KYNEX Bulletin

December 2006

CDS

Valuation & Recovery Rate Model

The Kynex Credit Default Swap (CDS) Model (as described in the June 2004 Kynex Bulletin) has been enhanced significantly. Model changes and their benefits are highlighted here, and you can follow the links for additional detail and explanation.

v

The Kynex CDS calculator now accepts a credit curve (term structure of CDS spreads). In the very near future, you will be able to

store the credit curve for a specific credit and maintain offsets for debt

subordination level, and contract specific items such as documentation type,

settlement type, and recovery type. Therefore,

you can consistently mark multiple CDS contracts on a credit from a single term

structure. You no longer need to mark

every individual CDS. You no longer need

to get quotes on contracts whose remaining life to maturity does not match any

tenors for which quotes are readily available in the market. If the term structure on a given credit

remains unchanged, you no longer need to mark these contracts, we will be able

to re-calculate the unwind value. As the

contracts age, mark-to-market will remain accurate. You

will spend less time gathering and marking CDS instruments and more time

identifying and managing your investments. For details on providing the

credit curve inputs to our calculator, please see the description of our valuation screen.

You will be able to maintain your

credit curves through the Credit Curve Maintenance Screen (and/or by ftp from a

third party provider).

v

The calculator now accommodates the market

convention of quoting to the next IMM roll date as

well as on a constant maturity basis. If a tenor type of IMM roll is chosen,

the calculator also quantifies your P&L on the next roll date as well as

the drop in CDS spread assuming the broker does not remark the CDS on the roll.

v The Kynex CDS calculator now offers an optional recovery rate model which simulates the expected relationship between CDS spreads and recovery rates. The model will also calculate the implied flat recovery rate while leaving default rates unchanged. The model can help identify potential pricing errors in the market based upon your expectations of realizable recovery rates upon default. This model is intended to address the “downturn LGD” (loss-given-default) concerns in the Basel II framework document (paragraph 468). The negative correlation between default rates and recovery rates will amplify the effects of economic cycles, and this expected behavior should not be overlooked from a risk perspective.

v The Kynex CDS calculator now offers equity-linked delta and gamma estimates. These measures help estimate the impact of stock prices on the value of a CDS. They will help you with the difficult task of hedging portfolios consisting of equity derivatives (e.g. convertibles and options) and credit default swaps. Please refer to our equity-linked portfolio hedging example.

v CDSs on distressed credits are now frequently quoted in terms of a running spread plus upfront points. The Kynex CDS calculator allows for such market quotes, thus saving time analyzing such contracts (an equivalent flat spread is calculated).

v The economics of hedging credit spread risk with CDSs is discussed. A fixed income portfolio hedging example shows four alternatives. The profit and loss on equity-linked portfolios using CDS and a long convertible position as well as a short stock position is also examined.

Hedging Fixed Income Portfolios with CDS

We analyze a 5-year bullet

corporate bond hedged with CDS of varying maturity. Our findings are as

follows:

·

If protection against a default event is the

major consideration, it is economical to hedge with the shortest duration CDS

to cover the expected default at the risk of spread DV01 mismatch and

inadequate protection against credit deterioration.

·

If protection against credit deterioration is the

major consideration, it is economical to hedge with a liquid CDS longer than

the maturity of the corporate bond at the risk of spread DV01 mismatch and

inadequate protection against a default event.

·

You could achieve protection against both a

default event and credit deterioration via a hedge made up of a short duration CDS

and a long duration CDS without sacrificing spread DV01 match at the risk of

managing a complex hedge.

When faced with hedging credit

spread risk on a fixed income bond with a CDS contract, most market

participants would not buy a CDS whose triggering credit event is a credit

downgrade. This approach would be expensive, and partial downgrades would be

ignored. Rather, you would buy long protection on a corresponding single name

CDS. This discussion assumes the

portfolio to be hedged consists of a long position of $5 million GMAC corporate

(the techniques evaluated here could also apply to a whole portfolio of bonds

and DJCDXs as the hedge). On 8/1/2006, we assumed a

GMAC term structure of 154.25bps for the

one year, 191.6 bps for the three year, and 224.8bps for the five year (longer

contracts were not quoted). Our terminal horizon date is assumed to be

The table below (details are in the Appendix) shows four approaches you might use. In all cases, the notional amount of the CDS is determined by matching the spread DV01 of the CDS with that of the corporate bond.

The standard way to hedge is to buy long protection on a CDS that

closely matches the remaining term of the corporate bond. In our example, you

need to buy about $4.95 million of a five year CDS. The spread DV01 tracks well a year from now

under both a tightening and widening scenario.

