KYNEX Bulletin

July 2009

Corporate Bond (with Financing) versus Credit Default Swap

Since the release of our

first “Corp

Vs CDS” analytic (May 2008 Kynex

Bulletin), the credit markets have changed dramatically. Even by the end of

April, 2008, we noted that a “credit crunch” premium of 50-75 basis points was

added to the coupon suggested by the CDS credit curve on newly issued bonds.

Investors were paying additional financing costs, so they demanded an

additional premium on top of the coupon suggested by the CDS market. Our model

had no way of reflecting this additional premium. We are pleased to announce

the following enhancements in response to the dynamics in the market.

v You

can now specify your financing assumption in basis points over 3-month LIBOR. This

assumption reflects the borrowing cost associated with financing the cost of

purchasing the bond long. Since the CDS is an unfunded transaction, the relative

value comparison to the bond must be funded regardless of whether the investor

is hedging or is investing outright. However, you can specify no financing by

“blanking” the financing input (a zero assumption will use financing at Libor).

v We

have developed a new model based on a Zero P&L Basis Trade. The Zero P&L Basis Trade Model uses

a carefully constructed basis trade consisting of a

long bond position, long CDS protection and an interest rate swap. The price of the bond is determined so that

the expected aggregate P&L of the basis trade is zero on the maturity date

of the bond regardless of whether default occurs. The previous model based on

Pull-to-Par is available as an option. A detailed description of the Pull-to-Par Model can

be found in the May 2008 Kynex Bulletin. A comparison

of the two models for a five year bond assuming a range of flat CDS spreads and

bond coupons is shown in the Appendix as well as a discussion of the advantages

and disadvantages of each model.

v Trading

opportunities in the investment grade, primary market appear to be few and far

between suggesting the CDS market and financing requirements drive new issue

pricing. Pricing irregularities in the secondary market seem to be relatively

common, resulting in a bond price disconnected from the CDS market. We present

a basis trade taking advantage of such a

situation.

v The

shape of the CDS credit curve and hence the default probability path will

affect the fair value calculation of the bond. Wider spreads and/or inverted

curves will increase the deviation in results from a credit curve vis-à-vis a

flat spread. We present an illustration in the

Appendix. Currently, we do not support the upfront loading of the probability

path corresponding to a “running + upfront points” CDS quotation.

v If

you maintain credit curves on Kynex and/or send us your credit curves

periodically, the “Corp

Vs CDS” analytic conveniently starts with your assumptions. If

you send us a list of bonds with their prices and credit curves, we can

automatically search for those bonds with a pricing disagreement between the

bond market and the CDS market, thus significantly enhancing the productivity

of your team.

Corp Vs CDS

We analyzed several corporate

bonds and the corresponding CDS market levels at different points in time over

the past several months when the financing requirements have been changing. We

present our findings and analysis below.

