|

An interest rate swap is a hedging tool frequently used

by our clients. Kynex provides its own proprietary model to value these

swaps. This calculator is fully integrated into the portfolio and trade

entry systems. The model will allow you to pay fixed rate payments and

receive floating rate payments or vice versa.

Critical to the standard valuation of a swap is the

determination of the implied forward rates derived from the swap curve.

These forward rates represent today’s best estimate of current index values.

Given the US$ Swap Curve and a 3-month fixed-to-float swap, the relevant

index value is 3-month libor. Displayed below are

the mid-market values for the US$ Swap Curve as of 5pm EST on 9/25/2003

(with settle on 9/29/2003) as well as the corresponding yields, spots, and

forwards for the subsequent ten years (the graph plots these values for 30

years).

These 3-month forward rates (yellow line on the graph

and yellow background in the table) are derived using the Kynex forward

rate model. This model connects and smoothes the forward rates while

maintaining term structure as well as no arbitrage on the yields. Note that the calculated yield curve

values (light blue) are exactly equivalent to the par-yields specified at

the swap curve tenor points. It is also important to note that the yields

at the intermediate points (e.g. 12/29/2010) are derived from the

forwards. Direct interpolation of

interest rates on yield curves will produce irregular forward rates (generally

having a “saw tooth” pattern). These

derived forward rates are semi-annual, 30/360 compound interest rates.

However, they need to be adjusted to an ACT/360, simple interest rate basis

in order to be used as a future 3-month libor

rate. For example, the first forward rate should be adjusted as follows to

current 3-month libor:

100*(360/days)*(1.00/0.997126613

– 1) = 1.14, where days = 91 is the

actual number of

days between 9/29/2003 and 12/29/2003

Similarly, the 3-month forward rate five years out

should also be adjusted from 5.33701782 to:

100*(360/days)*( 0.85298143/0.84194649 –

1) = 5.184975, where days = 91

is the actual

number of days between 6/30/2008 and 9/29/2008

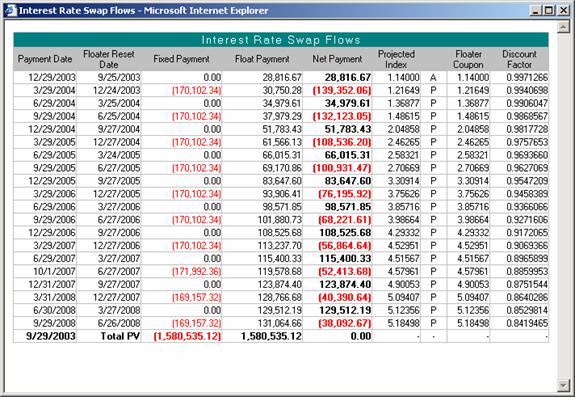

The Kynex interest rate-swap model makes the appropriate

adjustments in calculating the forward rates. These adjusted forward rates

give the market consensus of future 3-month libor,

and they are shown as the Projected Index values on the Flows window of the

IR Swap calculator.

However, the market consensus can be wrong. Certainly,

the forwards from the standard valuation were not close proxies five years

ago (hindsight is 20-20, but is instructive nevertheless). Consider below the mid-market values for

the US$ Swap Curve as of 5pm EST on 9/25/1998 (with settle on 9/29/1998).

If you purchased a five year, Pay-Fixed/Receive-Float

swap on 9/25/1998, you overpaid by 88.8bps (the 5 year fixed coupon was

4.237 based on the actual resets). Of course, the flip side of this is true

as well. If the interest rates rise higher than that suggested by the yield

curve at the time of valuation, the fixed payment would be under-estimated.

Kynex allows you to analyze alternate valuations by using a cap and floor.

If you believe, for example, that 3-month libor

will not go above 4.5%; you can use the Kynex swap model to cap forward

rates at 4.5% and to then recalculate the 5 year fixed swap rate.

To value a generic swap on Kynex, please click on the

Swaps tab and then IR Swap. You enter the general terms of the swap in the

upper portion of the panel on the left of the screen. Additional terms

(e.g. fixed coupon, index term of 0.25 for a float leg that resets

quarterly) are entered on the panel on the right. The Kynex model requires

certain other valuation parameters which are found on the bottom portion of

the panel on the left. For example,

the model can calculate any one of three different values of swap premium,

fixed coupon, and floating spread, given the other two. You may also select

if the principle is going to be exchanged at maturity. Kynex has defaulted this to “No” because

the DV+01 for each of the legs will be correctly measured. If this value is

set to “Yes”, the total DV+01 will remain unchanged and the swap premium

for each leg will show in familiar bond terms. If you want to see the curve

or your cash flows, click their respective buttons. You may also add a swap directly to your

portfolio by means of the “Create” button.

|