In the event of default however, the CDS does not quite cover the bond

(you would have needed to buy a full $5 million). If the DV01 of the bond is

significantly smaller than that of the CDS, this small difference in this

example can grow. The economics of hedging

with a longer duration CDS appears attractive if you are relatively

unconcerned about default. Under this

scenario, you take advantage of the lower notional amount. If you are only concerned with default, then

buying $5 million of the shorter duration

CDS is the way to go. Otherwise, the

shorter duration CDS approach should be abandoned. Buying both a longer duration CDS and a shorter duration CDS so that

notional amounts and DV01s are simultaneously matched appears attractive,

albeit with an additional inconvenience and expense of maintaining two CDS

contracts. This approach might be more

appropriately used on a portfolio of bonds where the CDSs used to hedge are DJCDXs. Even for

a single bond position with an odd remaining term to maturity, a longer duration

CDS with a standard tenor plus a shorter duration CDS with a standard tenor

might be cheaper due to liquidity.

Hedging Equity-Linked Portfolios with CDS

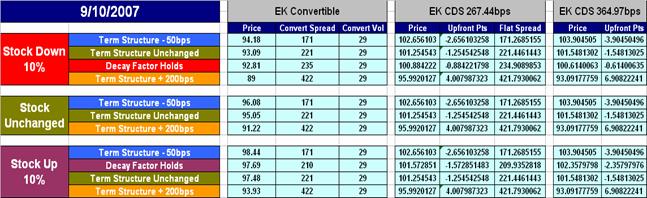

We analyze the Eastman Kodak

3.375% convertible bonds due 2033 hedged with various combinations of stock and

CDS, and our findings are as follows:

·

While it is possible to hedge a long convertible

position via CDS, unless there is a bankruptcy event, the drag on the carry

from the CDS deal payments makes the hedge more expensive than a simple short

stock hedge due to the rebate you collect from the short stock position.

·

Writing a CDS contract as a hedge against a

short convertible position instead of a long stock position would be attractive

if the stock pays no dividend and the coupon on the convertible is relatively

high, since the deal payments from the CDS offset the coupon payments on the

convertible helping the cost of carrying the position.

·

You can also hedge a long convertible position

with a CDS instead of a short corporate bond position if a corporate bond

exists from the same issuer. While the ease of wind-and-unwind as well as not

needing to borrow the short corporate bond make the CDS hedge more attractive,

it is important to realize that the CDS hedge does not provide a meaningful

interest rate hedge while a short corporate bond will.

A short stock position, or a

short call option on the stock, or a long put option on the stock or a

combination of the above are common hedges for a long position in a convertible

bond. Since several convertible securities exhibit an inverse relationship

between the stock price and credit spread (commonly referred to as bond floor

does not hold as the stock collapses) a CDS contract offers another alternative

to hedging. We compute the notional amount of CDS to hedge in two different

ways.

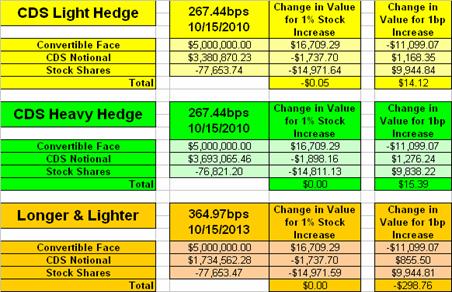

In the first method, we calculate

the difference in theoretical delta assuming the credit spread is independent

of the stock price and assuming a relationship (decay

factor) between the stock price and credit spread. This difference is

hedged via CDS, and the notional amount of the CDS is computed using the decay factor

(above) and spread dv01of the CDS. (in our example, the CDS Light Hedge in

yellow).

In the second method, we

calculate the CDS notional based on the spread dv01 of the CDS and the spread

dv01 of the convertible (in our example, the CDS Heavy Hedge in green) assuming

an inverse relationship between stock prices and credit spreads (decay factor). Our CDS calculator computes the

equity delta for the CDS which can be used to compute the effective share

equivalent. The difference between the effective share equivalent and the

theoretical delta of the convertible assuming an inverse relationship between

stock prices and credit spreads in shares would have to be hedged by selling

stock short.

The details for both of these

methods can be found in the Appendix.

Successfully managing credit

spread risk in an equity-linked portfolio starts with some science but

ultimately requires art (and probably some luck as well). We will start by

assuming that our portfolio consists of a $5 million long position of the

Eastman Kodak (EK) convertible maturing

For comparison, we included a

portfolio which is only long the convert, and two portfolios whose equity

exposure is hedged with and without the Convertible Model’s bankruptcy mode. The other three portfolios contain a short

stock position and a long CDS position (please see the Appendix for how these portfolios were

constructed). Not surprisingly, the CDS deal payments really drag down

performance (especially when the rebate rate is high). The “Heavy-CDS Hedge”

portfolio will perform the best if spreads widen dramatically, but the spread

dv01 coverage is expensive. The “Light-CDS Hedge” portfolio demonstrates the

usual way of hedging an equity–linked portfolio, but its performance is still

weighted down by the CDS deal payments. This situation can be partially ameliorated by going longer and lighter on

the CDS. The 7 year CDS has a larger delta and spread dv01. This means you can buy less of the CDS, and

therefore reduce your dollars of deal payments.

