The valuation of an Asset Swap (ASW) on a convertible

security consists of two parts: valuation of the recall value and valuation of

the stub. The latest release of the

Kynex valuation model values the ASW stub as an American style call

option on a convertible bond. The ASW recall value is calculated by our

interest-rate swap calculator, and has not been changed.

Asset Swaps allow an investor to take advantage of the

Gamma of the option embedded in a convertible, while providing insulation against

deterioration of the credit of the issuer. Since entering into an Asset Swap

releases capital, the holder of an Asset Swap can be significantly more levered

than the holder of the underlying bond. This can both magnify the return on the

investment (in favorable circumstances) and lead to a greater negative return

(in unfavorable circumstances).

While we use an American call option framework to

value the ASW stub, it is important to note certain differences between a

simple call option on a stock and a call option on a convertible. An Asset Swap

typically expires on the first call date (or first put date) of a convertible,

i.e. the bond typically does not terminate prior to the expiration of the Asset

Swap. However, we have also observed several examples of Asset Swaps which

expire on the maturity of the underlying bond, even though the bonds are

callable and/or put-able prior to maturity. The model enforces the boundary

condition that if the underlying bond is called (or put) before the expiration

of the Asset Swap, the Asset Swap terminates at the same time that the

underlying bond is terminated. The recall strike of an Asset Swap accretes with

time (reaching par at the expiration of the Asset Swap) i.e. if the stock price

does not change over time, the option goes more out of the money; hence the

time value of an Asset Swap decreases faster than that of a fixed-strike option

(higher negative Theta). This is a subtlety not encountered in pricing standard

equity options. The accreting strike feature is also included in the Kynex

valuation model.

In general, we expect an Asset Swap to be favorable in the

following scenarios:

-

Credit of the issuer of

the convertible deteriorates considerably

-

Interest rates rise

meaningfully

-

Volatility rises

meaningfully and Gamma is realized

-

Desire to not lock-up

capital or hedge fund does not have enough capital

-

Coupon on the convert

is small and recall spread is tight

We also expect an Asset Swap might not be advantageous in

the following scenarios:

-

Recall spread is wide

to begin with and credit tightens considerably

-

Interest rates decline

meaningfully

-

Volatility collapses

and very little Gamma is realized

-

Coupon on the convert

is big and recall spread is wide

We present various scenarios analyzed by us to

quantify the advantages of entering into an Asset Swap vs. holding the

underlying bond.

Scenarios

A few highlights are worth noting before delving into

the details.

- The ASW holder does not receive any coupons but does

not need to finance the bond portion that is swapped away. The convertible

holder receives the coupons but has to finance the entire market value of the

convertible. This dynamic affects the cost of carry in a significant way. For

low-coupon convertibles, the ASW holder is not giving up much but the

convertible holder is financing the bond at a much higher rate than the coupon

received. For high-coupon convertibles, the ASW holder is giving up quite a bit

and the convertible holder is able to offset the cost of financing with the

coupons received.

- Since the ASW has a higher negative Theta than the

convertible, the holder of the Asset Swap needs to realize volatility and/or

the interest rates have to rise to overcome the higher rate of time decay.

- If an investor is concerned about the deterioration

of the credit of the issuer, the underlying bond should be valued with our

bankruptcy mode turned on. (The description of the Kynex convertible valuation model

with bankruptcy mode is described in the Dec 2003 Kynex Bulletin.) We analyzed the relative

merits in both modes i.e. bankruptcy mode turned on and off. For the bankruptcy

mode, we employed a decay factor of 1, which means that the credit spread is

expected to double if the stock price declines to half of its current level. When

using the bankruptcy mode, you can set the decay factor to an appropriate level

based on the issuers expected creditworthiness, etc. In practice, we found

that the merit of entering into an Asset Swap (as opposed to holding the

underlying bond), does not depend on whether the bankruptcy mode is on or off.

- The Kynex calculator values the underlying

convertible using the risky-risky framework (risky stock growth, risky

discounting of cash flows), and the Asset Swap as risk-free (risk-free stock

growth, risk-free discounting).

