of assignment

is based on number of bonds. Let us say, your treasury

bond position is -10,000, and you assign -3,000 to convert a, -5000 to convert

b, and -2,000 to convert c. These assignments will be static regardless of any subsequent

trades done on the treasury bond and/or convertibles.

You will have to make necessary changes to assignments as required in this

scenario.

Static Relative

Assignment: This type of assignment

is based on percentage of bonds. Using the same example above, Kynex will

maintain 30% for convert a, 50% for convert b, and 20% for convert c.

Therefore, if you trade the treasury bond in response

to changes in interest rates, the converts will get assignment in the same

proportions, i.e. 30%, 50%, and 20% of the new quantity. However, if you trade

one of the convertibles, you would have to make necessary changes to the

assignments.

Dynamic Assignment: This type of assignment is based on customized rules

used to make assignments dynamically at a specific time of day automatically.

This requires you to come up with the rules, and Kynex to set up a customized

framework for dynamic assignment. The advantage to this assignment is that

trades done on converts and treasury bonds will not need manual intervention.

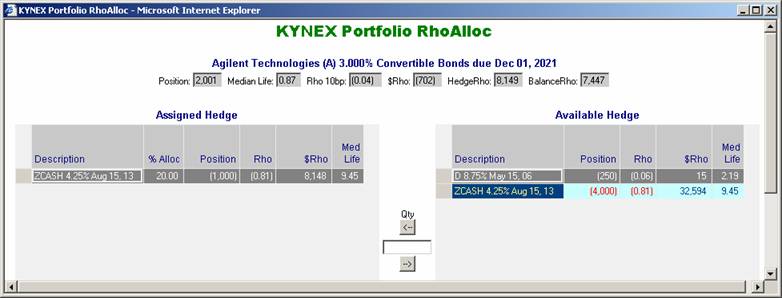

The snapshot below is a

picture of the Rho Allocation Application. The description of the security, the

current position, median expected life, rho, and hedged rho are on the top of

the screen. The various instruments that have been currently assigned as a

hedge to the security are on the left. Possible hedge instruments are on the

right. To specify a new assignment or a change to an existing assignment,

please follow the steps below:

-

Highlight the

security, on the left or the right which is the source.

-

Enter the number

of bonds in the box between the Assigned and Available Hedge securities.

-

Click the

left-to-right or right-to-left arrow button as applicable.

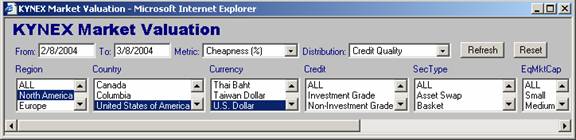

Custom Groups

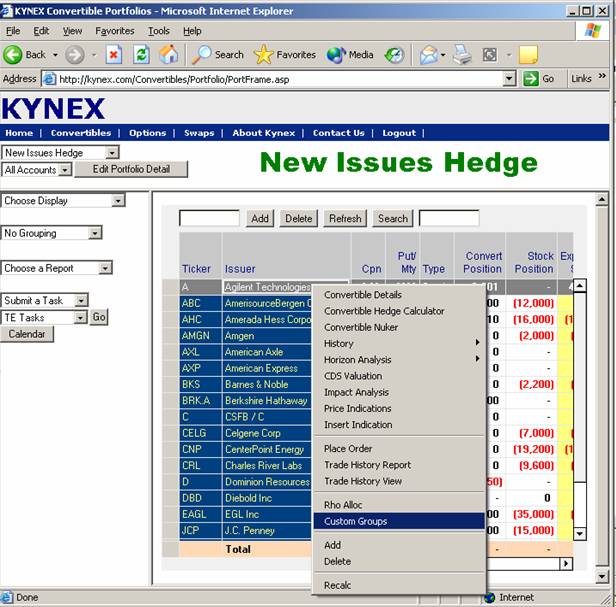

Allows you to maintain an unlimited

number of categories for your portfolio, and tag securities into multiple categories.