Although the coverage is not as good, the “Longer and Lighter CDS Hedge”

portfolio starts at an immediate annualized advantage of $27,112. The advantage

holds until spreads widen out to 277.1 bps or beyond. If you believe spreads will not widen beyond

this, there is no reason to make the additional deal payments. You can adjust your coverage based upon

your assumption on how wide spreads are likely to widen.

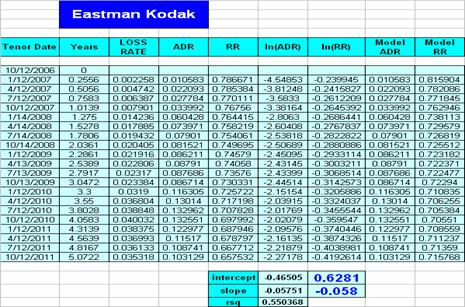

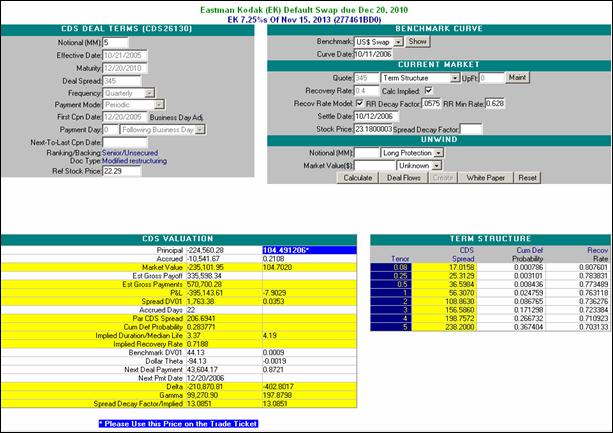

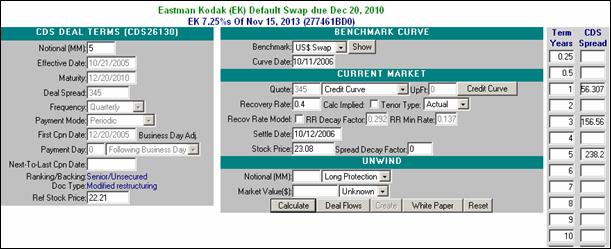

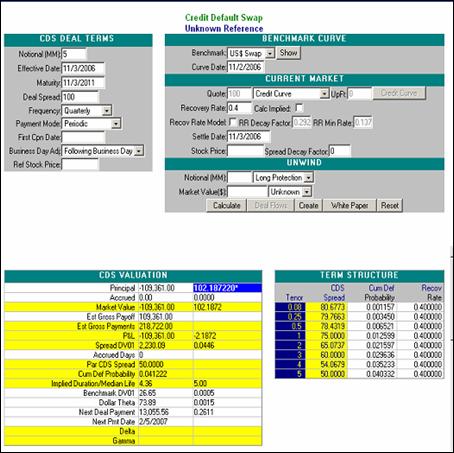

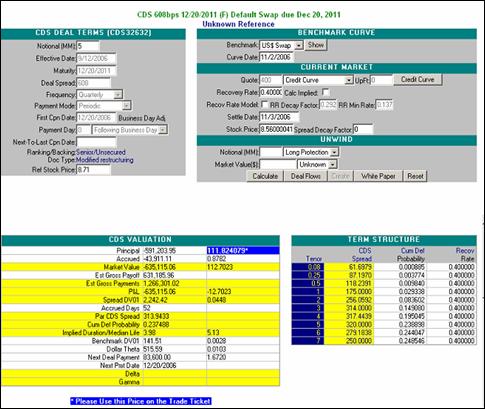

CDS Valuation Screen Description

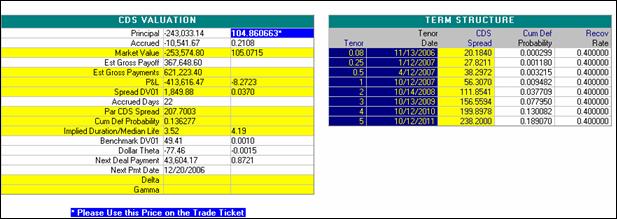

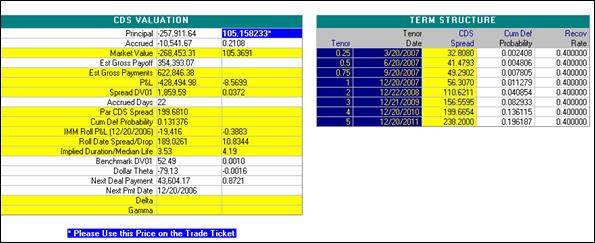

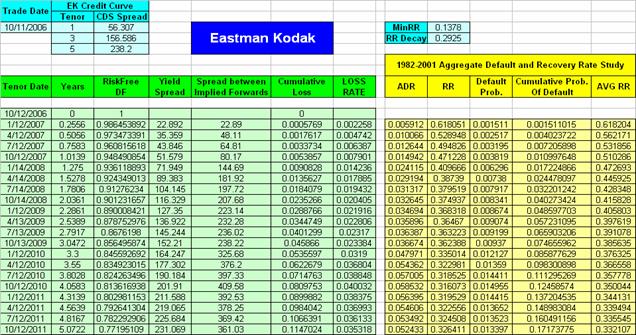

The CDS Valuation Screen (i.e. the CDS detail page) is now composed of several sections. As an example, the following input and output sections use a CDS on an Eastman Kodak straight bond.