The quantitative comparisons were performed using the

Kynex Impact Analysis. The initial position consisted of 1,000 (1 million face)

convertible bonds or Asset Swap on 1,000 bonds. In each case, a short stock

hedge was set up to make the initial portfolio Delta-neutral. A time horizon of

1 yr was employed. The P&L from Gamma trading was calculated using the

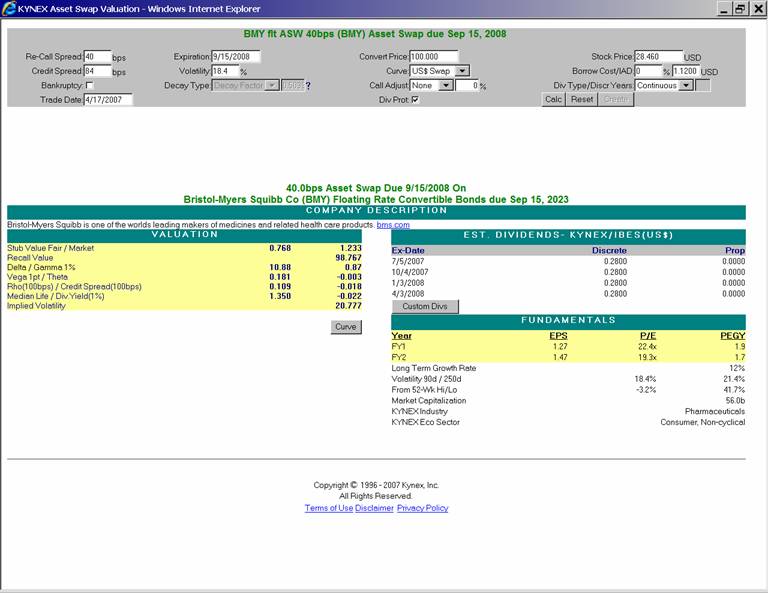

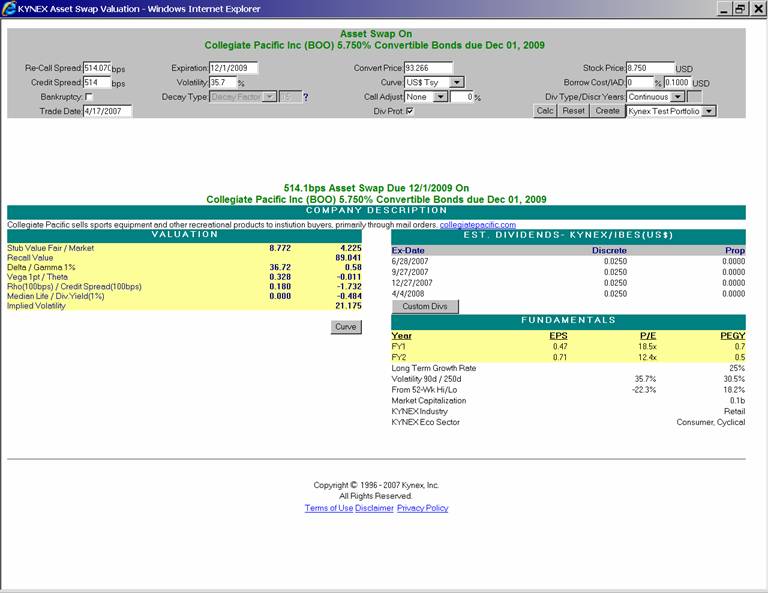

Hedge Calculator. For our investigations, we used two example bonds and Asset Swaps:

The first example is a bond with a relatively low

coupon and the Asset Swap has a tight recall spread. We used the AMGN Tranche-1

0.125% 2011 convertible bond. This is a bullet bond. We created an Asset Swap,

whose expiration is equal to the maturity of the bond (Feb 1, 2011), and a recall spread of

30 bps.

The second example is a bond with a higher coupon and

the Asset Swap has a wide recall spread. We used the China Medical (CMED) 3.5%

2011 bond (also a bullet bond). We created an Asset Swap whose expiration is

also equal to the maturity of the bond (Nov 15, 2011), and a recall spread of 300 bps.

We considered two possibilities for our analysis:

The investor enters into an Asset Swap, which releases

capital, thereby making the investor more levered than a bondholder.

The Asset Swap holder invests the released capital at

the risk-free rate. In this scenario, the Asset Swap holder locks up the same

capital (and has effectively the same leverage) as a bondholder.

For each of the above possibilities, we valued the

bond and Asset Swap with the bankruptcy mode turned on and off. Hence there

were a total of four calculations for each scenario. The quantitative results

for the AMGN bond/Asset Swap are summarized in Table 1 and for the CMED bond/Asset Swap in Table 2 (see below).