For example, a security can belong to non-investment grade, bio-tech,

high-volatility, and trader xyz at the same time. You can access your Custom

Groups from the Portfolios page by clicking on any name in your portfolio, and

selecting Custom Groups from the menu, as shown.

![]()

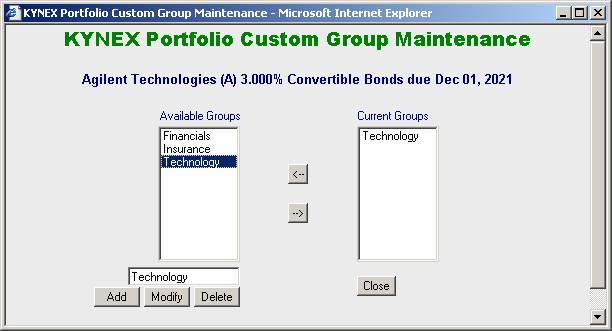

Please refer to the figure

below. There are two (2) columns in the Custom Group page: Available Groups,

which is a list of all the groups you have created; and Current Groups, which

are the groups that are currently assigned to the security that you clicked on

to open this page. To add a new group, type the group name in the textbox

underneath the Available Groups list, and click the Add button. To change a

groupís name, select it in the Available Groups list, change the name in the

textbox, and click the Modify button. To delete a group, select it in the

Available Groups list, then click the Delete button.

Use the arrow buttons

between the Available Groups and Current Groups lists to change the assignments

for this security. For example, in the window below, Agilent 3.000% is

currently assigned to the Technology group. To change the assignment to

Financials, you may select the Technology item in the Current Groups box, and

click the left-arrow button to remove it from the current assignments; then

select the Financials item in the Available Groups list, and click the

right-arrow button to add it to the current assignments.

Note that the previous

operation could also be performed in the reverse order (i.e. add Financials,

then delete Technology), and that any security can be associated with multiple

groups (i.e. have multiple groups present in the Current Groups list).

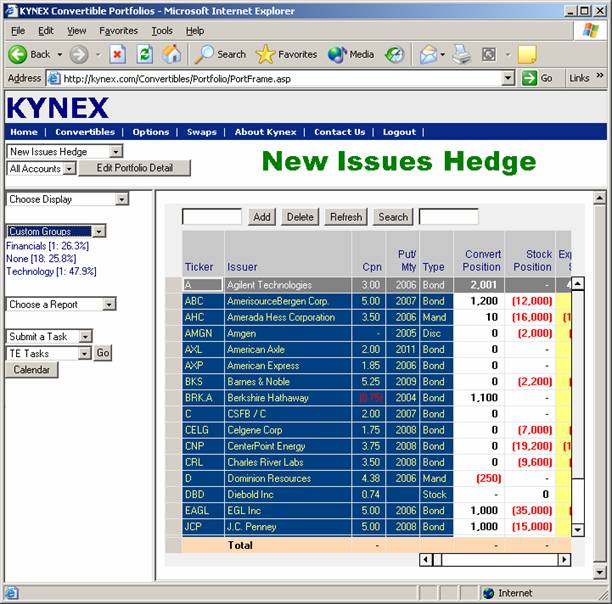

To view your portfolio by

Custom Groups, select the Custom Groups item in the Grouping drop-down menu, as

shown below.