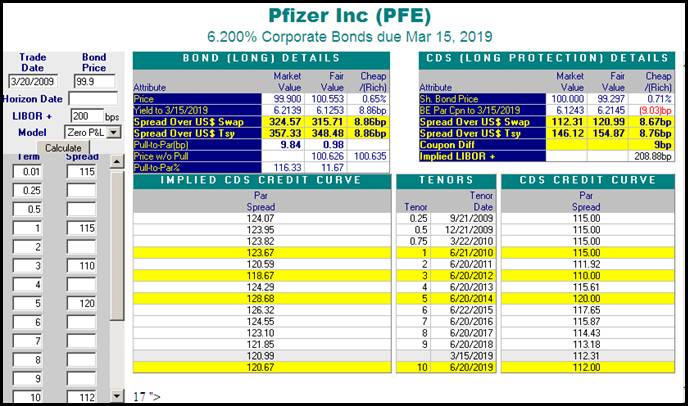

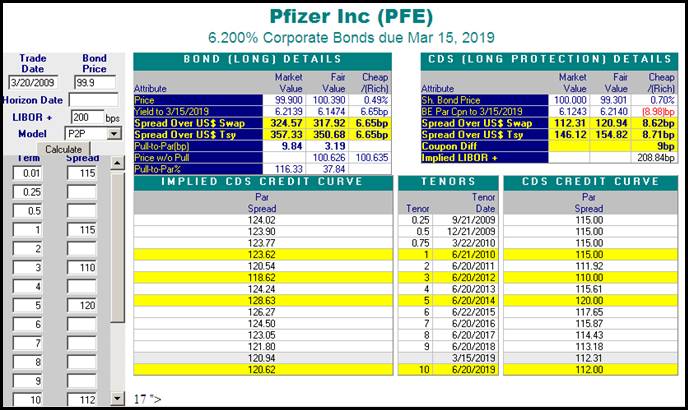

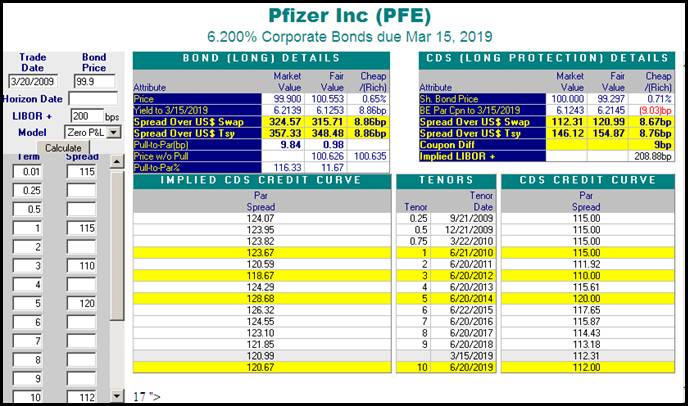

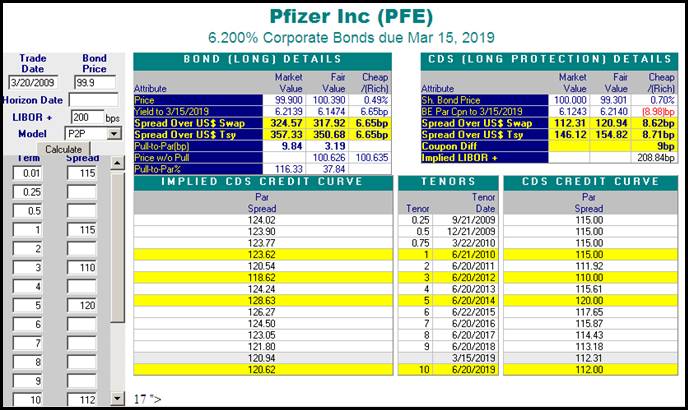

For illustrative purposes, we

chose the recently issued Pfizer bond, PFE 6.2% 3/15/2019. Around 3/20/2009, financing was around 200 basis points

over 3 month Libor. Assuming the specified

credit curve and financing of 200 over, the bond equivalent coupon is 6.12%. The

bond would have been issued with a coupon of 4.10% if financing was ignored. For

par bonds, both models give essentially the same results.

Zero P&L Model

Pull-to-Par Model

At 200 over, the bond fair

value is at a slight premium. The implied financing (209 bps over 3 month Libor)

shows what the financing assumption must be for the model price to be equal to

the market price. The implied CDS curve shows what the CDS curve would be

assuming financing of 200 over and a bond fair value equal to the market price

(flat CDS goes from 112 to 121). For outright

investors not interested in financing their positions, the new issue market is

one way to keep track of the consensus market financing level.

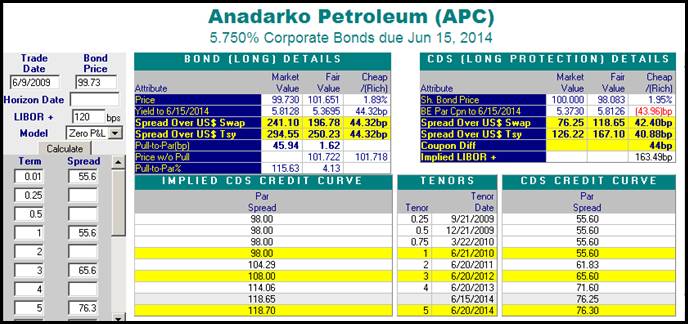

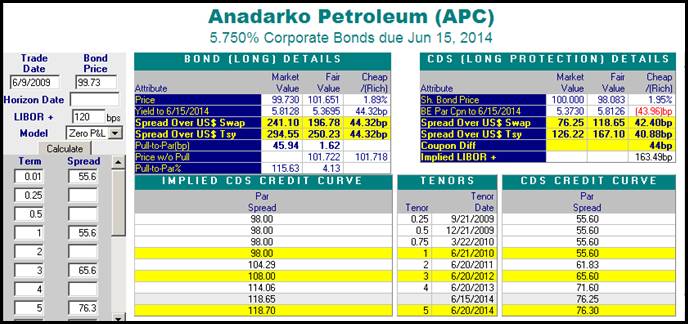

By June, financing levels

were at about 120 over. On 6/9/2009,

Anadarko Petroleum issued APC 5.75%6/15/2014 at just below par. Our analysis

suggests that the bond market and the CDS market were disconnected for this

issue. Either funding should be at about 163 over, or the CDS curve should be

wider by 42 basis points. However, by 6/11/2009, this bond was trading at 101.70 with no change

in the CDS credit curve, suggesting the market found this bond’s coupon very

attractive. If this bond had been issued with a coupon of about 5.35%-5.40%, we

believe it would have traded at par initially.