At the initiation of an Asset Swap, the recall spread

of an Asset Swap is equal to the credit spread of the issuer. In our analysis,

we therefore valued the AMGN bond and ASW with a spread of 30 bps, and the CMED

bond and ASW with a spread of 300 bps. The stock price, bond price, volatility,

credit spread and yield curve, etc., used for our analysis are shown in Table 3 below. Additional pertinent ancillary data are presented

in Tables 4 and 5. Table 4 shows the final bond price, ASW recall value and

stub value for the various scenarios. Table 5 shows the

P&L (from Gamma trading of the stock) and the carry for the bond and ASW. The

carry for the AMGN Asset Swap is substantially higher than for the convertible,

because the bondholder has to finance the bond, and receives little income from

the small coupon. The carry for the CMED Asset Swap is about the same as that

of the convertible because in this case the bondholder receives a substantial

income from the large coupon, which offsets the financing of the bond position.

The ratio of (recall value)/(convertible price) is a

measure of how soon the Asset Swap hits its floor as the credit deteriorates.

The bond price, Asset Swap recall value, and the above ratio are also presented

in Table 3. The value of the ratio is 0.92 for AMGN and

0.76 for CMED. Hence the CMED Asset Swap has a longer way to go to hit the

floor. This means that the CMED Asset Swap has much more negative time decay

than the AMGN Asset Swap. Our analysis illustrates how the larger time decay of

the CMED Asset Swap considerably reduces its rate of return, making it a less

attractive investment compared to the AMGN Asset Swap.

We summarize the results of our study below.

Stock Price, Volatility, Credit Spread, and

Interest Rates are Unchanged

For both AMGN and CMED (with and without the

bankruptcy mode), the underlying bond outperforms the Asset Swap. This can be

attributed to the higher rate of time decay of the Asset Swap relative to its

underlying bond. (Recall that the upward accretion of the strike price with

time causes an Asset Swap to go out of the money if all other parameters remain

constant.) Basically, if volatility is not realized and/or interest rates do

not increase, then an Asset Swap is not advantageous.

Stock Price

Falls, Credit Spread Widens, and Implied

Volatility Increases

We expect that a fall in the stock price may be

correlated with a deterioration of the credit of the issuer (i.e. wider credit

spread). The volatility may also typically increase. The widening of the credit

spread and increase in the implied volatility are offsetting factors with

respect to the change in the value of the Asset Swap.

The AMGN Asset Swap outperformed the underlying bond.

The CMED Asset Swap underperformed relative to the

underlying bond. This was traced to the effect on carry (as described earlier)

due to the high coupon as well as the distance between the market price and the

ASW recall value. The increase in the

implied volatility helps the Asset Swap holder, but (in the case of CMED) not

by enough to outperform the bondholder. Both the AMGN and CMED Asset Swaps hit

their respective floors in this scenario. For AMGN the floor is 87.0. The

initial market price is 90, so the ASW investor suffers a loss of 3.0 before

the floor kicks in. For CMED the floor is 85.4. The initial market price is 107,

so the investor suffers a loss of 21.6 points before the floor kicks in. An Asset

Swap investor is only protected against a widening of the credit spread after

the floor is reached. Hence an investor holding the CMED Asset Swap loses

substantial value if the spread widens, before the protection of the Asset Swap

takes effect.

The above statements were made assuming that the Asset

Swap investor is more highly levered than the bondholder. If the Asset Swap

holder has the same capital as the bondholder, and invests the extra capital at

the risk free rate, then in both examples the Asset Swap holder receives a

better return than the bondholder.

The use of the bankruptcy mode changes the

quantitative numbers but does not alter the above conclusions.

Stock Price

Rises, Credit Spread Tightens, and Implied Volatility Decreases

We might expect that the results will be the opposite

of the previous scenario. Both the AMGN and CMED Asset Swaps under-perform

compared to their underlying bonds. The magnitude of the under-performance of

the CMED Asset swap is much more than that of the AMGN. This is due to the

effect on the carry (as described earlier) due to the higher coupon on the CMED

convertible. The above statements assume that the Asset Swap investor is more

highly levered than the bondholder. If the Asset Swap holder has the same

capital as the bondholder, and invests the extra capital at the risk free rate,

then the magnitude of under-performance of the Asset Swap is lesser.

The use of the bankruptcy mode changes the

quantitative numbers but not the relative performances of the bonds and Asset

Swaps.