![]() †

†

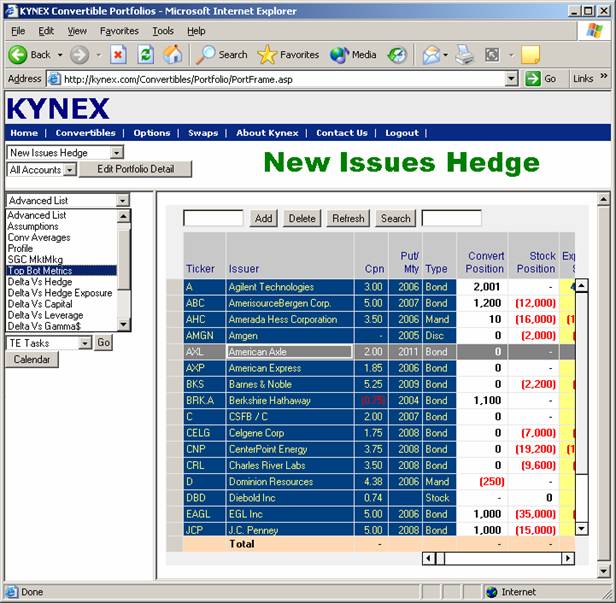

Top and Bottom Metrics

Top and Bottom Metrics shows the

P&L or Impact by Strategy for a particular portfolio. In order for this

functionality to be meaningful, you need to group the securities in the

portfolio using the Aggregation Code, which is accessible in the Assumptions

view. To display this feature, select Top Bot Metrics in the Choose Display

drop-down menu:

![]()

The top and bottom metrics

are calculated for Month-to-Date P&L, Year-to-Date P&L, Sensitivity to

Credit Spreads, Interest Rates, Volatility, Hedge Exposure, and Market Values,

as shown below.