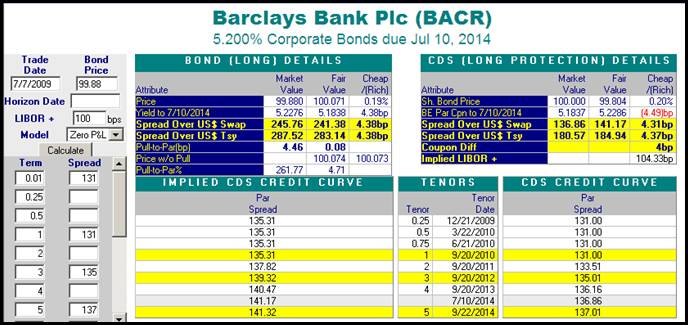

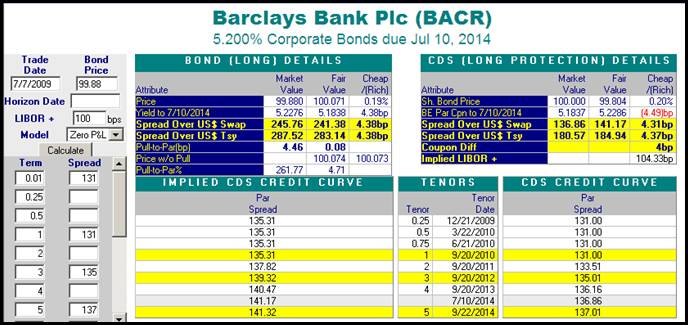

By late June and early July, financing levels had lowered

to about 100 over Libor. Barclays Bank took advantage of this with a new issue

BACR 5.2% 6/10/2014

pricing at 99.88. The implied financing of 104 over Libor is inline with the

assumed financing of 100 over Libor.

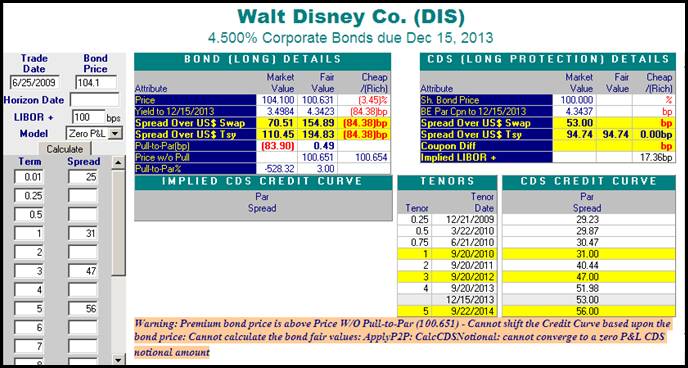

Unlike the primary market,

the secondary bond market appears to be inconsistently priced vis-à-vis the CDS

market. As might be expected in a time of investor uncertainty, high quality

credits are generally over-valued while lower quality credits are under-valued.

These pricing irregularities show up in the implied financing spread and the

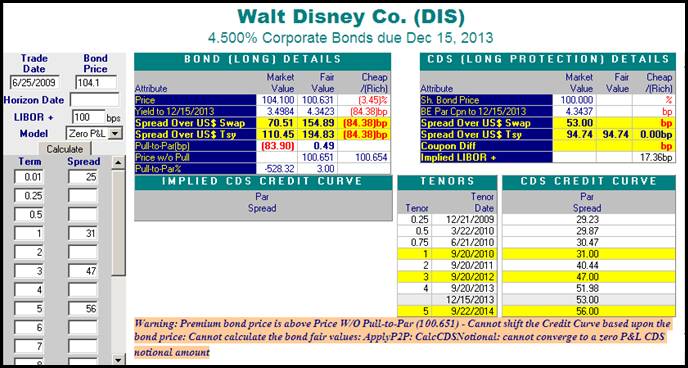

implied CDS credit curve. The pricing of DIS 4.5% 12/15/2013 at around 104.10 on 6/25/2009 is an example of

a price ignoring the fundamental differences in the bond market versus the CDS

market. When an investor buys a bond, capital is used. When a broker sells a

CDS, no money is exchanged. The Kynex analytic puts these two events on an

equal footing by financing the long bond position. For both transactions, the

investor starts at zero at settlement. Even a long-only

investor must consider funding (cost of capital) when pricing bonds using CDS

market spreads. At

least theoretically,

a CDS spread is a measure of pure credit worthiness. A bond yield

compensates the buyer for the initial outlay of capital as well. On 6/25/2009, our research

suggests a financing assumption of 100bps over Libor. However, the price of

104.1 results in a spread over swaps of 71bps, 30bps below financing.

With financing included, a

par coupon of 4.34% is expected. A bond with a 4.5% coupon should be priced at

a moderate premium. Without financing included, a par coupon 100 basis points

less is expected. A model price of 104.65 (using the Pull-to-Par model)

reflects the additional coupon income over par. The market appears to be

erroneously pricing this bond by merely discounting the future flows using the

raw risk free rates and default probabilities from the CDS market (and applying

a bit of price compression).