Interest

Rates Rise/Fall 100 bps

We hold the stock price etc., fixed in the Impact

Analysis, but apply an impact of a 100bp rise/fall (parallel shift) in the

interest rates. We expect that if interest rates rise, the Asset Swap

outperforms the bond, and if interest rates fall, the Asset Swap will give a

lower rate of return than the underlying bond.

Our findings do not completely confirm this

expectation. For the AMGN bond and Asset Swap, the above behavior is observed

(with both the bankruptcy mode on and off). The CMED Asset Swap, however,

underperforms the bond even when interest

rates rise, when the bankruptcy mode is off. This is again due to the

effect on carry due to the high coupon as well as the longer distance between

the market price and the ASW re-call value. When the bankruptcy mode is on, the

CMED Asset Swap outperforms the underlying bond when the interest rates rise.

The CMED Asset Swap underperforms the bond when the interest rates fall, both

with and without the bankruptcy mode on.

The above statements assume that the Asset Swap

investor is more levered than the bondholder. If the Asset Swap holder has the

same capital as the bondholder (and invests the extra capital at the risk-free

rate), then the return obtained by the Asset Swap holder might or might not be

better than the bondholder when interest rates rise (both with and without the

bankruptcy mode) depending on other factors such as carry, theta, etc.

The above findings for CMED are consistent with our

expectation that an Asset Swap is not advantageous if the bond pays a large

coupon and has a wide spread to begin with.

Credit

Default Swap (CDS)

Another possibility for the investor to hedge against deterioration

in the credit of the issuer is to buy protection via a Credit Default Swap

(CDS). Please refer to our December

2006 Bulletin for more details. In this

scenario, the investor holds the underlying convertible bond, and therefore

does not unlock any capital. The CDS requires deal payments, which can drag

down the return on the portfolio. The CDS reduces the required short stock

position to be Delta-neutral since the CDS provides a hedge against credit

deterioration which is correlated with stock price declines (most of the time),

so in our analysis below we employed a lighter stock hedge.

We considered an example CDS on the AMGN Tranche 1

bond. The deal spread on the CDS is 30 bps (equal to the recall spread of the Asset

Swap). The CDS maturity was set to March 20, 2011 (with a first coupon date of June 20, 2007). From Table 3, the hedge Delta of the bond is 48. We set the CDS

notional to hedge 8%, and hedged the remaining 40% with a short stock position.

The return on the bond + CDS + short stock position was calculated for a

horizon of 1 year (the same as with the Asset Swap). Table 6

shows the return on the CDS (with a stock hedge of 40%, as noted above). The

corresponding return obtained by using an Asset Swap (with a stock hedge of

48%) is also shown. The data for the Asset Swap was copied from Table 1 (the data where the bankruptcy mode was turned on).

The returns are presented for the two scenarios

·

stock price declines, spreads rise, implied

volatility increases

·

stock price rises, spreads tighten, implied

volatility decreases

Note that the bankruptcy mode must be turned on when

valuing the bond (the use of a CDS implies a probability of default). Recall

that we set the decay factor to 1. We see from Table 6 that

the use of a CDS (and light short stock position) does not give as good a

return as the use of an Asset Swap in the first scenario (stock price declines

and the spread widens). The CDS gives a better return than an Asset Swap when

the stock price increases and the spreads tighten. This is because, in this

scenario, the Asset Swap suffers from the reduction in the realized volatility and has large time decay. The bond + CDS

portfolio does not have such large time decay.

For reference, we also constructed a CDS on the CMED

bond, and display the results in Table 6. The deal

spread on the CDS is 300 bps (equal to the recall spread of the Asset Swap).

The CDS maturity was set to Dec

20, 2011 (with a first coupon date of June 20, 2007). For CMED, we already know that

the convertible bond by itself (with Delta-neutral short stock hedge)

outperforms the Asset Swap in both cases when the stock falls and credit widens

and the stock rises and credit tightens. The use of a CDS (with a light stock

hedge of 60 instead of 68) also outperforms the Asset Swap in both of the above

scenarios.

However, there are other factors to consider when

deciding to hedge with a CDS or to enter into an Asset Swap. There is no

clear-cut best solution. Some points to note are:

A CDS is more liquid than an Asset Swap. Furthermore,

the bond and CDS trade independently, so it is easier for the investor to

change the position in the bond and/or CDS.

An Asset Swap holder is essentially locked into the

position until the expiration (or recall) of the Asset Swap. To change the

position, the investor must buy new convertibles and enter into a new Asset

Swap agreement with a broker.