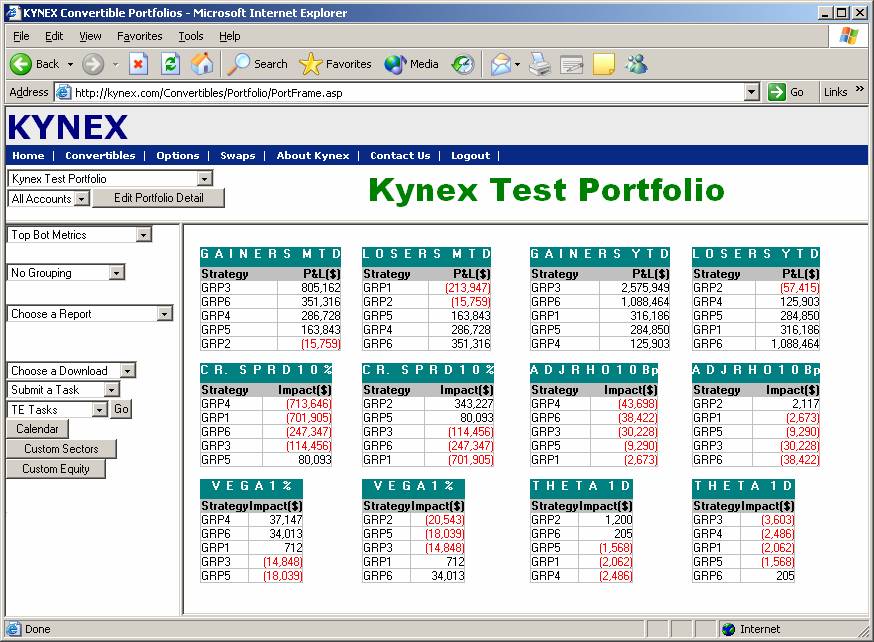

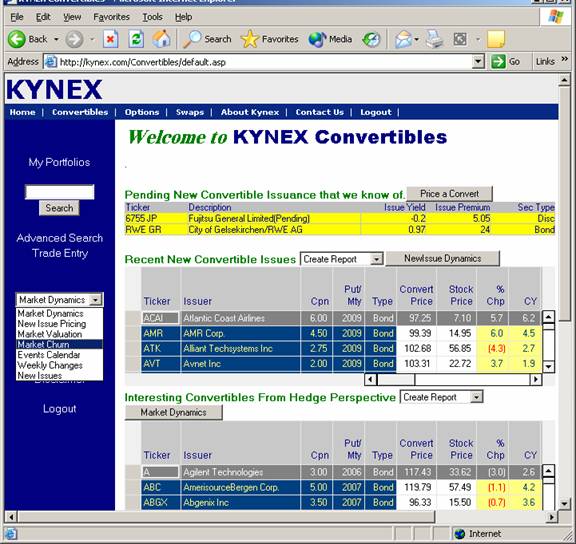

Convertible

Market Valuation

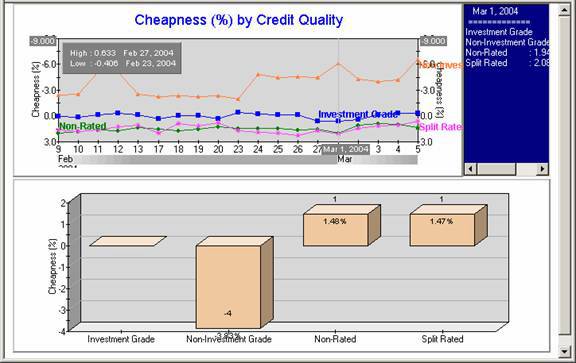

The Convertible Market Valuation section

can be accessed by clicking on the Convertibles link on the top navigation bar,

then selecting Market Valuation in the drop-down menu along the left side of

the page, as shown below.

![]() †

†

![]()

The Convertible Market

Valuation Section allows you to gain insight into dynamics of the convertible

market over time, by graphically viewing valuation metrics along two

dimensions, which could be filtered in many different ways. For example, you

can analyze how the implied volatilities have been changing grouped by credit

quality and filtered by economic sector.

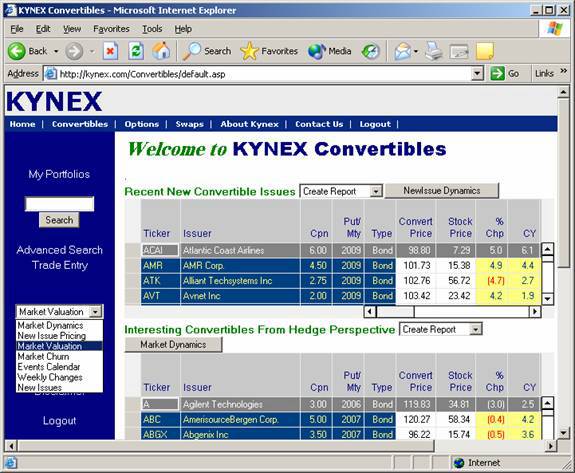

The top frame of the screen

displays the choices for data presentation. The From and To fields are used to

select the date range for the data, while the Metric and Distribution control

the Y- and X-axis of the graphs, respectively.

Using the appropriate

drop-down boxes, the data can be filtered by the following fields: Region,

Country, Currency, Credit, Security Type, Equity Market Cap, Economic Sector,

Industry, and Sensitivity. Multiple selections can be made in each field by

holding down the CTRL key and individually clicking on each desired menu item.

Note that selecting the ALL option on the top of a menu, or not selecting

anything in the menu, will have the same effect of returning data corresponding

to all of the items in that menu.

Once the desired criteria have been selected, click the Refresh button to view the results in the bottom frame of the screen.

Typical output graphs are

shown below.

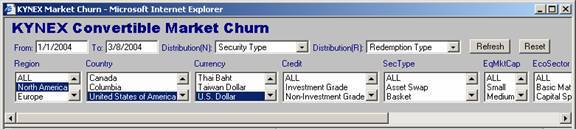

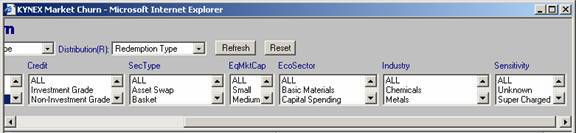

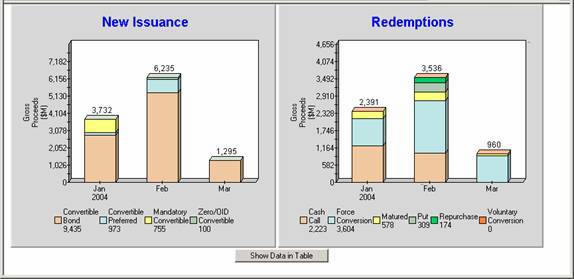

Convertible Market Churn

The Convertible Market Churn section

can be accessed by clicking on the Convertibles link on the top navigation bar,

then selecting Market Churn in the drop-down menu along the left side of the

page, as shown below.