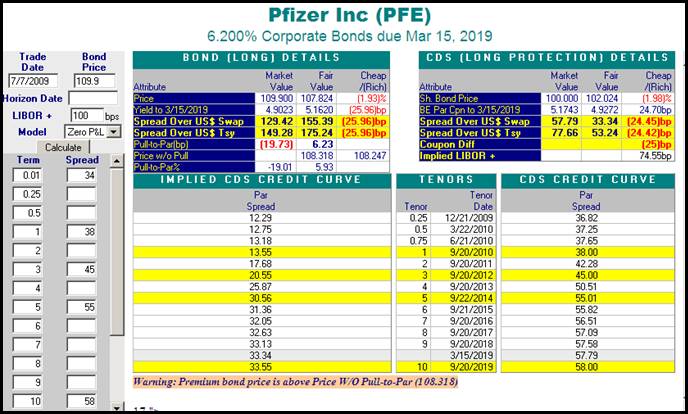

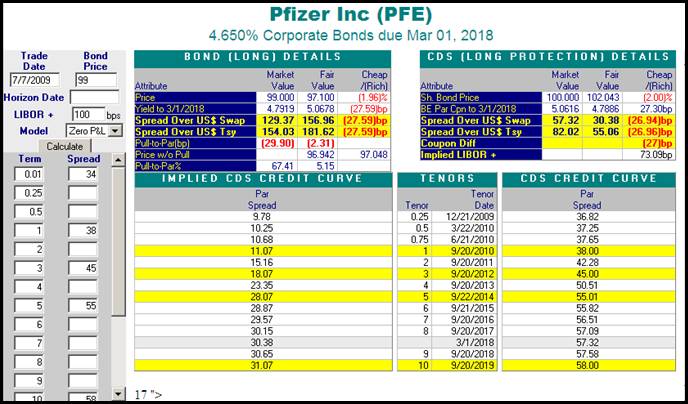

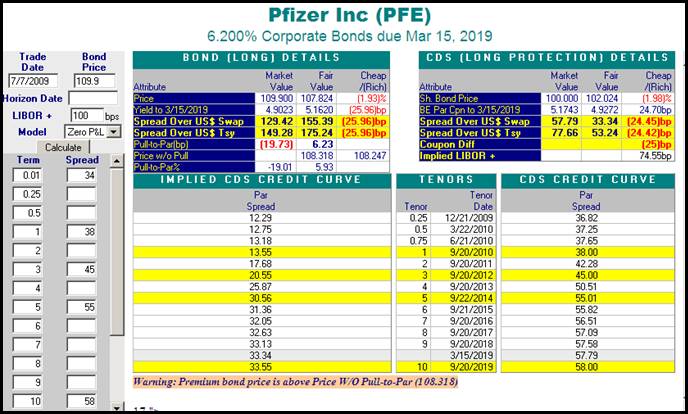

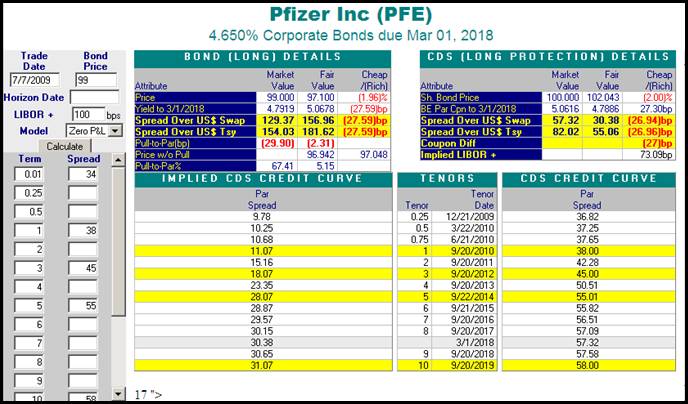

By 7/7/2009 circumstances have changed for

the Pfizer bond, PFE 6.2% 3/15/2019.

The Barclays’ new issue indicates that financing is around 100 over. Since the

issuance of PFE 6.2% 3/15/2019,

financing has dropped by 100 bps and the CDS spread has dropped by almost

55bps. 3 month Libor has dropped by almost 69bps, but the 10 year USD swap has

widened by almost 67bps. The aggregate effect of these changes is captured in

the par coupon. The par coupon has

dropped from 6.12% to 5.17%. But the yield

on this bond has dropped 131bps to 4.90%, making this bond rich when compared

to the

CDS market. The spread of

129bps should be troubling since the CDS spread at 3/15/2019 is around 58 and financing is

assumed to be 100 over. If this bond had

a par coupon, you would expect a spread over swaps at around 158. Other Pfizer bonds

have performed similarly in the market.