A CDS does not release capital, whereas an Asset Swap

does. A hedge fund with limited capital may have no choice but to enter into an

Asset Swap.

Metrics

We compare various metrics of an Asset Swap vs. the

underlying bond below. For example, Asset Swaps usually have a lower Delta than

the underlying bond, and are therefore hedged using a smaller short stock

position. Furthermore the value of Rho

is negative for a convertible bond, but is positive for an Asset Swap. Hence an

Asset Swap has an implicit hedge against a rise in interest rates, as we noted

in the Impact Analysis study above.

We performed sweeps with the bankruptcy mode off and

also with the bankruptcy mode on. With the bankruptcy mode off, we used the

AMGN bond and Asset Swap mentioned above. We performed four sets of sweeps

(Spot price, Volatility, Credit Spread and an Interest Rate Shift (parallel

shift of yield curve)). The graphs are shown in Figures 1

through 28 below. With the bankruptcy mode on, we employed

the CMED bond and Asset Swap mentioned above. The graphs are shown in Figures 29 through 36 below.

Bankruptcy

Mode Off

We discuss the case of bankruptcy mode on below, after

first analyzing the results for the case of bankruptcy mode off. The input

parameters for the AMGN bond and Asset Swap are the same as in Table 3, except for the credit spread. If an Asset Swap is

valued by setting the credit spread of the underlying bond equal to the ASW

recall spread, then we have found that the median life of the Asset Swap is

zero. The advantage of entering into an Asset Swap is based on the expectation

of the future credit spreads, behavior of the volatility and interest rates

etc. For the purposes of comparison of the bond and Asset Swap metrics, we

valued the AMGN bond with a credit spread of 150 bps.

We swept the stock price, volatility, credit spread

and interest rates. For each sweep, we plotted graphs of the bond fair value

and Asset Swap stub fair value, Delta, Gamma, Vega, Rho, Credit Spread 01, Theta and the median life.

In all the graphs, the dark blue curve describes the bond and the pink curve

describes the Asset Swap. We analyze the comparison of the metrics below.

Stock Sweep

The graphs

obtained by sweeping the stock price are the most informative of the various

sweeps.

·

The first graph displays the bond fair value and

Asset Swap stub as a function of the stock price. As expected, they both have a

(smoothed out) hockey stick shape.

·

The graph of Delta indicates that the Asset Swap

has a lower Delta than the bond. This is consistent with the market expectation

that holding an Asset Swap requires a smaller hedge than holding a bond.

·

The Gamma of the Asset Swap has a peak which is

slightly higher than the bond, and the location of the peak is also slightly

displaced to a higher stock price. At about S=110, the two graphs coincide. At

this stock price level, the median life of the Asset Swap decreases to zero,

and so the Gamma of the Asset Swap equals that of the bond.

·

The Vega curve is similar to the Gamma curve.

·

The graph of Rho shows a significant difference in the

behavior of the Asset Swap and the bond. The curves are parallel, but Rho is positive for the Asset

Swap and negative for the bond. This is indicative of the fact that the Asset

Swap holder is not exposed to the interest rate sensitivity of the pure bond

part of the convertible (which is negative).

·

The graph of the credit spread01 sensitivity

also shows a significant difference in the behavior of the Asset Swap and the

bond. The curve for the bond is negative. The curve for the Asset Swap is

almost zero, indicative of the fact that the Asset Swap holder has divested himself

of the credit risk of the issuer.

·

The graph of Theta shows that the Asset Swap has

more negative time decay than the underlying bond. Roughly speaking, the pure

bond part of the convertible has a positive Theta (accretion to par), and the

option part has a negative Theta. The Asset Swap holder has only the option

part. Effectively, the Asset Swap holder has removed the exposure to the credit

risk of the issuer, but at the price of more negative time decay.

·

The median life of the bond is always equal to

the time to maturity, since this is a bullet bond. The median life of the Asset

Swap is also equal to the time to maturity at low stock prices, but then

decreases with increasing stock price and drops to zero above about S=110. At

such high values of S, the sensitivity to credit spread is very small, and the

expected value of the cash flows including the value of the option embedded in the

bond make it preferable to hold the convertible.

Volatility Sweep

The graphs

obtained by sweeping the volatility are mostly featureless, and are included

for completeness of the presentation. The median life of the Asset Swap

displays a complicated dependence on the volatility, but it is difficult to

draw any conclusions from this fact.