![]()

The Kynex Convertible Market

Churn allows you to analyze the new issuance and redemption proceeds over a

specified period.

The top frame of the screen

displays the choices for data presentation. The From and To

fields are used to select the date range for the data. There are two (2)

Distribution drop-down boxes: one for the New Issuances (N) table or graph, and

one for Redemptions (R).

Using the appropriate

drop-down boxes, the data can be filtered by the following fields: Region,

Country, Currency, Credit, Security Type, Equity Market Cap, Economic Sector, Industry,

and Sensitivity. Multiple selections can be made in each field by holding down

the CTRL key and individually clicking on each desired menu item. Note that

selecting the ALL option on the top of a menu, or not selecting anything in a

menu, will have the same effect of returning data corresponding to all

of the items in that menu.

Once the desired criteria have been selected, click the Refresh button to view the results in the bottom frame of the screen. By default, the graphs are shown first. To show the data in tables, click the Show Data in Table button at the bottom of the page. To switch back to the graphical view, click the Show Data in Graph button.

Typical output graphs:

Typical output tables:

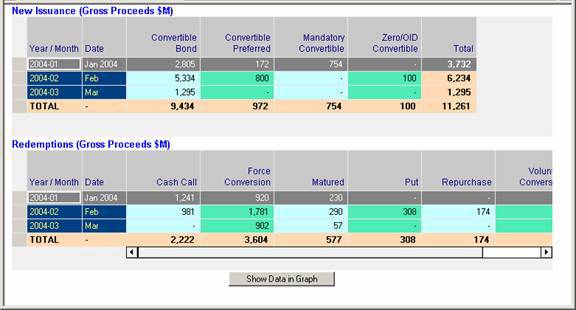

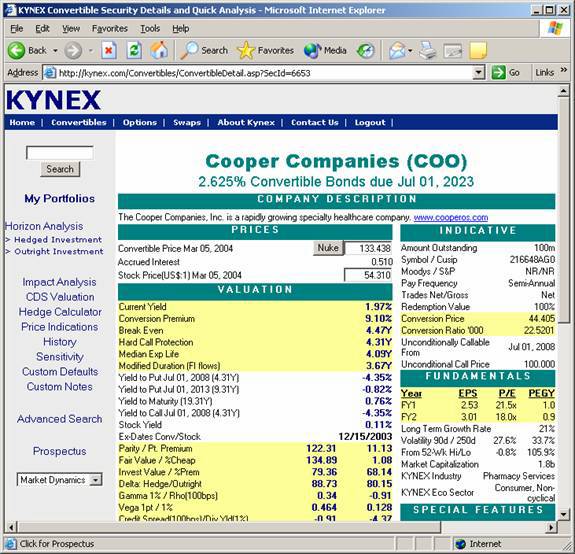

Prospectus

Displays an electronic version of the

prospectus, book marked with links to critical sections of the prospectus such

as call schedule, conversion details, change-of-control provisions, dividend

protection provisions, etc. that help you navigate and find the information you

are looking for quickly and easily.

The Prospectus page is

accessed from the Convertible Details page, which can be opened in several

ways:

∑

From the My

Portfolios page, click on any security, and select Convertible Details from the

menu.

∑

Click on the

Convertibles link on the top navigation bar, click on any security in the

tables, and select Convertible Details from the menu.

∑

Type the ticker

of the underlying equity in the Search box, and click the Search button to pull

up the Convertible Details page for that security.

From the Convertible Details page, click

on the Prospectus link on the left side of the page, as shown below.

Our team is tagging the electronic prospectuses digitally, starting from the

recent issues and working backwards in time. If we have not yet tagged a

prospectus, you will not see the Prospectus link for that security.

![]()

The Prospectus page will then

open in a new window:

The right frame of the

Prospectus screen contains the entire prospectus document. Links to specific

sections of the prospectus are found in the left frame. Clicking on any of

these links will automatically scroll the document to the appropriate section,

if that section actually exists in the prospectus.