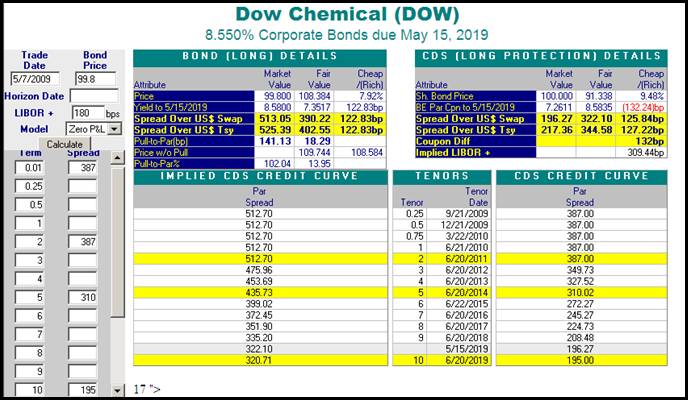

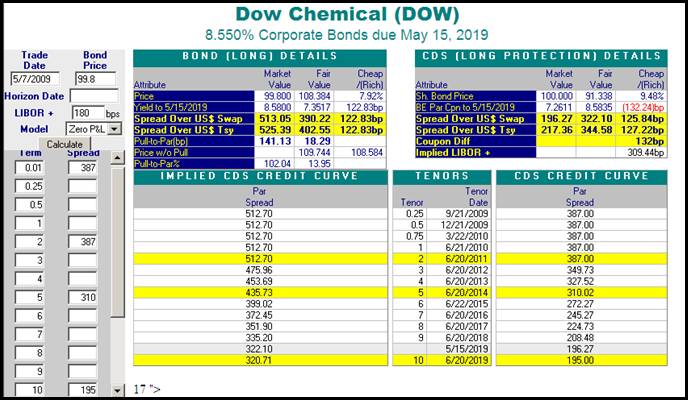

However, not every bond and

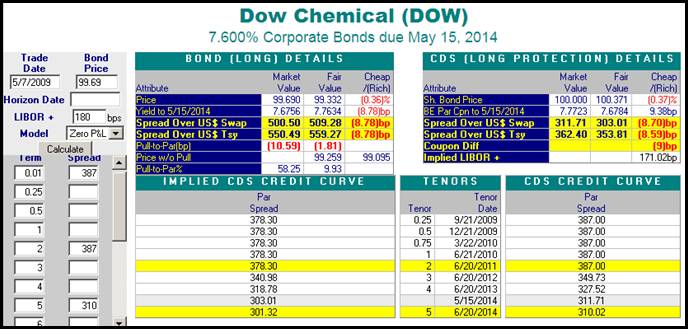

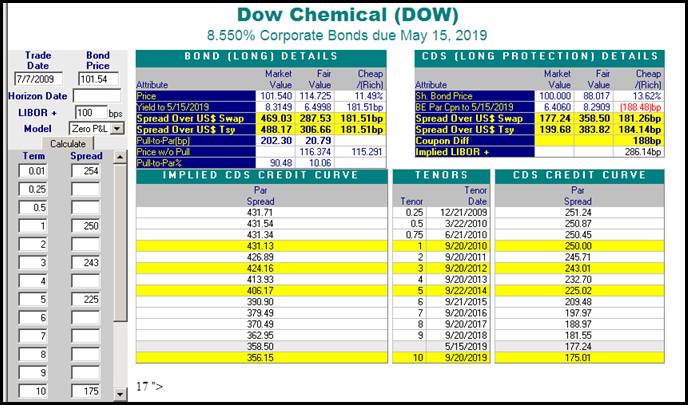

issuer was treated as favorably as Pfizer. On 5/7/2009, Dow Chemical issued DOW 8.55% 5/15/2019. The initial

pricing appeared very attractive for investors vis-à-vis the ten-year CDS quote

of 195bps.

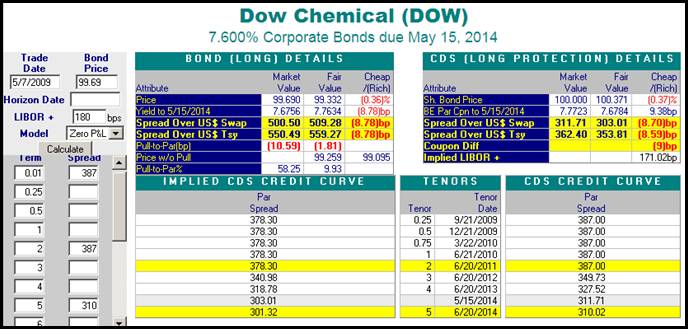

The bond market obviously

ignored the CDS market’s view of the long term credit worthiness of Dow

Chemical, using a spread (322bps) just higher than the 5 year CDS spread of

310. The pricing of DOW 7.6% 5/15/2014

was more inline.