In this example, we show the screens you will see displayed

if you choose the Credit Curve option in the quote type box. A separate section allows you to enter the

desired credit curve. The quote type options are as follows.

CDS Spread

Short Bond Price

Upfront Points

Paid

Upfront Points

Received

Running Spread +

Upfront Points

Credit Curve

If the Credit Curve option is selected, the calculator will

always use the CDS term structure displayed.

If a credit curve has been stored (either from the Credit Curve

Maintenance screen or from an uploaded file), then the Credit Curve Option will

be used at the initialization of valuation.

Additional documentation on

Credit Curve Maintenance will be forthcoming. If you are interested in the

calculation of delta and gamma, you must enter a spread

decay factor. If you wish to use the

Recovery Rate Model, you need to check the Recovery

Rate Model box and override the model

parameters if desired. If the spreads

in the credit curve are IMM roll spreads, then you

should select the IMM roll tenor type. The valuation output section follows.

Under the CDS Valuation section, standard values in dollars

and short bond points are shown. The

P&L values assume no unwinds from the effective date until settlement. The

Spread DV01 values show the change in market value for a one basis point

parallel upward shift in the entire credit curve. Similarly, the Benchmark DV01

shows the change in market value for a one basis point upward shift in the

entire benchmark curve. The Par CDS Spread corresponds to the exact maturity

date of the CDS, and results in the identical market value if used as a flat

CDS quote. Dollar Theta shows the change in principal if the settlement is

incremented by one (calendar) day. Delta values show the change in principal

for a 1% change in stock price using the specified spread decay factor for

every point on the credit curve (e.g. the expected short bond price for a 1%

change in stock price equals 104.860243*(1 + 0.01*4.0751) = 109.1334). Gamma values show changes in Delta values

(strictly speaking, the signs of the short bond point values should be reversed

for all of the Greeks as well as SpreadDV01 and Benchmark DV01). If the Recovery Rate Model is turned on, an

implied flat recovery rate can also be calculated. The implied flat recovery rate is computational intensive and time consuming

if a credit curve is specified. If

you choose to calculate it, its value will result in the identical market value

if you then turn off the Recovery Rate Model and specify the flat recovery rate

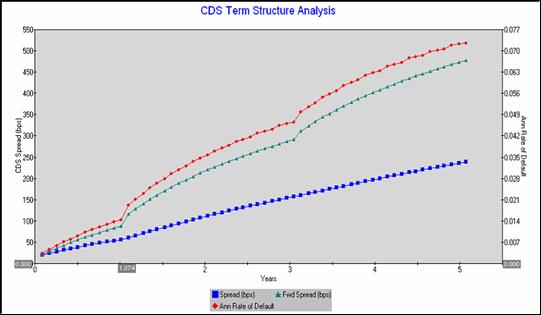

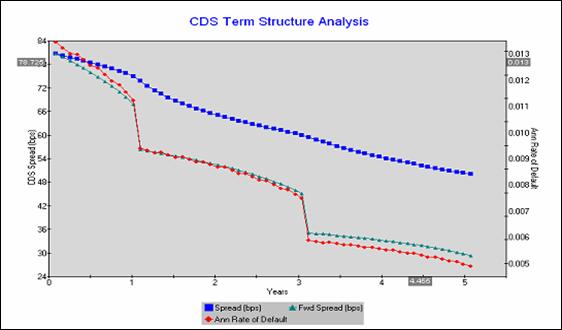

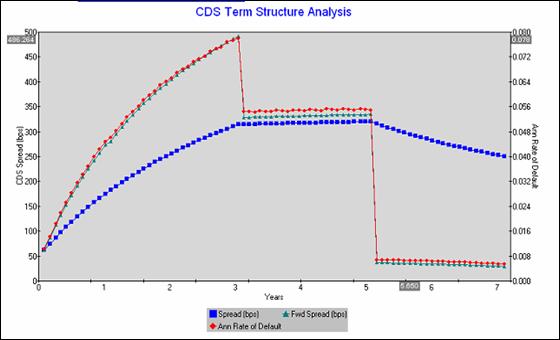

as that value. The Term Structure

section shows the Credit Curve for additional tenor points. These values (along with additional internal,

valuation points) are graphed as follows.

