Dividend Assumptions

Our valuation model offers two methodologies for specifying dividend assumptions on the underlying common stock of a derivative: Continuous and Discrete. When Continuous is specified, dividends are applied continuously over time. The dividend amounts are determined by your IAD (Indicated Annual Dividend) assumption and today’s spot price. This proportion remains constant for stock prices higher or lower than today’s spot in the valuation grid. Therefore at higher stock prices, larger dividends are applied and at lower stock prices smaller dividends are applied. Discrete dividend assumptions apply dividend amounts on specific dates supplied in the dividend schedule. The dividend amount can be a fixed number (discrete amount), proportional amount, or combination of discrete and proportional amounts. Click here for more detail on discrete and proportional dividend amounts. We recommend favoring discrete dividend amounts as far as practically possible to estimate as your dividend expectations in valuing derivatives with dividend protection. Using discrete amounts as far as practically possible is especially recommended if you expect the company to pay dividends which exceed the dividend protection threshold (anchor dividend). For more information on discrete dividends relating to dividend protection please see our March 2006 Bulletin.

How to Enter a Discrete Dividend Schedule

Below we will describe the mechanics of how to properly incorporate discrete dividends into the valuation of a derivative.

It should be noted that if you are using discrete dividends and have

supplied a discrete schedule for a particular stock, the schedule will be

applied to the valuation of all derivatives with the same underlying stock

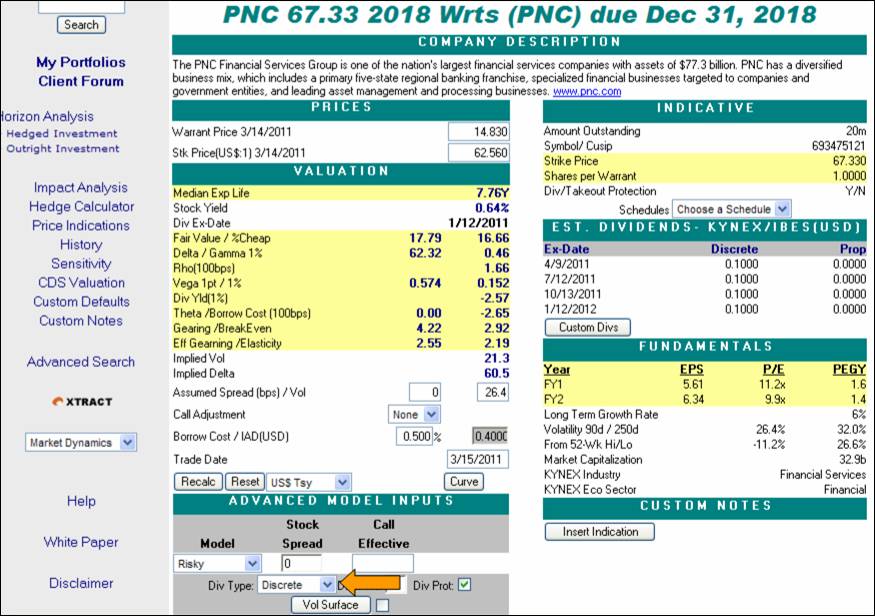

To value a derivative using a discrete dividend schedule, first select the Dividend Type as “Discrete” under the Advanced Model Inputs. If an estimated dividend schedule is already displayed in Kynex, by clicking the “Recalc” button, the valuation will now incorporate this discrete schedule.