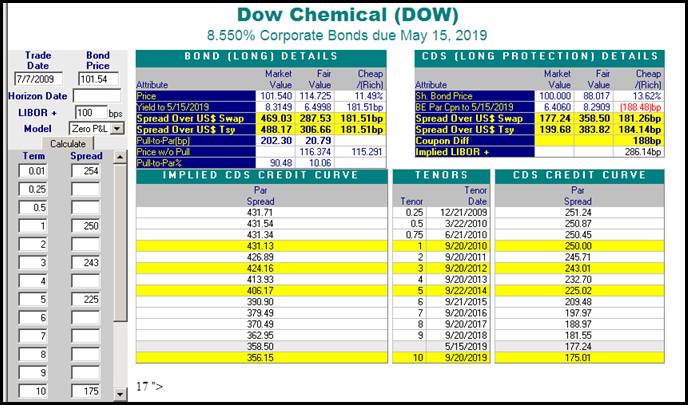

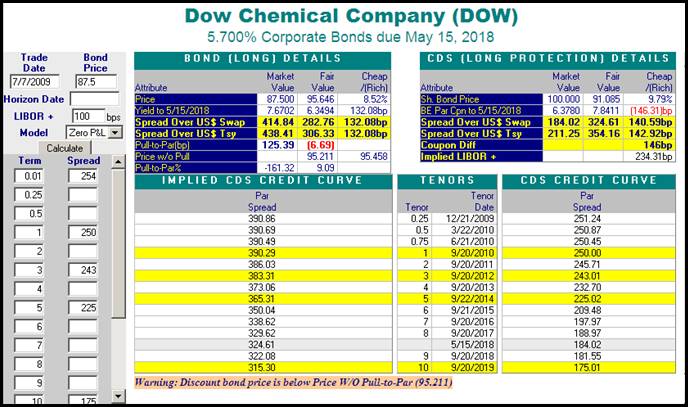

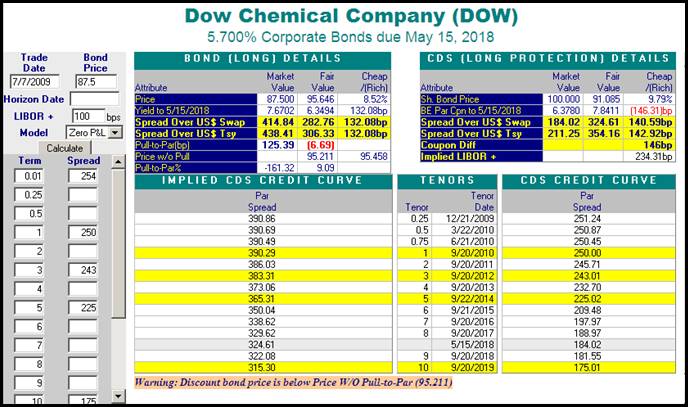

By 7/7/2009, the Dow CDS curve has improved.

But the bond market did not accept the longer term view of the CDS market for

Dow Chemical. Both bonds shown below suggest that the bond market has not

changed the long term outlook for Dow Chemical.

One

way the investor can take advantage of a situation like DOW 5.7% 5/15/2018 is to do a basis

trade. The investor finances the long bond position, buys CDS protection, and

enters into an interest rate swap. The difficult decision here is to determine

how much protection to buy. If no default is expected by the investor, then he

should consider light protection. Under this scenario, the investor will not bleed

deal payments, and he hopes the credit will improve enough so that the trade

can be unwound for profit or held until maturity. On 7/7/2009, if the CDS notional amount is $812,409, the

expected P&L is $120,989. But if default occurs (especially early), the

investor will experience a significant loss. This risk is expressed in a

P&L standard deviation of $53,200 (due to the timing of default). A neutral

position for the investor would be the purchase of $1,006,904 CDS protection.

The expected P&L is lower at $109,596. But this expected amount is the same

whether or not default occurs. Risk in terms of P&L deviation due to the

timing of default is $4,658. At this protection level, the standard deviation

is minimized. A detailed description of

these two alternatives can be found in the Appendix.