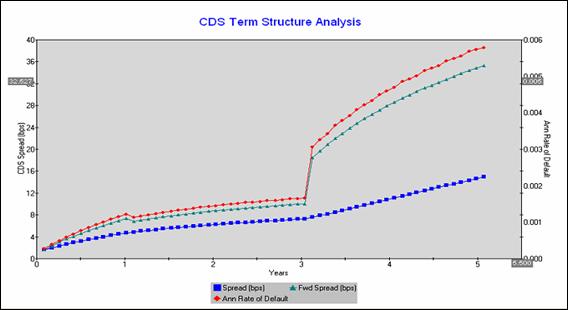

The CDS spreads (blue) and the forward CDS (green) spreads

are plotted versus the left hand axis, and annualized default rates (ADR) are

plotted versus the right hand axis. Forward CDS spreads are the basis point equivalent

of ADRs.

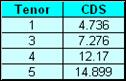

In constructing your CDS credit curves, clients should be careful when mixing CDS

quotes from different trade days or contributors. You can easily wind up with a term structure

fruit salad (apples and oranges).

Consider the ask side CDS spreads shown by Bloomberg™ for IBM on

Bloomberg™

clearly marks the 4 year value as originating on

If the 4 year tenor is removed, the analysis shows the

following.

More tenor points will not necessarily make

your valuation more accurate.

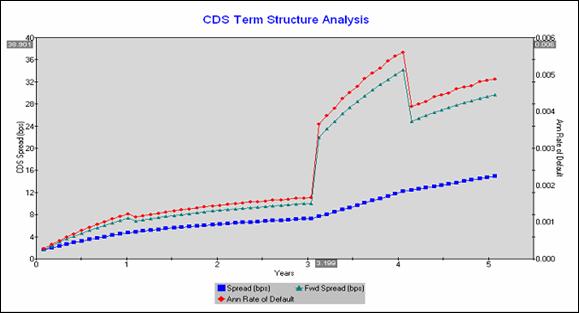

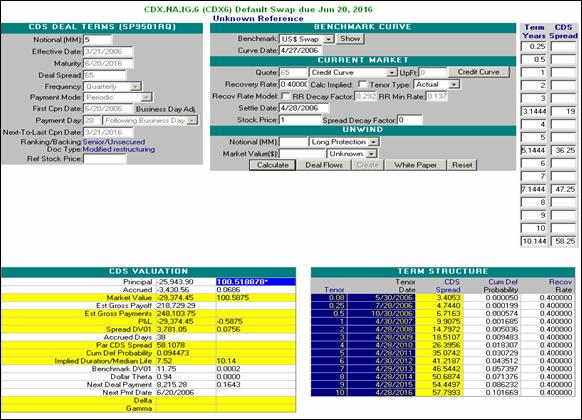

If you interpret

the credit curve spreads as IMM roll spreads, then the output section is as

follows. The output tenors are reinterpreted,

and the tenor dates show the future roll dates corresponding to the tenor

points.

The next IMM

roll date is shown as well as the expected P&L drop on the roll date. We

also show the drop in the CDS spread due to the roll.

As noted in the CDS Valuation Screen Description, you can

now enter CDS spreads that conform to the IMM quarterly roll convention. If the “IMM Roll” tenor type is selected,

both input and output CDS spreads will be consistent with this convention. This

roll convention combines the usual daily drops throughout the quarter together at

the beginning of the current roll period.

To see the roll in action, we selected a Kodak CDS as an example and

calculated CDS spreads and unwind values from a constant credit curve for every

trade date over a full quarter starting from 6/20/2006 until 9/20/2006.assuming

both actual and roll tenor types.

As

expected, the CDS spreads using the actual tenor type exhibits a classic roll-down-the-curve

behavior.

The roll tenor type shows that the CDS spread is flat within the quarterly

period with an abrupt drop when the trade date is on the 20th. On

the 19th, the CDS spreads are identical.

Unwind

values (as measured in principal upfront bond points) also exhibit the same

behavior.

The

Roll P&L value gives today’s expectation of what the drop in unwind will be

on the next roll date. Since the credit

curve was held constant during the quarterly period, the Roll P&L is flat.

If you are long CDS, you should consider

unwinding near the end of the IMM quarter if possible.

Inverted Credit Curves

For most credit curves, the Kynex assumption that CDS

spreads tend toward zero as the time to expiration goes to zero is reasonable.

But clients can control their “time 0” values by inserting a tenor at 0.01

years. For inverted credit curves, this

is especially useful. The five year generic CDS shown below illustrates how to

do this.