Credit Spread Sweep

The graphs

obtained by sweeping the credit spread illustrate one fairly obvious point. In

all the plots, the curve for the Asset Swap becomes flat as the credit spread

is increased. This is consistent with our expectation that, at high spreads,

the bond value declines and contributes little to the valuation of the Asset

Swap. (Think of a deep out of the money option.) The Asset Swap (which is

valued on a risk-free basis) is then insensitive to the precise value of the

credit spread, leading to flat curves in the plots.

Interest Rate Shift

Unlike a sweep of the

credit spread, an interest rate shift changes the risk-free interest rate. This

affects the recall value of the Asset Swap, whereas a change in the credit

spread does not. The curves for the Asset Swap therefore do not flatten out as

the risk-free rate increases. The graph of the Asset Swap stub and bond fair

value is the most informative. Since the Asset Swap has a positive Rho and the bond has a negative Rho, the ASW stub value and the bond fair

value move in opposite directions as the risk-free rate increases.

Bankruptcy Mode On

We now discuss

the case of bankruptcy mode on. As stated above, we employ the CMED bond and

Asset Swap. The parameters are the same as in Table 3. We

swept only the stock price. We know that when the bankruptcy mode is on, at low

parity the fair value of the bond drops to zero, the bond Delta increases (in

principle to infinity at zero parity), and the Gamma is negative. However, the

Asset Swap stub value has a floor of zero and the Delta and Gamma behave more

like those of an equity call option, i.e. Delta increases from 0 and 100 in an

S-curve as the stock price increases, and Gamma is always positive. Hence we

expect a significant difference in the graphs of the bond and the Asset Swap.

This is confirmed in Figures 29 through 36 below. We again plotted graphs of the bond fair

value and Asset Swap stub fair value, Delta, Gamma, Vega, Rho, Credit Spread 01, Theta and the median life.

In all the graphs, the dark blue curve again describes the bond and the pink

curve describes the Asset Swap.

We see that the median life of the Asset

Swap drops to zero at about S=26. The interesting behavior is when the Asset

Swap median life is nonzero, i.e. S<26. As the parity decreases to zero, the

holder of an Asset Swap would decrease the stock hedge to zero, whereas a

bondholder would need to increase the stock hedge. Furthermore, the bondholder

would be hurt by the negative Gamma, but an Asset Swap holder does not have

this problem. Furthermore, even in the region where both the bond and Asset

Swap have positive Gamma (e.g. S=24, which is the stock price used in the

scenario analysis above), the Asset Swap has substantially more Gamma than the

bond. This explains why, in Table 5,

the P&L for the CMED Asset Swap, with bankruptcy mode on, is substantially

larger than the P&L for the underlying convertible.

The graph for Rho (Figure 33)

indicates that the Asset Swap continues to have an implicit hedge against a

rise in interest rates, and the graph for Theta (Figure

35) indicates that the Asset Swap

continues to have more negative time decay than the underlying bond. Switching

on the bankruptcy mode does not change these aspects of the behavior of an

Asset Swap.

The graphs for the AMGN Asset Swap and bond,

with the bankruptcy mode on, are similar but the differences are not as

pronounced. Basically, with the bankruptcy mode on, if the median life of the

Asset Swap is nonzero, then the Asset Swap has a substantially larger Gamma

than the underlying convertible, as well as a smaller Delta (which goes to zero

whereas the bond Delta goes to infinity at zero parity). The Asset Swap holder

can realize much greater P&L from Gamma trading.

Table 1 Return on Bond and Asset Swap for AMGN Tranche 1

|

Scenario

|

Bankruptcy Mode Off

|

Bankruptcy Mode On

|

|

Bond

|

ASW

|

Bond

|

ASW

|

|

No excess capital

|

Invest excess

capital at risk-free rate

|

No excess capital

|

Invest excess

capital at risk-free rate

|

|

Return

|

P&L($)

|

Return

|

P&L($)

|

Return

|

P&L($)

|

Return

|

P&L($)

|

Return

|

P&L($)

|

Return

|

P&L($)