Appendix

Model Comparison

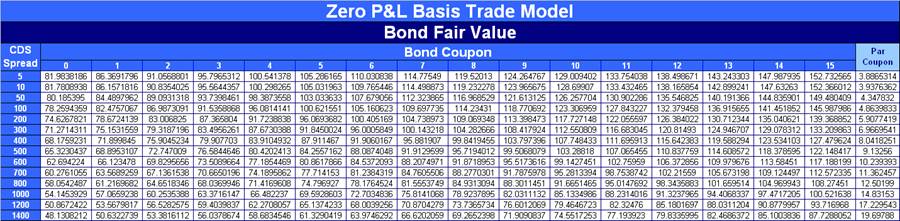

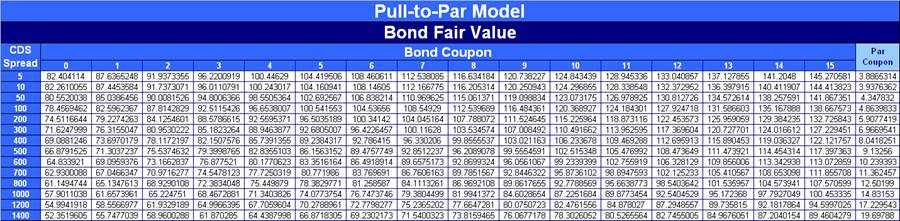

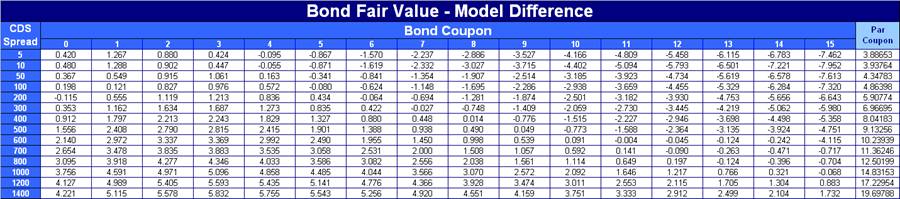

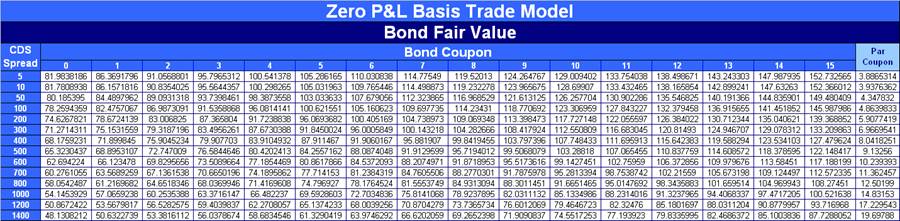

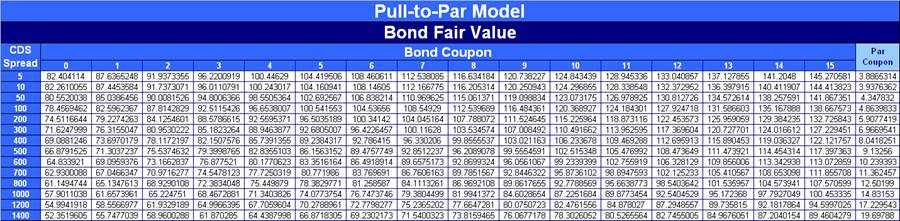

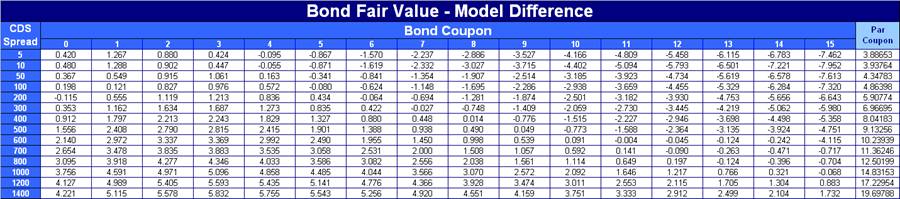

The following tables compare

model prices for a 5 year bond on 7/7/2009 using 100 over Libor for the financing

assumption. The CDS curve is assumed to be flat for every CDS spread. For

specific CDS spreads, we also graph the prices of the two models. At the par

coupon, both models (and the Price-Without-Pull-to-Par as well) return par as

the fair values. For premium bonds, the Pull-to-Par Model returns a lower price

reflecting increased risk. For discount bonds, the Pull-to-Par Model returns a

higher fair value reflecting the decreased amount of loss from any default (if

not otherwise constrained).

Anatomy of the Zero

P&L Basis Trade Model

To illustrate how the Kynex

Zero P&L Model works, we will use the Pfizer bond, PFE 6.2% 3/15/2019, priced at 109.9

on 7/7/2009. Please

refer to this example mentioned above. A premium bond will show the moving

parts of the model more than a par bond. We should initially note that the

market price of 109.9 implies a spread of around 130 (129.4 interpolated, 132.5

par spread) over swaps. This spread should be troubling since the CDS spread at

3/15/2019 is

around 58 and financing is assumed to be 100 over. If this bond had a par coupon, you would

expect a spread over swaps at around 158. Both the Zero P&L Model and the

Pull-to-Par Model first identify the par coupon with and without financing. If

par cannot be accurately identified, there is no hope of pricing a similar bond

with a lower or higher coupon. The par coupon is calculated by iteratively

constructing a basis trade with a bond whose yield must equal to the coupon.

The spread on the floating leg (ASW) of the interest rate swap is calculated to

hedge away price movements on the par bond, and the CDS notional amount is

calculated so that P&L will be zero at maturity. Since the price of the par

bond is known, the coupon is calculated. For the actual bond in question, the

coupon is known but the price is not. The model then iteratively solves for the

price (as well as the ASW and the CDS notional amount) so that P&L is once

again zero at maturity. The results of the two calculations are shown below. The CDS notional calculation is important to

maintain a low P&L standard deviation.

Therefore, the model price

should be 107.82 since the expected P&L at maturity is zero if default does

not occur, and the expected P&L is zero if default does occur. If default

does not occur, the detail for the P&L is shown below.

Although the argument for the Zero P&L model is

compelling, this example does expose a problem with bonds priced at a large

premium. The par bond yields 5.174276%,

but PFE 6.2% 3/15/2019

yields 5.162% at 107.8235. Why would an investor ever pay over 107 for a yield

of 5.16% when able to earn 5.17% on the corresponding par bond (if it existed

in the market)? This is especially true if default were to occur. The premium

bond buyer has much more to lose regardless of the recovery rate. The Kynex

Pull-to-Par Model is a yield and a risk based model, and it attempts to pull

the price on premium bonds back down to a price and up to a yield that

compensates for the additional default loss associated with premium bonds. For

this bond, the Pull-to-Par Model price is 106.387 (yielding 5.345%).