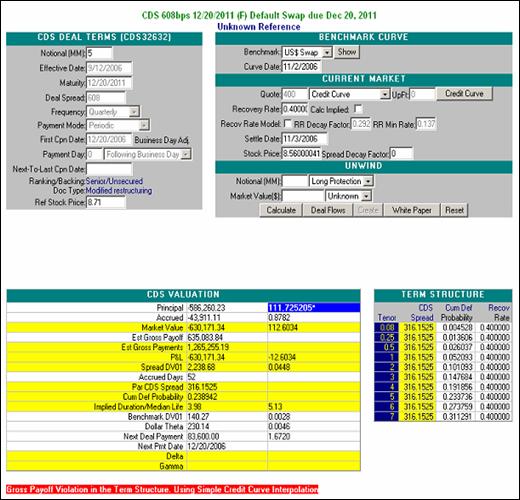

Impossible Credit Curves

Suppose you believe Ford (F) will begin to improve after

about five years, and will substantially improve by year seven. You might

reflect that on a Ford CDS as follows.

However, if you decided the spread corresponding to the seven year should really be 225, you would get the following.

In this case, a flat seven year CDS spread of 225 produces a gross payoff far too low. It cannot be reached from the five year point unless probabilities of default become negative between five and seven years. But this is not possible. In this case Kynex does a simple interpolation on the credit curve to determine a flat CDS, and a flat CDS valuation is performed.

The Kynex Recovery Rate Model arose out of our concerns over risk. The theoretical basis of our model is the work by Altman, Brady, Resti and Sironi in their March 2003 paper entitled “The Link between Default and Recovery Rates: Theory, Empirical Evidence and Implications”.

In that paper, the negative

correlation of default and recovery is effectively explained and

demonstrated. This inverse relationship

has two main reinforcing determinants which act in addition to a default payoff

as merely arising from the residual value of a company’s assets. At the company level, the same economic

conditions that increase the rate of default will also increase default severity. At the market level, higher default rates

means a larger supply of distressed securities. With a larger supply available,

the vulture funds will pay less for the debt of the same distressed

company. The result is a “perfect storm”

scenario in which the “rate of default is a massive indicator of the likely

average recovery rate amongst corporate bonds.”

In order to value a CDS, market participants are faced with an

impossibly difficult task of assigning a recovery rate to a company’s credit

which may be currently rated as AAA. No one knows beforehand exactly how a

company will fare in bankruptcy court, especially one whose credit is so far

away from default. Kynex does not pretend to shed any light on that

question. However the Kynex Recovery

Rate model can provide recovery rates which are consistent, on average, with

specified market CDS spreads. Once a CDS

term structure is given with the recovery rate model turned on, default and

recovery rates are calculated. Recovery

rates can be calculated which are consistent with the 1982-2001 data as

presented in Table 1 (Default Losses, Recovery Rates and Losses) of the paper

mentioned above, or they can be calculated from user specified input for the

recovery rate decay factor and the recovery rate minimum rate. Please refer

to the recovery rate section of the

Appendix for a description of the Kynex methodology. You must decide if it

is more realistic to use a flat recovery rate or a recovery rate that adjusts

for rates of default.

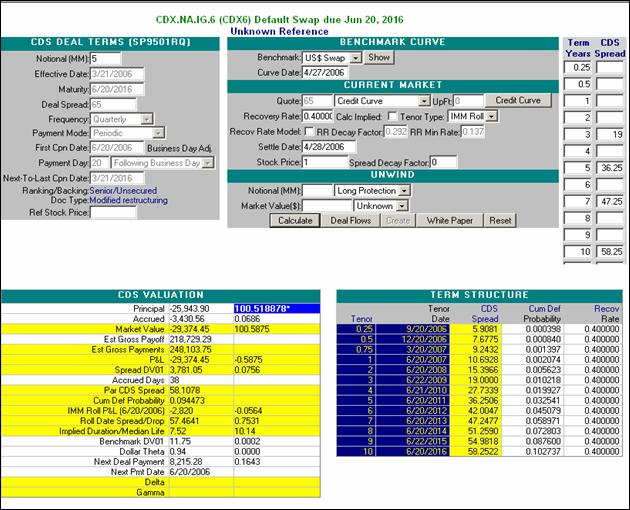

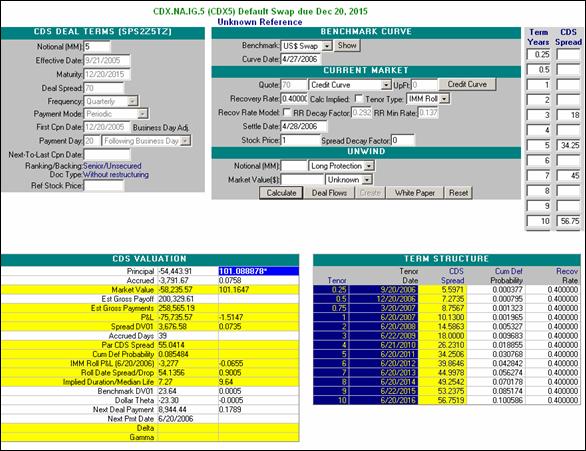

Although

you must create and store individual single name CDSs, DJCDX issues are already

stored in Kynex for your use. As new

issues come out, their contract terms will be entered into Kynex by our staff. You

can access them by the Bloomberg™ deal number

(e.g. the CDX.NA.IG.6

The term structure will price the

underlying quoted contracts accurately. Any variation is due to business day

adjustments and to a different cycle (the CDX contracts cycle on the 20th,

while the underlying calculation uses a cycle based upon the settlement date,

e.g. the 28th in this case).