|

|

Unchanged

|

5.33%

|

11,990

|

3.23%

|

610

|

4.85%

|

10,917

|

5.14%

|

11,576

|

0.97%

|

182

|

4.66%

|

10,489

|

|

Interest Rates Rise 100 bps

|

2.17%

|

4,890

|

37.02%

|

7,020

|

7.70%

|

17,322

|

2.33%

|

5,234

|

35.20%

|

6,677

|

7.55%

|

16,978

|

|

Interest Rates Fall 100 bps

|

13.32%

|

29,970

|

28.95%

|

5,489

|

2.14%

|

4,812

|

13.09%

|

29,446

|

31.36%

|

5961

|

1.93%

|

4,338

|

|

Stock Down 20%, Spread Widens, Implied Volatility Increases

|

0.70%

|

1,586

|

137.15%

|

25,953

|

16.11%

|

36,257

|

6.70%

|

15,070

|

134.75%

|

25,499

|

15.91%

|

35,803

|

|

Stock Up 20%, Spread Tightens, Implied Volatility Decreases

|

2.25%

|

5,054

|

87.79%

|

16,398

|

2.70%

|

6,082

|

2.18%

|

4,908

|

86.90%

|

16481

|

2.75%

|

6,180

|

Table

2 Return on Bond and Asset Swap for CMED

|

Scenario

|

Bankruptcy Mode Off

|

Bankruptcy Mode On

|

|

Bond

|

ASW

|

Bond

|

ASW

|

|

No excess capital

|

Invest excess

capital at risk-free rate

|

No excess capital

|

Invest excess

capital at risk-free rate

|

|

Return

|

P&L($)

|

Return

|

P&L($)

|

Return

|

P&L($)

|

Return

|

P&L($)

|

Return

|

P&L($)

|

Return

|

P&L($)

|

|

Unchanged

|

8.95%

|

23,935

|

23.58%

|

15,029

|

1.81%

|

4,840

|

6.83%

|

18,723

|

2.79%

|

1,776

|

3.14%

|

8,412

|

|

Interest Rates Rise 100 bps

|

2.17%

|

5,795

|

6.40%

|

4,080

|

2.28%

|

6,109

|

0.56%

|

1,493

|

16.58%

|

10,562

|

7.76%

|

20,751

|

|

Interest Rates Fall 100 bps

|

16.19%

|

43,295

|

40.68%

|

25,923

|

5.88%

|

15,734

|

13.47%

|

36,033

|

22.40%

|

14,270

|

1.53%

|

4,081

|

|

Stock Down 20%, Spread Widens, Implied Volatility Increases

|

88.54%

|

236,846

|

183.78%

|

117,150

|

39.99%

|

106,962

|

95.3%

|

254,798

|

171.4%

|

109,268

|

37.04%

|

99,080

|

|

Stock Up 20%, Spread Tightens, Implied Volatility Decreases

|

2.16%

|

5,765

|

52.81%

|

33,649

|

8.77%

|

23,460

|

5.33%

|

14,263

|

9.08%

|

5787

|

1.65%

|

4,402

|

Table 3 Input Parameters for P&L and Impact Analysis

|

Parameter

|

AMGN

|

CMED

|

|

Bond Price

|

90

|

107

|

|

ASW Recall Value

|

82.45

|

81.51

|

|

Recall Value/Bond Price

|

0.92

|

0.76

|

|

Stock Price

|

60

|

24

|

|

Volatility

|

19

|

35

|

|

Credit Spread (bps)

|

30

|

300

|

|

Yield Curve

|

US $Swap

|

US $Swap

|

|

Borrow Cost

|

0

|

0

|

|

Dividend Model

|

Continuous

|

Continuous

|

|

Bond/ASW Quantity

|

1000

|

1000

|

|

Delta Hedge

|

48

|

68

|

|

Finance/Rebate Rate

|

5.75/5.00

|

5.75/5.00

|

|

Horizon

|

1 year

|

1 year

|

|

Leverage

|

4

|

4

|

|

Bond Capital ($)

|

225,000

|

267,500

|

|

ASW Capital ($)