Basis Trade Using DOW 5.7% 5/15/2018

CDS Notional $812,409 vs

CDS Notional $1,006,904

All P&L values are as of 5/15/2018. The investor’s

need to possibly unwind the trade before maturity is a cause for concern when

buying $812,409 CDS protection. Consider the circumstance of default on 11/15/2011. As shown by the projection below, cumulative

P&L is negative immediately after default. The projected performance of the

IR swap (which does not disappear if default occurs) brings the investor back

to positive P&L territory.

If the investor buys

$1,006,904 CDS protection, this concern is ameliorated if default occurs on 11/15/2011.

If default never occurs, the

bleed from the deal payments and the financing can be seen when the CDS

protection is at the higher amount.

Bond Fair Values and the

Shape of the Credit Curve

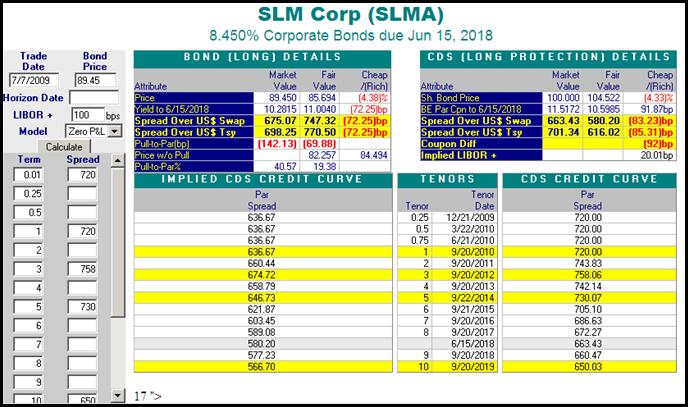

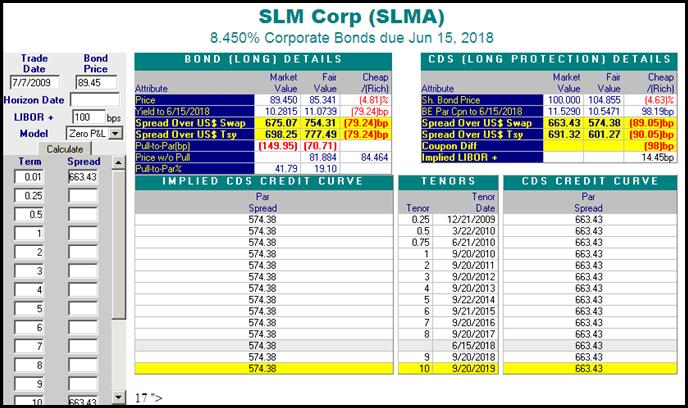

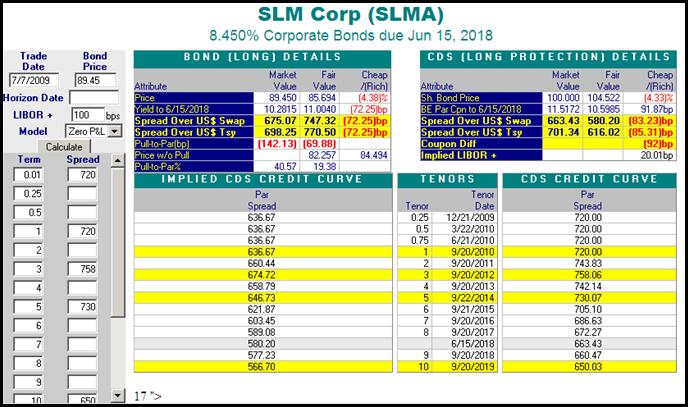

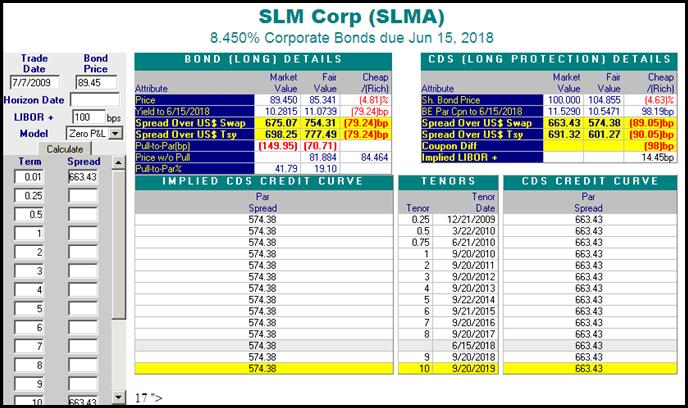

For illustrative purposes, we

chose the SLMA 8.45% 6/15/2018

bond trading on 7/7/2009.

At a price of 89.45, the market price appears to be very rich when compared to

the CDS market. We can only speculate

that financing has been ignored (fair value goes from 85.694 to 91.00).

Regardless of that, when the equivalent flat spread of 663 is used; the fair

value drops to 85.34.