Even though the earliest quote is on the 3 year contract, Kynex will

price the shorter contracts as well. This extrapolation is based on model

defaults and the Kynex belief that CDS spreads tend towards zero on settlement.

If you want to compare the CDX5’s to the CDX6’s, an additional valuation is

required.

If you desire constant maturity spreads (e.g. credit

spreads), then you need to switch to the actual tenor type, and compute

fractional tenors for the spreads.

Kynex CDS Model Appendix

Hedging Fixed Income with CDSs (Detail

Table)

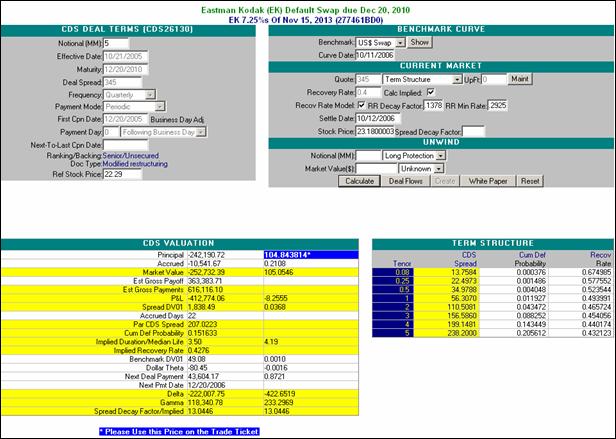

Valuation Model Comparisons

Although the Kynex model has undergone substantial changes, your current valuations and risk measures should be relatively unchanged. As an example, we show valuations on an Eastman Kodak CDS assuming flat market spreads of 100 and 500 and a flat recovery rate of 40%.. The columns labeled “BB/JPM” show values based upon the Bloomberg™ JPM CDS model. The new Kynex model will give benchmark DV01 values more in line with the JPM model (Kynex changed the definition slightly).

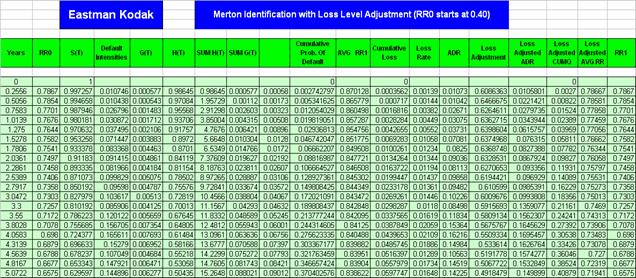

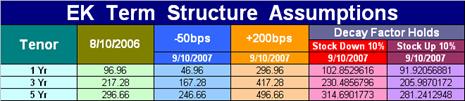

Historical Spread Decay Factor

For the EK 3.375% 10/15/2033 (10/15/2010) convertible bond., the graph below plots daily stock prices starting on 4/3/2006 and through 8/10/2006 versus three year and five year mid-level CDS spreads over the same interval. These values are readily available on Bloomberg™, for example.

This graph

depicts an almost classic inverse relationship between stock prices and credit

spreads. EK posted a widening first-quarter loss on

A positive decay factor indicates an inverse relationship

between stock prices and spreads. This data can be used in at least three ways

to get an estimate of the spread decay factor. The results of the three methods

are summarized below.

Stock prices and spreads at the starting and ending points can be used. You can also get an estimate of the decay factor by using the following regression formula.

Alternatively, you can determine the decay factor that minimizes the following equation.

The following graph shows how the modeled spreads track the actual raw spreads for the five year CDS.

As can be seen by the difference between the 3 year and the 5 year decay factors, decay factors have a term structure.

Hedging Equity-Linked

Portfolios with CDSs (Details)

On

Calculating the CDS Notional Given a

Desired Equity Hedge

![]()

![]()

![]()

Calculating the CDS Notional from Spread

DV01

![]()

The implied

volatility on the convertible was 28.1 without bankruptcy, and 29.1 with

bankruptcy. On

CDS Model Enhancements

In the prior release of the CDS Model (June 2004 Kynex Bulletin), Kynex implemented a Yield Spread probability model (YSM). Now that the model can accept a term structure, we are now using a Present Value Cost of Default Model (PVCDM). This model expresses the relationship between interest rates and defaults in the following way.