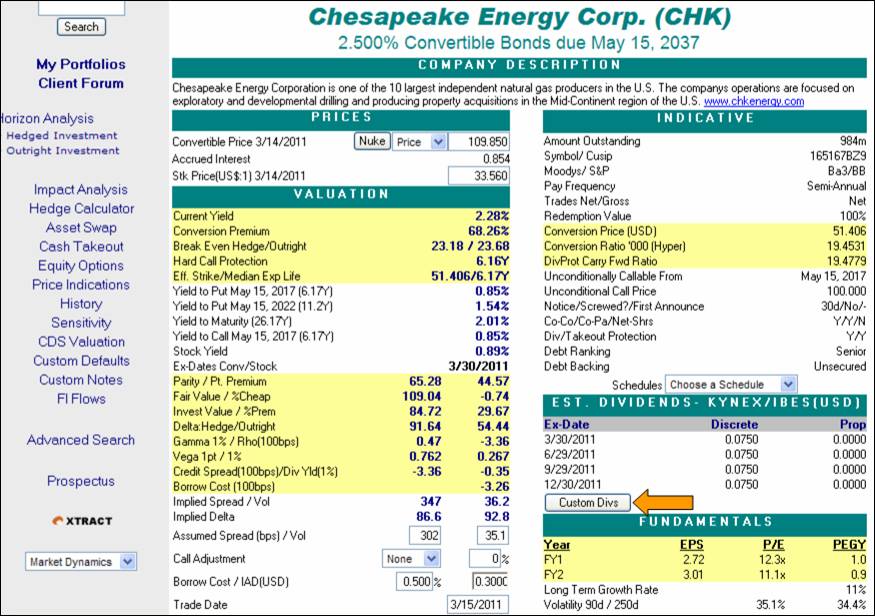

In the case where an estimated dividend schedule is already displayed in Kynex and you would like to modify this estimated dividend schedule, the discrete dividend schedule can be accessed by simply clicking on the “Custom Divs” button located below the estimated dividend schedule. A pop up should appear that allows you to enter a discrete schedule. If you click on the “Custom Divs” and you do not receive a pop-up, please check your browser settings and modify to allow pop-ups from Kynex if necessary.

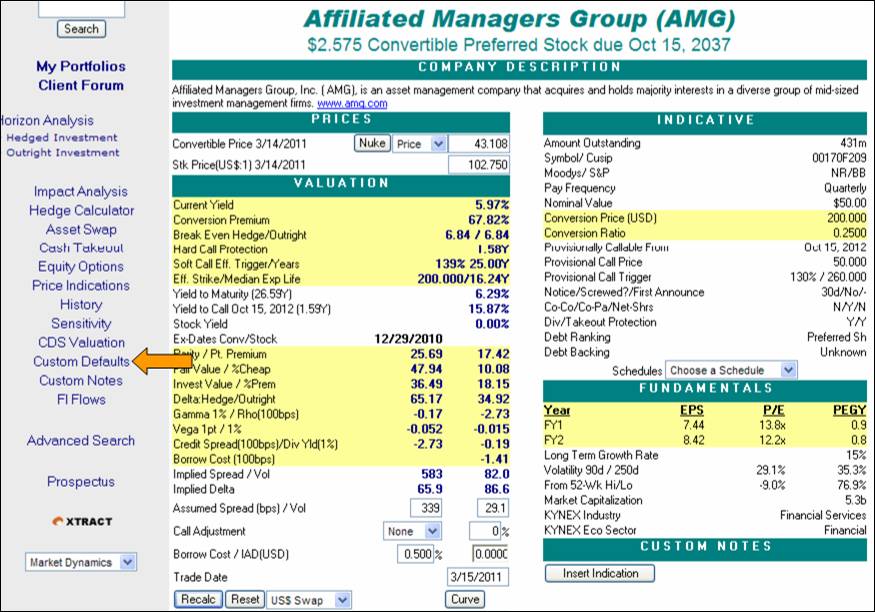

If there is not a discrete dividend schedule displayed on the details page, the discrete dividend schedule can be accessed by first navigating to the “Custom Defaults”.