|

18,877

|

63,727

|

|

ASW Leverage if no excel capital

|

47.7

|

16.8

|

Table 4

Bond Price and ASW Recall Value & Stub Value

|

Scenario

|

AMGN

|

CMED

|

|

Bond Price

|

ASW

|

Bond Price

|

ASW

|

|

Recall Value

|

Stub Value

|

Recall Value

|

Stub Value

|

|

Initial

|

90

|

82.45

|

7.55

|

107

|

81.51

|

25.49

|

|

Interest Rates

Rise 100 bps

|

90.0

|

84.66

|

5.34

|

103.93

|

82.52

|

21.41

|

|

Interest Rates

Fall 100 bps

|

93.48

|

89.39

|

4.08

|

107.69

|

88.45

|

19.24

|

|

Stock Down

20%, Spread Widens, Implied Volatility Increases

|

83.12

|

87.01

|

0

|

69.55

|

85.42

|

0

|

|

Stock Up 20%,

Spread Tightens, Implied Volatility Decreases

|

97.20

|

87.33

|

9.87

|

114.02

|

85.43

|

28.60

|

Table 5 Gamma Trading P&L and Carry for Bond & ASW

|

Scenario

|

AMGN

|

CMED

|

|

Bond

|

ASW

|

Bond

|

ASW

|

|

P&L Bankruptcy

Mode Off

|

14,680

|

14,680

|

22,147

|

22,147

|

|

P&L Bankruptcy

Mode On

|

14,226

|

14,226

|

11,115

|

30,029

|

|

Carry

|

19,580

|

14,828

|

14,218

|

14,396

|

Table 6 Return on Portfolio using CDS or Asset Swap

|

Scenario

|

AMGN

|

CMED

|

|

Bond + CDS + light hedge

|

ASW (from table 1)

|

Bond + CDS + light hedge

|

ASW (from Table 2)

|

|

No excess capital

|

Invest excess capital at risk-free rate

|

No excess capital

|

Invest excess capital at risk-free rate

|

|

Stock Down 20%, Spread

Widens, Implied Volatility Increases

|

10.22%

|

134.75%

|

15.91%

|

92.5%

|

171.41%

|

37.04%

|

|

Stock Up 20%, Spread

Tightens, Implied Volatility Decreases

|

3.58%

|

83.33%

|

2.65%

|

4.94%

|

9.08%

|

1.65%

|

AMGN Tranche-1 Bond & ASW valued with CS = 150 bps

Figure 1 Bond Fair Value & ASW Stub v. Spot Price

Figure 2 Bond & ASW Delta v. Spot

Price

Figure 3 Bond & ASW Gamma v. Spot

Price

Figure 4 Bond & ASW Vega v. Spot Price

Figure 5 Bond & ASW Rho v. Spot Price

Figure 6 Bond & ASW Credit Spread01 v.

Spot Price

Figure 7 Bond & ASW Theta v. Spot

Price

Figure 8 Bond & ASW Median Life v.

Spot Price

Figure 9 Bond Fair Value & ASW Stub v.

Volatility

Figure 10 Bond & ASW Delta v. Volatility

Figure 11 Bond & ASW Gamma v. Volatility

Figure 12 Bond & ASW Vega v. Volatility

Figure 13 Bond & ASW Rho v. Volatility

Figure 14 Bond & ASW Credit Spread01

v. Volatility

Figure 15 Bond & ASW Theta v. Volatility

Figure 16 Bond & ASW Median Life v. Volatility

Figure 17 Bond Fair Value & ASW Stub v.

Credit Spread

Figure 18 Bond & ASW Delta v. Credit

Spread

Figure 19 Bond & ASW Gamma v. Credit

Spread

Figure 20 Bond & ASW Vega v. Credit

Spread

Figure 21 Bond & ASW Theta v. Credit

Spread

Figure 22 Bond & ASW Median Life v. Credit

Spread

Figure 23 Bond Fair Value & ASW Stub

v. Interest Rate Shift

Figure 24 Bond & ASW Delta v. Interest

Rate Shift

Figure 25 Bond & ASW Gamma v. Interest

Rate Shift

Figure 26 Bond & ASW Vega v. Interest

Rate Shift

Figure 27 Bond & ASW Theta v. Interest

Rate Shift

Figure 28 Bond & ASW Median Life v. Interest Rate Shift

CMED Bond & ASW valued with bankruptcy mode on

Figure 29 Bond Fair Value & ASW Stub v. Spot Price (CMED,

bankruptcy mode on)

Figure 30 CMED Bond & ASW Delta v. Spot

Price (CMED, bankruptcy mode on)

Figure 31 CMED Bond & ASW Gamma v. Spot

Price (CMED, bankruptcy mode on)

Figure 32 CMED Bond & ASW Vega v. Spot

Price (CMED, bankruptcy mode on)

Figure 33 CMED Bond & ASW Rho

v. Spot Price (CMED, bankruptcy mode on)

Figure 34 CMED Bond & ASW Credit

Sperad01 v. Spot Price (CMED, bankruptcy mode on)

Figure 35 CMED Bond & ASW Theta v. Spot Price (CMED, bankruptcy

mode on)

Figure 36 CMED Bond & ASW Median Life v. Spot Price (CMED,

bankruptcy mode on)

Top