Present Value Cost of Default Model

![]() ,

,

where ![]() = the

risk-free discount factor that discounts $1 to settlement using the risk-free

spot rate at time n,

= the

risk-free discount factor that discounts $1 to settlement using the risk-free

spot rate at time n,

![]() = the risky discount factor that discounts $1

to settlement using the risky spot rate at time n,

= the risky discount factor that discounts $1

to settlement using the risky spot rate at time n,

![]() = the average (or implied flat) recovery rate

effective from settlement until time n,

= the average (or implied flat) recovery rate

effective from settlement until time n,

![]() = the cumulative probability of default from

settlement until time n

= the cumulative probability of default from

settlement until time n

The present value of the expected loss is equal to the difference between the present values (please see a paper by John Hull and Alan White, "Valuing Credit Default Swaps I", University of Toronto, April 2000). Since recovery rates are no longer assumed to be constant, the above equation is adjusted as follows:

![]()

![]()

where ![]() = the cumulative

loss from settlement until time n,

= the cumulative

loss from settlement until time n,

![]() = the recovery rate effective from time n-1

until time n,

= the recovery rate effective from time n-1

until time n,

![]() = the time from settlement until time n,

= the time from settlement until time n,

![]() = the

annualized loss rate between time n-1 and time n

= the

annualized loss rate between time n-1 and time n

Annualized loss rates are defined here as the aggregate effect of default and recovery (defaulted but not recovered). As such, they are entirely defined by the risk-free and risky curves, and they will follow the spread between the implied risk-free forwards and the implied risky forwards (please see the December 2003 Kynex Bulletin on Interest Rate Swaps for a discussion of our bootstrap methodology).

The basis of the Kynex Recovery Rate Model is the power model as explained in the March 2003 paper entitled “The Link between Default and Recovery Rates: Theory, Empirical Evidence and Implications” (Altman, Brady, Resti, Sironi). In that paper, the authors explained a significant amount of the variation in aggregate recovery rates (over the period from 1982 until 2001) by using aggregate default rates alone. The form of the power model is as follows.

![]()

![]()

where ![]() = the annualized default rate effective from

time n-1 to n,

= the annualized default rate effective from

time n-1 to n,

![]() = the minimum

recovery rate,

= the minimum

recovery rate,

![]() = the recovery

rate decay factor

= the recovery

rate decay factor

Using aggregate default and recovery rates, the authors of the above mentioned paper solve for MinRR (0.13777) and RRDECAY (0.29249). Those parameters are used to generate the following graph.

Given current default and recovery rate data, these recovery rate parameters can be easily updated. But on a daily basis, default is not observed in the credit markets for a particular issuer, but loss is. Given risk-free and risky rates, the implied loss rates (aggregate of default and recovery) are known. The following graph plots the study data versus loss (in addition to certain constant recovery rate assumptions).

For investment

grade names (lower loss rates, tighter spreads), a constant recovery rate

assumption of 0.40 is seems to be quite close if nothing else is known. Ideally,

the recovery rate parameters for single name CDSs should reflect company

fundamentals as well as the general economic climate. Intuitively, an

economic climate of high losses (wider spreads) should reduce recovery based solely

upon assets on the balance sheet. (e.g. the same commercial jet has a lower

residual value if other carriers are defaulting or are otherwise uninterested

in purchasing the leftovers). Conversely, an economic climate of low losses

(tighter spreads) should allow the expected recovery derived from the company’s

balance sheet alone to be realized. In their July 2006 paper, “Implied

Recovery”, the authors, Das and Hanouna, skillfully combine elements from both

reduced-form models and structural models to identify recovery rates. As an example of determining the recovery

rate parameters for a single name credit, the following graph and tables show

our results for Eastman Kodak (EK) as of day end on

The final table shows the Eastman Kodak minimum recovery rate and decay factor to be 0.628 and 0.0575, respectively. Although the Merton identification approach (as described in the Das and Hanouna paper) converges, it seems to do so at unexpectedly high recovery rates (and therefore unexpectedly high default rates given the same loss level). This happens despite the fact the raw Merton identification function gives very low default rates. The problem appears to come about because the identification function occurs at very low loss levels (minimum loss rate equals 2.205E-16, maximum loss rate is 0.00731) but is applied at much higher loss levels (identification occurs in one domain but is applied to another). Loss levels from the term structure are at much higher levels (minimum loss rate equals 0.00226, maximum loss rate is 0.04). The results shown in the table not only converge via the algorithm but they have been adjusted to the higher loss levels (using default given loss from the raw Merton values). This adjustment brought the recovery rates down, but they still seem higher than expected. We believe these recovery rate levels are not sustainable given an economic downturn and are not consistent with the concerns raised by the Basel II framework document (paragraph 468). The important point here is that you can determine your own recovery rate parameters (given your own judgment and identification methodology) and apply them in the valuation of the CDS. At this time, Kynex is not suggesting what the recovery rate parameters ought to be for a given single name CDS.

Strictly

speaking, every CDS spread in a term structure has an implied recovery rate

associated with it. Given today’s market, that rate is almost always

40%. This associated recovery rate is

the one that should be used for valuation (the valuation will be correct, but

the identification of the underlying probability of default will be off).