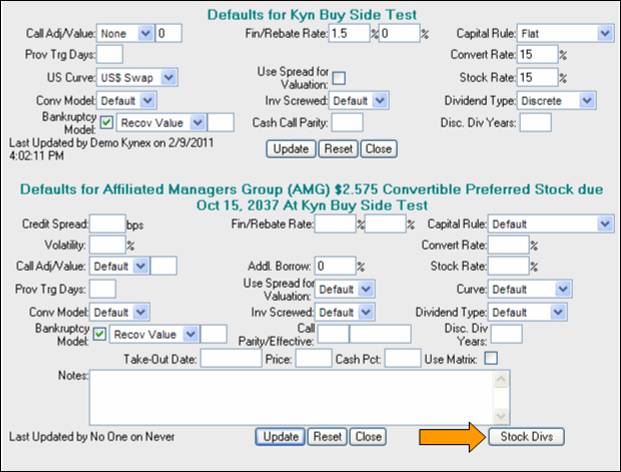

Now select the “Stock Divs” button located in the lower right hand corner. You may need to scroll down if your browser is not maximized.

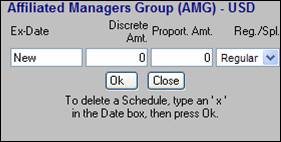

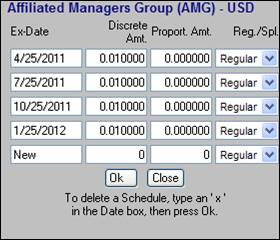

A window will now appear that allows you to enter a discrete schedule.

To generate a custom discrete dividend schedule, you must input an estimated ex-date for the dividend, the discrete or proportional amount of the dividend, and tag the dividend type as either “Regular” or “Special”. Once you have input this information for the first dividend, click “OK” to generate another row. Repeat these steps until you have created a dividend schedule for at least one full year. If dividends are paid on a quarterly basis, a minimum of 4 rows are required in the schedule. Once you have inserted your schedule click the “Close” button. To incorporate the schedule you have created in your valuation, please click “Recalc” on the details.

Discrete Amount vs. Proportional Amount - When

creating a custom dividend schedule, the discrete and proportional dividend

amounts should always be entered as a

dollar amount in the currency of the underlying equity. Discrete amounts are applied on the specified

ex-dates regardless of the stock price.

Proportional amounts are also applied on the specified ex-dates, however

the actual amount of the dividend applied remains proportional to the stock

price. In other words, the proportional amount provided in the discrete

schedule will be adjusted inside the model so that the relationship between

stock price and dividend remains the same. Therefore, if the stock price

in the future is lower than today’s spot price, the dividends are lower.

Similarly, if the stock price is higher than today’s spot price, the dividends

are higher. You may supply both discrete

and proportional amounts in which case fixed discrete amounts and proportional

amounts will be applied on the ex-dates provided in the schedule.

Regular vs. Special - We support discrete dividend streams containing regularly scheduled dividends and/or special, one-time dividend payments. You can specify a dividend by selecting “Special” or “Regular” from the “Reg./Spl.” dropdown menu. It is important to tag each dividend correctly should the derivative have dividend protection. Most derivatives have a threshold dividend (anchor dividend) which if exceeded triggers adjustments to conversion ratio. However, in the case of special dividends, adjustments are made as if the anchor is zero.

Discrete Years - If you choose to supply discrete amounts, you may provide a number of “Discr Yrs” under the “Advanced Model Inputs” which gives you the flexibility to specify the number of years you would like the discrete dividend amounts to be applied. The Discrete Years is useful when you have entered a schedule and would like to repeat the last full year of dividends for additional years. Take an example where you have entered a discrete schedule that is less than 5 years, and would like to apply your discrete schedule for 5 years. By entering 5 in the Disc Yrs we will repeat the last full year of dividends provided in the schedule for up to 5 years from the valuation date. For dates beyond your discrete years we internally convert the amounts of the projected dividends into proportional amounts. Those amounts are then applied on future discrete dates. If you have created a dividend schedule that is longer than 1 year, we will only use the discrete amounts for the last one year of the schedule to come up with the proportional amounts.