KYNEX Bulletin

March 2011

Warrants

Calculator Enhancements

Over

the past eighteen months, we have seen warrants being issued with new

features. The most notable feature is protection

from increases in future dividends on the underlying common stock (Dividend

Protection). We have also seen warrants

that can be terminated if the underlying common stock exceeds a pre-set trigger

(Provisionally Callable). We have

enhanced our warrants calculator to accommodate these features. You can also maintain custom volatility

surfaces for stocks to be applied in valuing warrants. The following is a

more detailed explanation regarding the features now supported by our warrants

pricing model:

- Dividend Protection: Our

warrants calculator projects future expected shares per warrant when the

actual dividend on the common stock and/or your future expected dividends

increase beyond a pre-set threshold (which we refer to as the anchor

dividend) in the warrant contract. Therefore, the valuation of the

warrants and the calculation of risk measures are accurate allowing you to

setup trades to capture your dividend expectations in an effective manner. It should be noted that if the actual dividend

on the common stock and/or your future expected dividends are equal to or

less than the anchor, no adjustments are made to the shares per

warrant. Our implementation of

dividend protection for warrants is based on our well-established feature

for convertible bonds. For more

detail, please see our March 2006 Bulletin

which explains how dividend protection is implemented for

convertibles. The impact of

dividend protection on the valuation is driven largely by actual increases

in dividends by the issuer as well as your dividend expectations. You are able to specify your

expectations of future dividends for each underlying

stock. Click here

for instructions on how to specify your dividend assumptions.

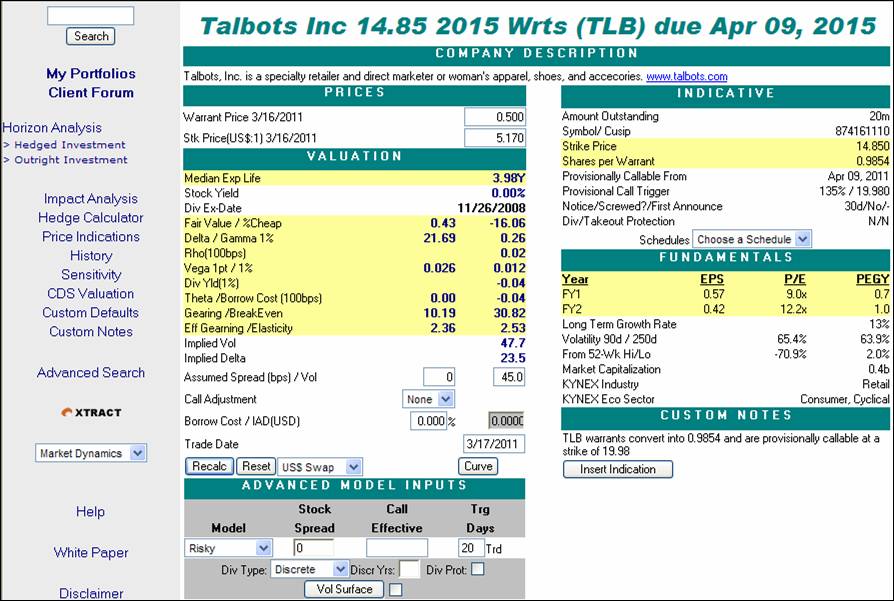

- Provisional Calls: Some warrants have a conditional call

feature with a trigger level. We incorporate the probability of early

termination in our valuation based on your volatility assumptions and

stock price level. In the

event of a call, the issuer delivers a fractional number of shares (S – K) / S in return for early

termination. Hence, the dollar value delivered is max(S – K,0), but the investor receives fractional shares and

does not pay the strike price. We also look back at the stock price history and

take into account the number of days the stock price has exceeded the

trigger. Hence, the valuation of

warrants and especially the Delta is very precise allowing you to hedge your

warrants appropriately. Our

implementation of the stock history relating to provisional calls is based

on our implementation for convertibles which is outlined in our October 2009

Bulletin.

- Volatility Surface: You can

value a warrant based on a surface of volatilities specified by you as

opposed to a single flat volatility.

The specification of the volatility surface can be along expiration

as well as along strike (money-ness).

The ability to precisely value warrants, especially long dated ones

based on your volatility expectations allows you to come up with effective

trading strategies. Click here

for instructions on how to create a volatility surface.

Our warrants pricing model

employs standard geometric Brownian motion techniques in an implicit finite

difference grid. The valuation returns the theoretical Fair Value and the

standard sensitivities (Greeks): Delta, Gamma, Vega,

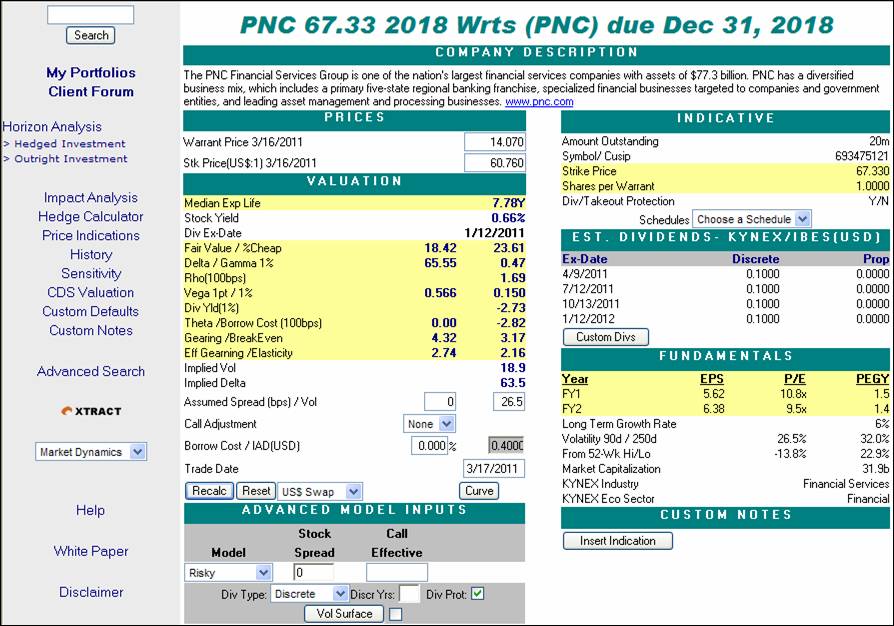

An illustration of the enhanced

warrants calculator details is shown in Fig 1 below, for

the

Below is a brief description of

outputs specific to warrants:

Gearing ~ Ratio of the stock price to warrant price

Break-Even ~ Rate at which the stock must compound over the life of the warrant in order to breakeven on the expense paid (warrant price plus exercise price)

Effective Gearing ~ Ratio of a percentage change in the underlying stock and the resulting percentage change in the warrant price

Elasticity ~ Ratio of a

percentage change in the underlying stock and the resulting percentage change

in the Fair Value